After updating and migrating the DAI stablecoin from its previous form to its latest iteration, Multi Collateral DAI, Maker has conducted the first major token upgrade, proving that token migrations don’t have to be cumbersome.

From SAI to DAI

The introduction of Multi Collateral DAI (MCD) sparked life to a new concept of protocol and token innovation. Rather than upgrading tokens via code changes, Maker deployed a new smart contract with fresh code to improve DAI. The old DAI is now called SAI, or Single Collateral DAI.

Notable changes from MCD include the DAI Savings Rate, Basic Attention Token (BAT) as collateral for loans, and a system surplus auction to erase system debt.

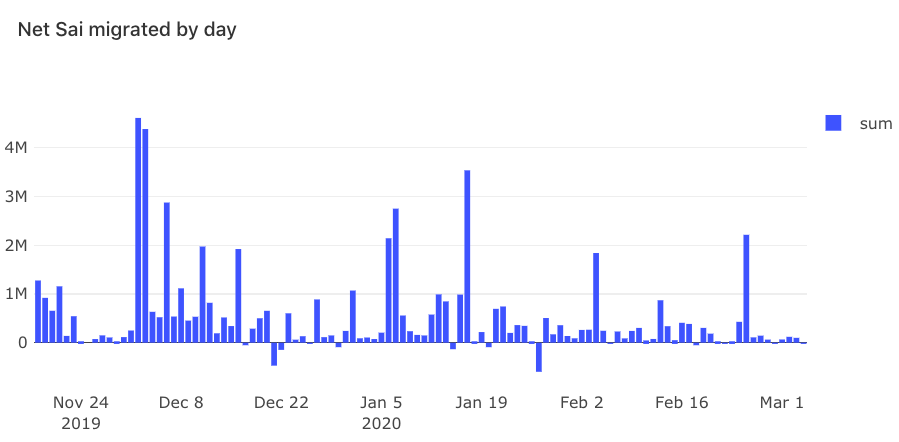

Since November 2019, a net total of 56.56 million have been migrated from SAI to DAI using Maker’s migration facilities. Close to 101 million DAI were in existence prior to MCD, indicating a rough migration rate of 56%.

A major reason for MCD’s success has been sustained support from the DeFi ecosystem.

From lending avenues like Compound and dYdX to wallets like MetaMask, DeFi protocols took it upon themselves to ease user burdens and help facilitate migration from SAI to DAI without using Maker’s migration tool.

Without support from other DeFi projects, it is near impossible to assume that Maker could have pulled off the migration alone. Compound allowed users to keep their cToken balances intact during the migration process which abstracted away a lot of additional processes. This helped these users upgrade to the new DAI with the click of a button.

These changes were made after serving the necessary time lock for administrator changes, so users could remove their funds if they didn’t want to upgrade from SAI to DAI. The same holds for dYdX’s migration too.

Spurring Token Innovation in DeFi

MCD has set an important precedent for protocols that want to change their token economic models. The difference between deploying a new smart contract rather than just updating the contract is akin to hard forks and soft forks, respectively.

However, rather than claiming tokens as one would during a chain fork, MCD has to be migrated from the first contract to the second or simply minted on the second contract.

The importance of this has been undersold so far.

Apart from the value overflow incident, Bitcoin’s hard forks, including Bitcoin Cash and Bitcoin Gold, have been contentious.

Taking heed from this, many in the Ethereum community believed that social consensus over MCD would be a barrier to widespread implementation. This narrative withered away as DAI gained prominence over SAI as the stablecoin of choice.

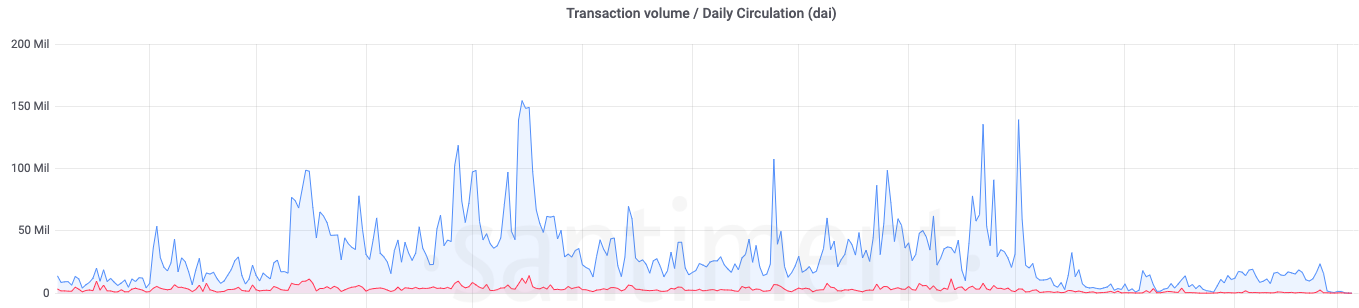

While there is still activity using the SAI stablecoin, it is negligible compared to DAI. The end result of this is a successful migration of activity from SAI to DAI.

If the DeFi ecosystem comes together to help facilitate token migration, there is almost nothing to stop it. MCD was well received by the community, so there was little contention from the community. However, if there was, banding together as they have to oppose ProgPoW would be the community’s best chance at stopping the token migration from succeeding.

As a new cycle in the market approaches and crypto-native investors become more selective, tokenized projects will have to stand out to gain attention. This requires improving the protocol and the economics of its token.

Migrations, which were previously seen as taboo, now have a successful model to follow in Maker’s Multi Collateral DAI.