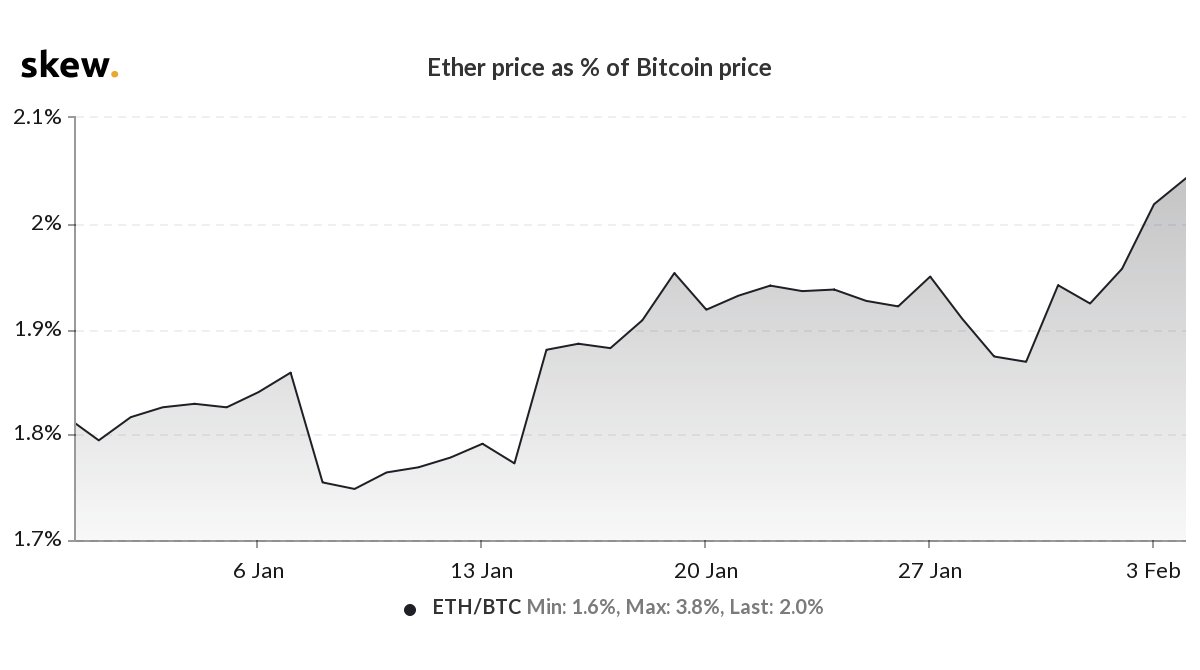

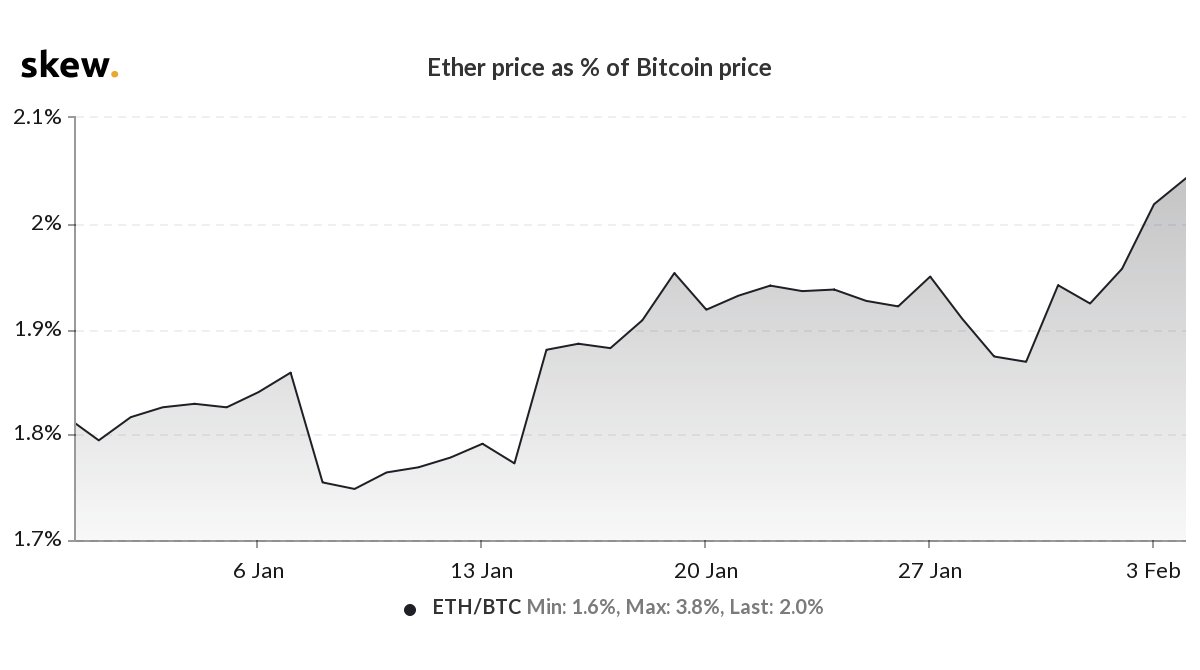

Bitcoin’s performance has been widely discussed in the new year with a special focus on its upcoming halving. However, the second-largest cryptocurrency in the market, Ethereum, has been outperforming the king coin in terms of its year-to-date returns. Ethereum’s YTD was reported to be 44%, while Bitcoin noted a gracious rise of 29.17%. According to data provider Skew markets, Ethereum has been reporting its all-time high trading against Bitcoin.

Skew, in a tweet, stated,

“ETH / BTC new high for the year – trading 0.0208 (2.08% ETH / BTC new high for the year – trading 0.0208 (2.08% 🙊)”

