DeFi protocols are proving their value after providing profit-making opportunities during diverse market conditions.

Building Financial Utility

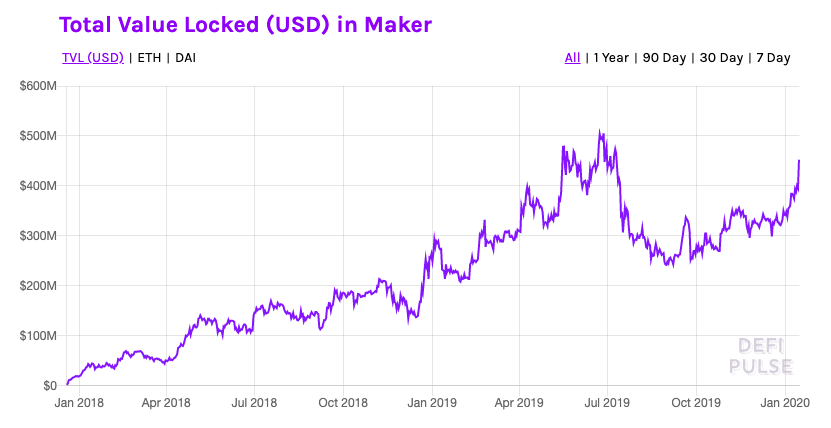

In the first half of 2019, as the cryptocurrency market started to rise from multi-year lows, DeFi got its first taste of a bull market as loans on Maker hit an all-time high of $505 million.

Just like one can make money any time of year in the traditional markets, DeFi has provided people with yield through challenging market conditions.

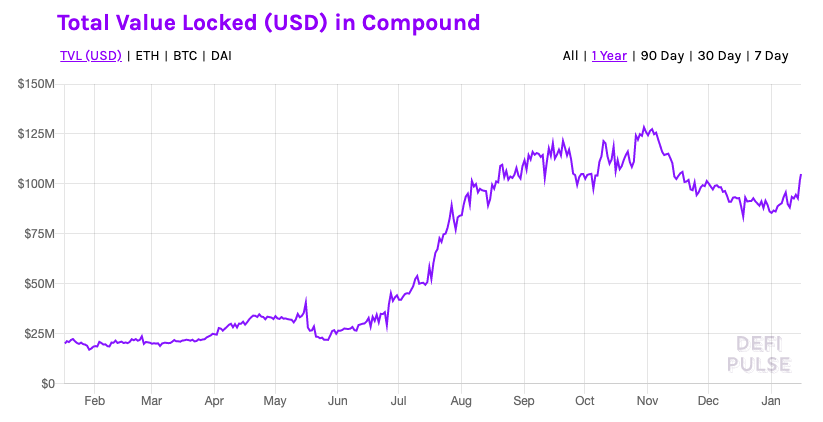

Prior to the boom in lending and interest-bearing crypto assets, red markets revealed few opportunities for profit-taking. That is until non-custodial money markets entered the picture. The launch of Compound v2 in May 2019 was a game-changer for DeFi as a whole.

Once implications of a crypto-native money market were realized, assets locked in Compound grew from $25 million to over $100 million. For its part, dYdX also capitalized on this opportunity, growing from $140,000 to $31 million in value over seven months.

Automated investment strategies, such as Set Protocol, are a way for investors to take advantage of prolonged bear markets by accumulating more assets with the potential to appreciate. Launched in April 2019, Set Protocol has grown to nearly $3 million in assets under management in under a year.

Anybody can invest in a strategy that automatically rebalances between ETH and USDC, depending on conditions set by market indicators, such as the 21-day moving average crossover.

Set’s strategies work best during times of downfall as the protocol accrues more ETH as prices drop.

When an ETH bull market arrives, Set Protocol investors have a major edge over those who have just held ETH. This is because of their dynamic strategy of hoarding stablecoins as markets fall and pushing the capital back into ETH as markets take off.

Protocols Through Rallies and Troughs

From Jan. 10 to Jan. 15, ETH rose roughly 21% against the dollar. Over this same period, value locked in DeFi went from $650 million to $796 million.

Incoming data from the past few days also indicates a strong correlation between the price of ETH and sentiment around DeFi applications.

First, consider the behavior of one of crypto’s most prominent demographics. In prolonged bull markets, speculators typically use their ETH as collateral to take loans and hoard more ETH.

