Key Takeaways

- Ampleforth will launch its own versions of Uniswap, Compound, and other DeFi primitives

- AMPL has been forked numerous times over the past month, and this new infra can allow them to capitalize on the popularity of elastic money

- Ampleforth’s financial stack can become the base layer of elastic finance if countercyclical monies prove useful

Share this article

Ampleforth has announced the launch of a suite of financial tools to improve the utility of AMPL, its native asset, and other elastic tokens. If the concept of countercyclical money succeeds, Ampleforth’s “E-Fi” layer can become the base for an entirely new ecosystem.

Ampleforth to Build a Base for Elastic Tokens

Ampleforth’s roadmap, which was recently made public, discloses plans to build an automated market maker (AMM), money market, and on-chain derivatives.

This infrastructure has been dubbed as elastic finance or “E-Fi.”

The team will build an AMM that enforces “efficient supply discovery” to maximize the utility of elastic money. Further, the derivatives segment will include on-chain futures, insurance, and perpetual contracts built with elastic tokens in mind. All of this put together can create real usage for Ampleforth’s native token, AMPL.

As is stands today, the token does not have much utility aside from speculation and portfolio diversification.

Extracting Value from Forks

AMPL’s unique rebasing mechanism drew attention after the launch of its incentivized Uniswap pool.

Uniswap is the only automated market maker that can support a rebasing token. But the liquidity pool must have a special function enabled to host the rebase.

Ampleforth’s new financial infrastructure will, however, be completely rebase-friendly with a few extra touch-ups.

This means forks like YAM and Based will benefit from creating liquidity on Ampleforth’s AMM and futures market, which will end being a net positive for AMPL.

This dynamic of cannibalizing forks was previously observed with yEarn Finance and its token, YFI.

YFI had tens of forks that ultimately became slaves to YFI. yEarn Finance implemented automated investment strategies that farmed these forks and dumped them for stablecoins. As more people joined in, this eventually pushed prices down.

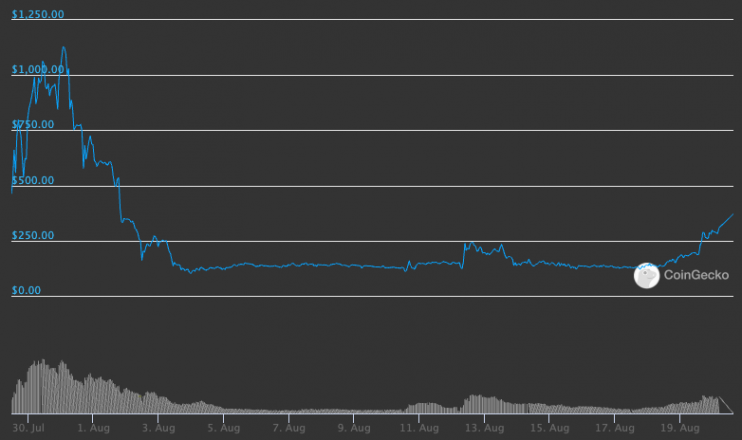

The price of YFII, the first fork, is down 68% since its high, despite rallying 55% in the last 24 hours.

Other protocols built with elastic money, like Terra, will also benefit from Ampleforth’s new products. Eventually, if elastic tokens prove to be a valuable monetary model, it can become the base layer for E-Fi.

Share this article

Ampleforth Gushes 130% APY in DeFi Liquidity Rewards “GeyserR…

DeFi supply-coin Ampleforth has announced a new system called “Geyser,” which will distribute AMPL tokens to liquidity providers—yielding upwards of 100% APY. What Is Ampleforth? Ampleforth is a cryptocurrency that…

Understanding Position Sizing

Let’s briefly examine the most important aspect of any trading system, position sizing, or specifically how much we will bet on any one given trading idea.

Ampleforth Holders Get Ready To Earn Crypto Compound Interest

One of the problems with crypto is that there aren’t many ways to put your money to work. Traders can speculate on their tokens, or earn staking rewards, but there’s…

Ampleforth’s Unique Design Put to the Test After Market Cap Drop…

Ampleforth and its token, AMPL, are the center of attention as the network’s market cap crashed over 55% from its peak. However, this was an expected reaction and proves that…