Source: Skew

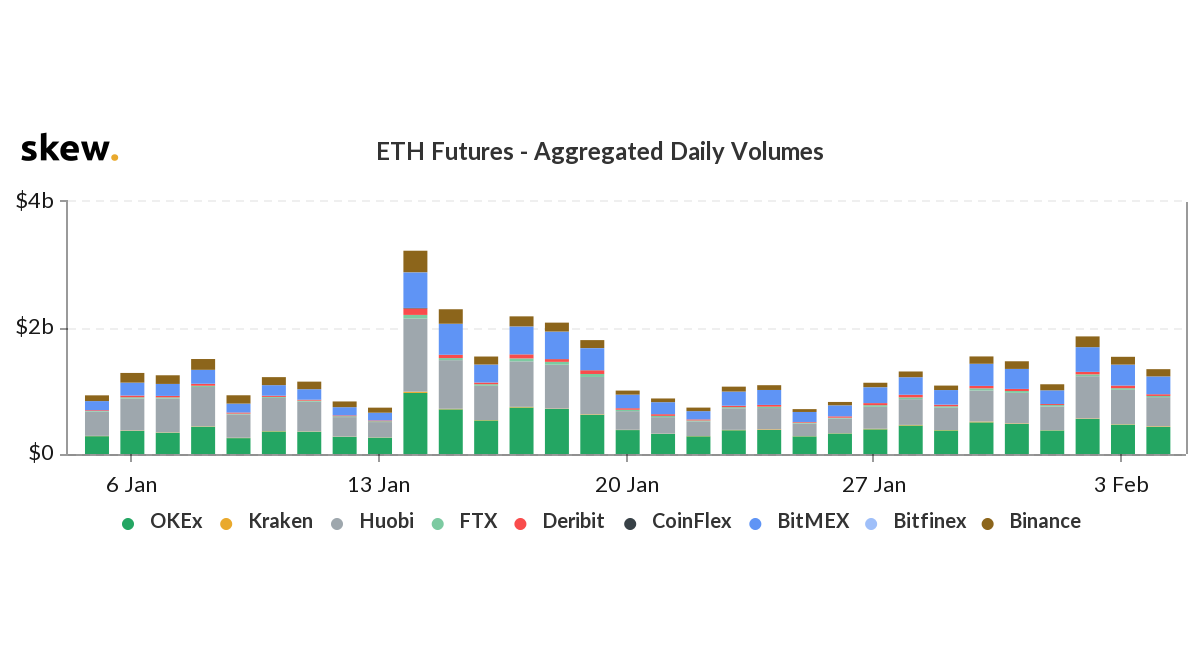

Ethereum Futures reflected the precariousness of the market by the end of the previous year. However, in 2020, the price of the crypto-asset was in contango. Deribit users expect the price of the commodity to reach $210.65 by 26 June, whereas users on other exchanges in a shorter period expected the price to rise to $205 by 27 March.

Source: Skew

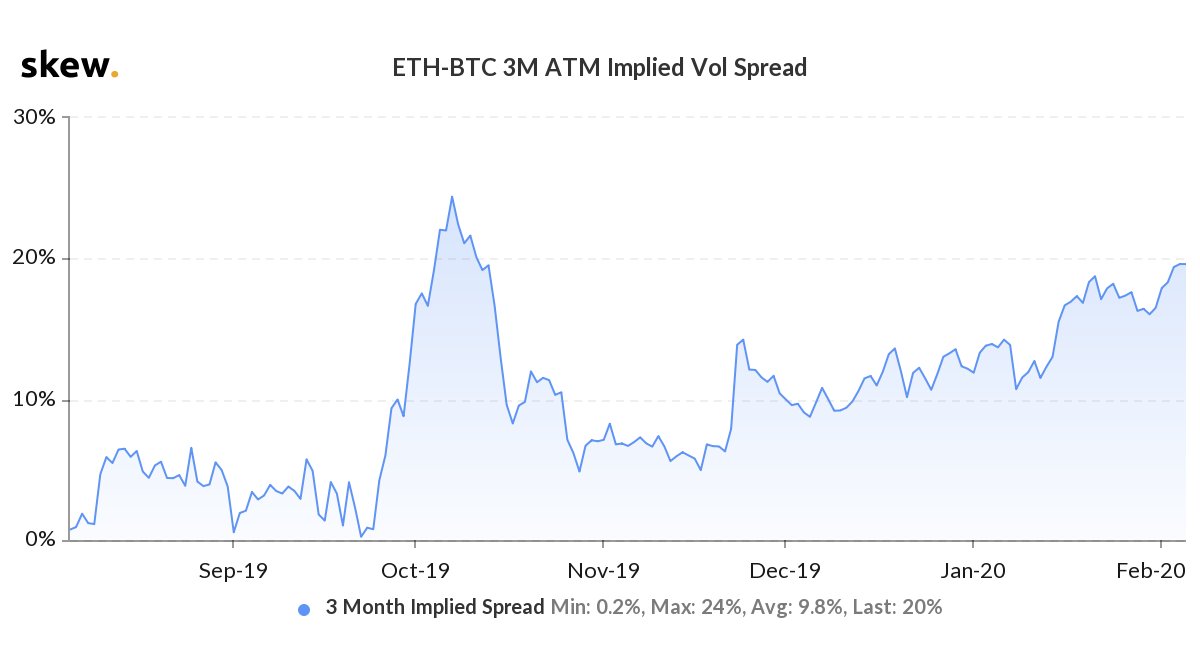

Apart from the growing interest, Skew markets also highlighted that the implied volatility spread [ETH-BTC] remained elevated.

Source: Skew

It also indicated a forecast of likely movement in Ethereum’s price. The second-largest crypto-asset’s Futures volume suffered a little after 14 January, but has managed to pick up the pace since.

Source: Skew

The price of Ethereum at press time was $209.61, with a 24-hour trading volume of $15.86 billion. The market cap of the second-largest asset was around $22.9 billion. However, according to ETH’s price analysis, the price of ETH in terms of USD might drop to a low range of $170 to $168, while in terms of BTC, the price might take a u-turn.