Decentralized Finance [DeFi] protocols have been gaining popularity with the returns they have been churning out for the users who have locked in Ethereum [ETH] on the platform. This growth of the protocol can be visible in the total amount of ether locked in the applications, which has noticeably tripled in a period of one year and has registered an all-time high.

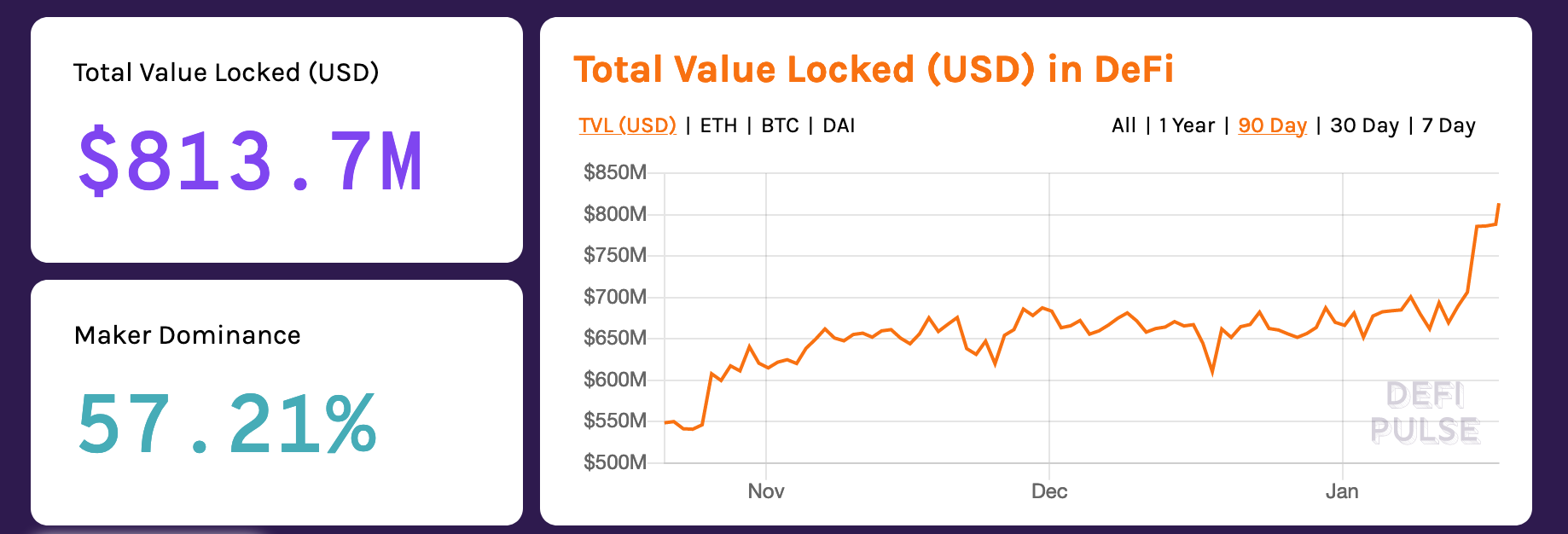

Source: DeFi Pulse

The Total Value Locked [TVL] reached 3.114 million in ether or $813.7 million in USD. The TVL has been on a rise since 12 January, where the value was noted to be $699.342 million [3.0811 million Ether]. The TVL noted a spike between 14 January and 15 January as the value jumped from $706.203 million [3.09 million Ether] to $785.699 million [3.09 million Ether]. This could be attributed to a bitcoin rally, which caused the price of Ethereum [ETH] to also rise by almost 20% within a day.

The users that locked ETH in DeFi considered this a positive signal as it would create upward pressure on the digital asset’s price. Twitter user and active market analyst, @IamCryptoWolf predicted the TVL to reach 1 Billion by February.

The user tweeted:

Applying some simple TA, I would not be surprised to see 1B locked in DeFi in the next month pic.twitter.com/Qm3TrcsmUn

— CryptoWolf (@IamCryptoWolf) January 5, 2020

However, crypto market analysts and founder of Quantum Economics, Mati Greenspan shared a word of caution to users deliberating joining the platform in a blog. Greenspan stated:

“For anyone thinking about entering the space, just know that if lending your money to the government of Brazil is considered risky, lending it to a crypto start-up is exponentially more dangerous. Though I’m glad to see this new market progressing, keep in mind that there’s no Fed to bail you out when things do turn sour and on a long enough timeline its very likely that many will get rekt.”