The past week has been noteworthy for most crypto-assets, with a majority of them recording significant gains. The world’s largest crypto-asset, Bitcoin, surged by over 9% over the past week, while most other altcoins in the top 10 registered double-digit growth. Ethereum and other smaller-cap assets have been outperforming Bitcoin too, with the second-largest coin noting positive returns for five consecutive days from 5 February through 9 February.

Source: ETH/USD on Trading View

Ethereum‘s price had been surging with strong green candles over the past week. Within five days of consecutive returns, ETH registered 24% in growth, contributing to the price of the coin shooting from $186.89 to $230.90. However, Ethereum’s beginning of the new week also saw the coin rally alongside a surging Bitcoin price, reporting an 8.23% spike that pushed the coin further to $257.57.

Apart from the price perspective, Ethereum has been a leading choice among users as the number of active addresses rose by 21.5% over the past week, while transaction count also grew by 13.2%. XRP, which is the third-largest digital asset in terms of market cap, saw the number of active addresses shooting up by 396%. However, unlike ETH, XRP‘s transaction count only budged by 5.9%.

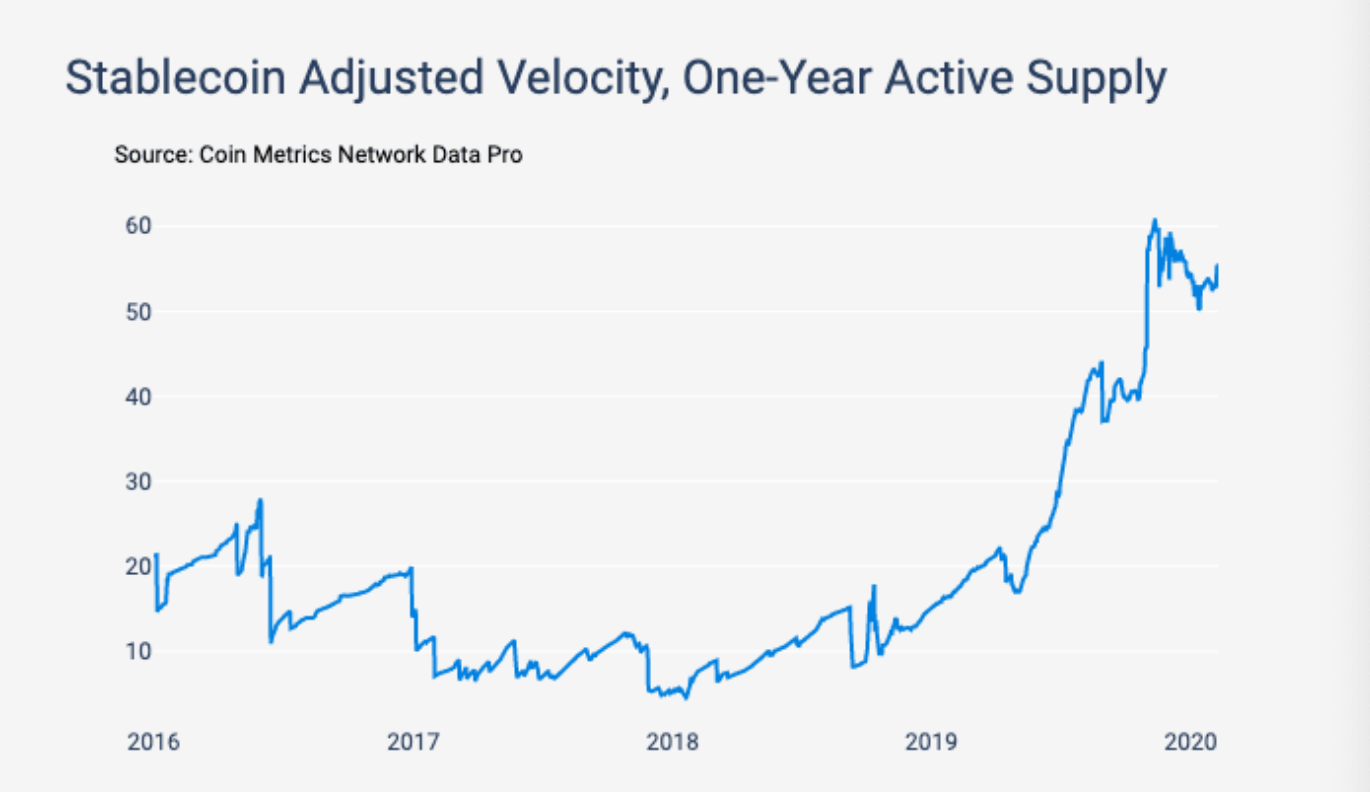

The altcoins have been responding to the active market, but so are the stablecoins as the velocity of a one-year active supply of stablecoins reached an all-time high. It meant that the supply of stablecoins has been transacted at least once within the year and an increasing velocity suggested that stablecoins are changing hands more often, thus marking a potential increase in them being used as a medium of exchange for transactions.

Source: Coin Metrics

Tether [USDT] has been the most dominant stablecoin in the market for quite a while now. With a total supply of 4.77 billion, USDT was launched recently on Algorand blockchain. According to Tether‘s CTO Paolo Ardoino, the collaboration will be leveraging the speed and security of Algorand. Tether‘s supply was largely held on Ethereum blockchain with a value of $2.30 billion, followed by Tron that had a supply of $839.38 million. On the other hand, Omni had a sum of $1.55 billion authorized USDT.