When the spot price of ETH trended during Dec. 2018 to June 2019, speculators used their ETH to borrow DAI and either hold it or sell it for more ETH. In this situation, there is a lower risk of such a loan being liquidated due to the collateral losing value.

In the last three days, there have been 6,983 DAI trades across 1225 traders and 5 DEXes.

The average size of each trade was 9.89 ETH. At 6,983 trades, that’s a three-day DEX volume of 69,053 ETH. Maker also enjoyed an uptick after jumping from $391 million of collateral locked to $457 million over the same period of time.

Almost 52% of that trade volume came from OasisDEX, Maker’s own DEX, which recently reopened and has been integrated into the platform.

This further supports the narrative that the uptick in DeFi usage during this period came from speculators using Maker to enter leveraged spot long positions.

By posting ETH as collateral and buying ETH with that loan, speculators use their ETH holdings to buy even more ETH. There are similar trends in the broader DeFi ecosystem that show investor’s appetite for risk has moved toward collateralized leverage.

Additionally, Synthetix, a protocol with a similar value proposition to Maker, saw its value locked rise from $108 million to $145 million within the last three days. With Synthetix, users can hold the native token, SNX, to collateralize with an inherent leverage of 1.13x thanks to its 750% collateralization.

One of the synthetic assets on the protocol is sETH (synthetic ETH), which recreates the investment effect of ETH by introducing a one-to-one peg. This is another means of capturing capital appreciation from ETH.

In sum, bear markets create demand for stablecoins while money markets become lender-oriented as the search for yield ramps up. In bull markets, speculators leverage their positions through spot trading or derivative platforms like dYdX.

DeFi’s Resilience

This entire episode stands as a testament to DeFi’s ability to thrive in a variety of circumstances. Bull markets tend to create exuberant sentiment within the market, leading to greater growth. But for investors with an appetite for risk during corrections, there are still opportunities.

This week’s edition of Our Network, a newsletter curated by Spencer Noon, sheds more light on how DeFi protocols managed to turn a bear market into an opportunity.

Alex Kroeger, a data scientist for 0x, revealed in the newsletter that slippage on the platform was minimized as the market turned downward. Typically, market downturns are accompanied by a reduction in liquidity and an increase in slippage, so this is a rather unexpected finding.

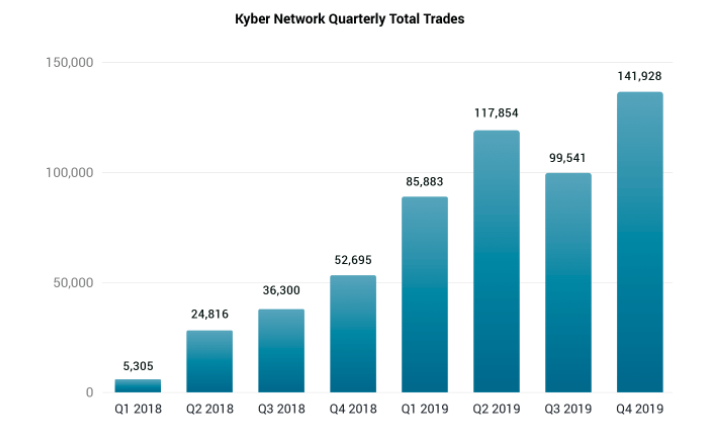

In the same report, Kyber Network’s Deniz Omer indicated that Kyber went from $70 million in volume in 2018 to $380 million in 2019. One would expect the major chunk of this to come in Q1 and Q2, when sentiment was soaring. However, 64% of that volume came in Q3 and Q4, showing robust growth even during a bear market.

Kyber even managed to grow in terms of the absolute number of trades executed, which shows diverse activity rather than just a few massive orders placed by individual whales.

What This Means for DeFi

DeFi has been undeniably sustainable during the span of the last two years since Maker kicked off the movement by launching DAI. There is still a lot that can be done, however, to make dApps more accessible to the general public.

For example, the majority of developers are involved in mobile interfaces, but most dApps need a browser wallet to give users the ability to transact. Argent, one of many mobile wallets built on Ethereum, is being touted to bridge the gap between regular users and the complex world of crypto.

Protocol growth is moving in the right direction by focusing on the development of sustainable risk-taking opportunities, but the gargantuan task of actually bringing this utility to the masses remains a marked challenge.