It’s been a rough past week for the collective digital asset market, with Ethereum emerging as one of the worst affected assets in the industry.

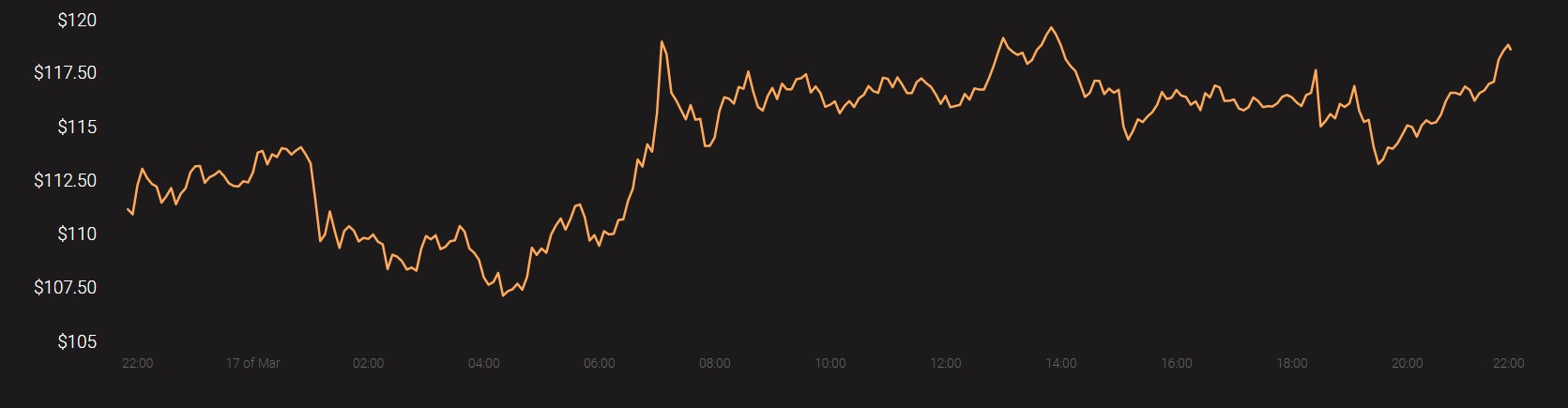

At press time, Ethereum was valued at $118.51 after collapsing from above the $200 range in less than a week.

Despite such a devastating turn of events, however, the crypto-asset’s derivatives market continued to picture an undecisive sentiment, at the time of writing.

