After Bitcoin registered corrections on 15 and 19 February, market speculators are now pinning their hopes on Bitcoin, hoping that the king coin shifts its gears and records another bullish rally soon. However, the situation has only moved south since the middle of the month.

Bitcoin recorded another drop of over 6 percent over the past 24-hours, movement which saw the valuation go below its support levels at $9333. This is the third correction over the past 12 days and it has added more fuel to the discussion that bulls might be losing their grip on the market.

Bitcoin’s depreciation has impacted other crypto-assets well, according to the chart analysis.

Ethereum’s performance in 2020 has been impressive with the coin mustering a 132 percent hike since January. It largely outperformed Bitcoin over the past couple of months, but registered its own corrections after hitting a high on 14 February.

Bitcoin seemed to affect Ethereum’s valuation, at press time. From the chart, it can be observed that Bitcoin’s dump on the 19th triggered a decline in Ethereum’s chart as well. Bitcoin went under its support levels at $9800, whereas Ethereum dropped below $268. A similar situation transpired on 26 February as Bitcoin’s decline below its strong support at $9333 triggered Ethereum’s fall below its support at $251.

With bearish pressure slowly creeping up over the short-term, Bitcoin may re-test the next support at $9116. A mediation below that mark may trigger a significant dump for Ethereum as it may fall below $229 on the charts. A dump below $229 would open the possibility of ETH crashing below its psychological $200 mark as that would mean Ethereum losing over 30 percent of its gains from 2020.

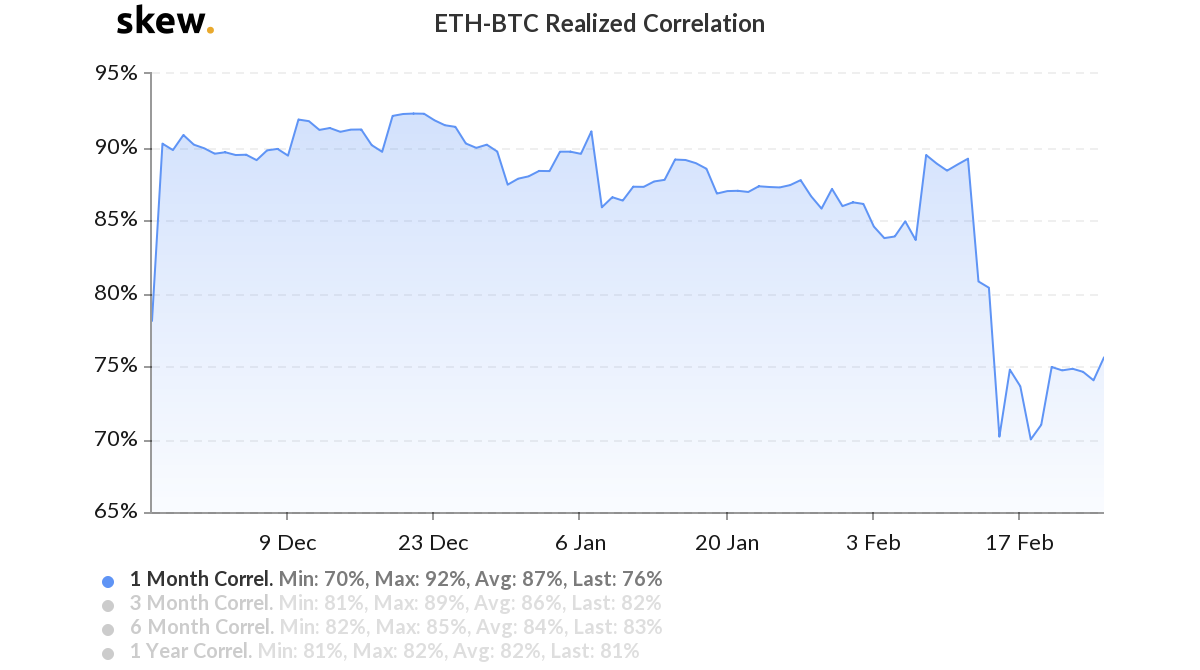

After decoupling from Bitcoin, Ethereum’s price appeared to be reactive to BTC again as it was observed that the correlation factor between ETH and BTC had increased over the past few days.

Source: Skew

From the chart above, it can be observed that while the correlation between ETH-BTC dropped to 70 percent, it was back on the rise at press time, picturing a 76 percent in terms of 1-month correlation.

Many users in the space have speculated about the fact that Ethereum’s growth could be one of the strongest factors that may catalyze an altseason. However, with bullish pressure getting exhausted on Ethereum’s front, the alt rally and the collective market may undergo a series of changes over the next week if things don’t change.