The price of Bitcoin felt the effect of a bearish market on 8 March as it fell under the $8k mark within 36 hours. The 15.27% dip was followed by more bad news in the altcoin market. The second-largest cryptocurrency, Ethereum [ETH] was devalued by 22.36%, within the same period, bringing its price down from $252.82 to $196.29. However, at press time, ETH buyers have managed to pull the price up to $206.35, as the third green candle tried to outlast selling sentiment.

Source: ETH/USD on Trading View

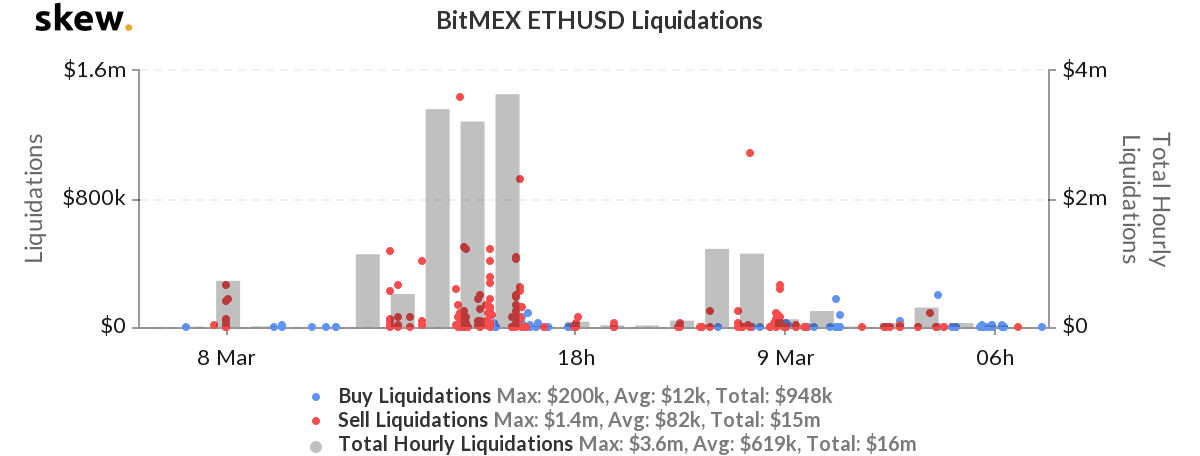

As the drop crept in the XBTUSD market, triggering longs liquidations worth $206 million, the Ethereum futures market was also subjected to a similar fate. On 8 March at 05:30 UTC the fall in the market set off total liquidation worth $15 million on BitMEX. According to data provider, Skew, the liquidations took place in two phases for the ETHUSD contracts being traded on BitMEX.

The first set of liquidations took place from 1400 – 1600 UTC on March 8. The three hours marked ETHUSD contracts liquidations worth, $3.4 million, $3.2 million, and $3.6 million [which included single trade of $1.4 million]. This was followed by a second set of liquidations between 2200- 2300 UTC, wherein $1.2 million and $1.1 million liquidations took place.

Source: Skew

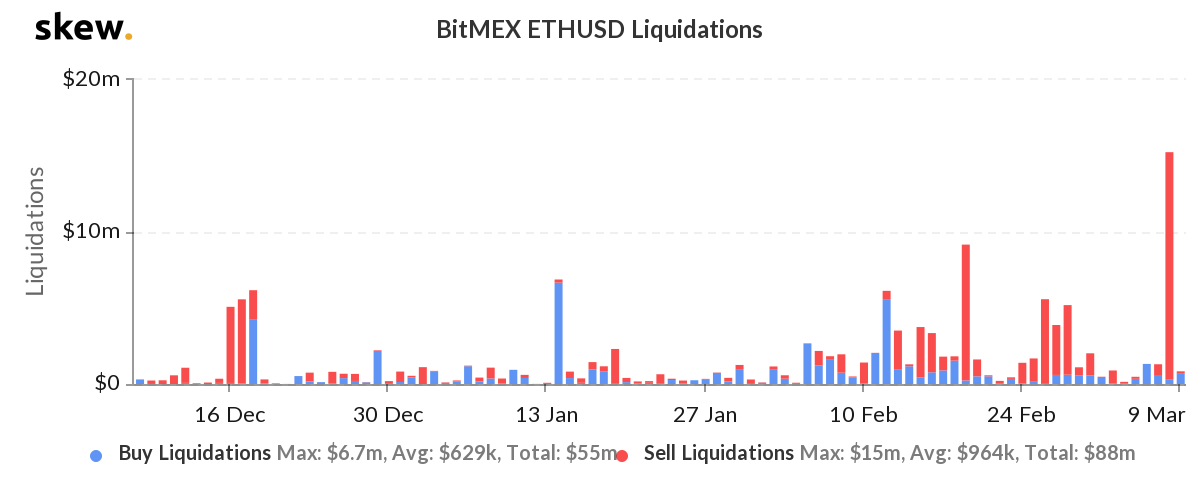

Due to the recurring hit taken by ETH in 2020, its total liquidations in 3 months stood at $21.7 billion. This value was contributed highly by longs liquidations worth $88 million, followed by $55 million worth of shorts clearance.

BitMEX’s liquidations of ETHUSD contracts on 8 March was highest since the price drop faced by ETH in the spot market on 19 February. As the cryptocurrency market crumbled within hours, Ethereum’s market price fell from $287 to $251.03, a fall of 12.53% within four hours, giving an opportunity to the longs to play their cards resulting into total liquidation of $9.2 million.

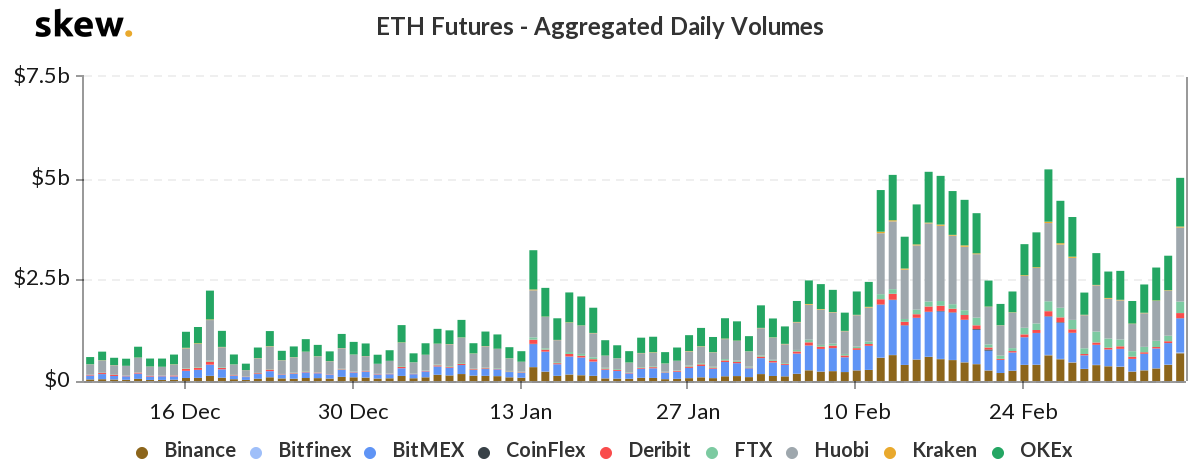

However, the aggregated daily volumes of ETH futures reflected an upward movement, due to the drastic change in the spot market. At press time, the daily volume of the ETH futures was $4.98 billion.

Source: Skew