Source: Skew

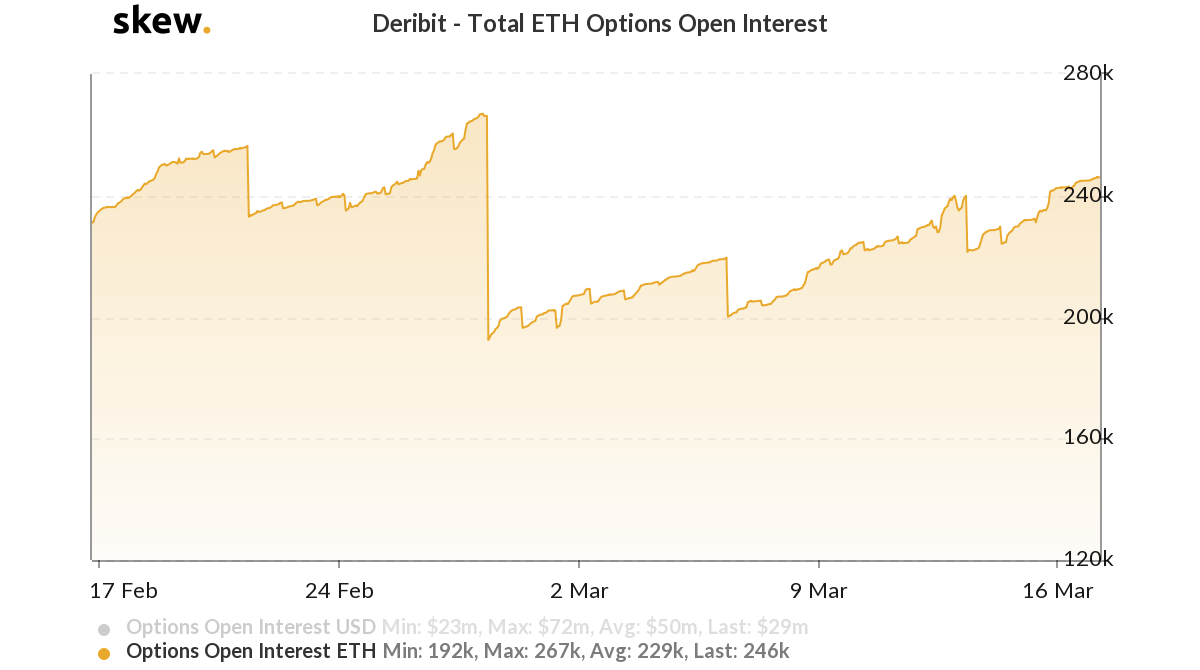

According to data released by Skew analytics, it can be observed that the total ETH Options‘ Open Interest on Deribit has continued to build positive momentum since the 44 percent drop on 12 March. At press time, the Open Interest registered was around 246K, a figure which was around 225K on 12 March.

The Open Interest, at the time of writing, reciprocated similar levels, something that was observed in early February as well. Here, it is important to note that the bullish momentum was significantly high during that time.

Source: Skew

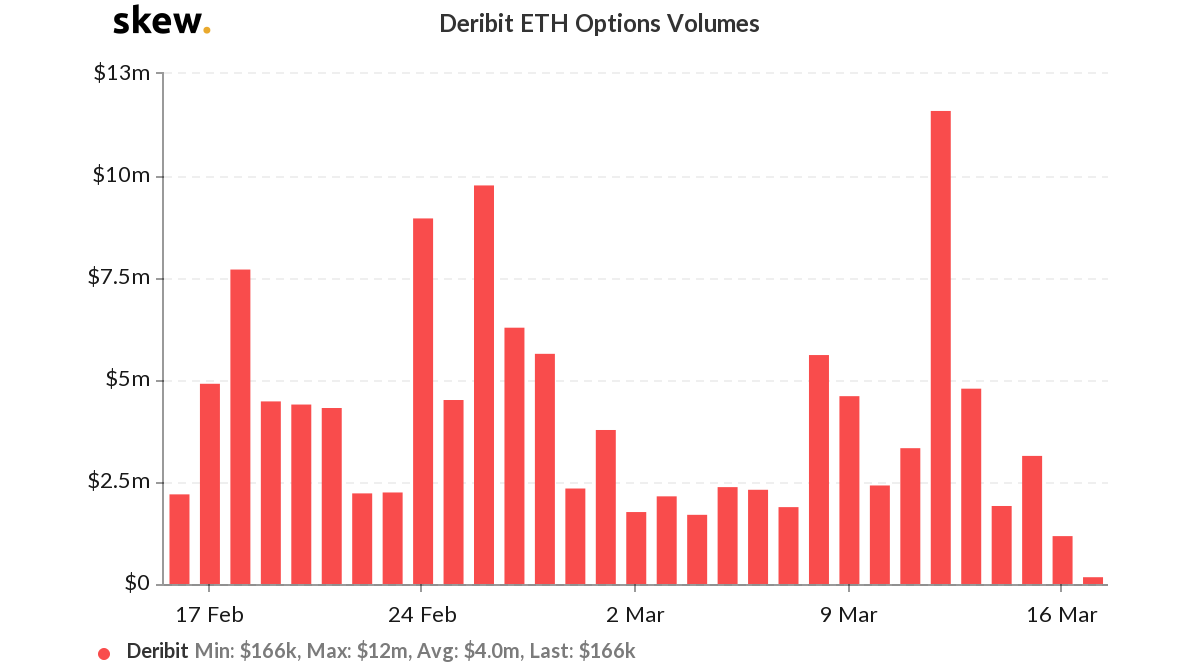

A split in sentiment can be presumed as it was observed that the ETH Options trading volume on Deribit did not mirror the same kind of momentum. The trading volume on 12 March was as high as $12 million, but over the past few days, the drop has been significant.

At press time, the volume was as low as $170k, a figure that suggested that despite high Open Interest, there is a lack of activity in the derivatives market from investors.

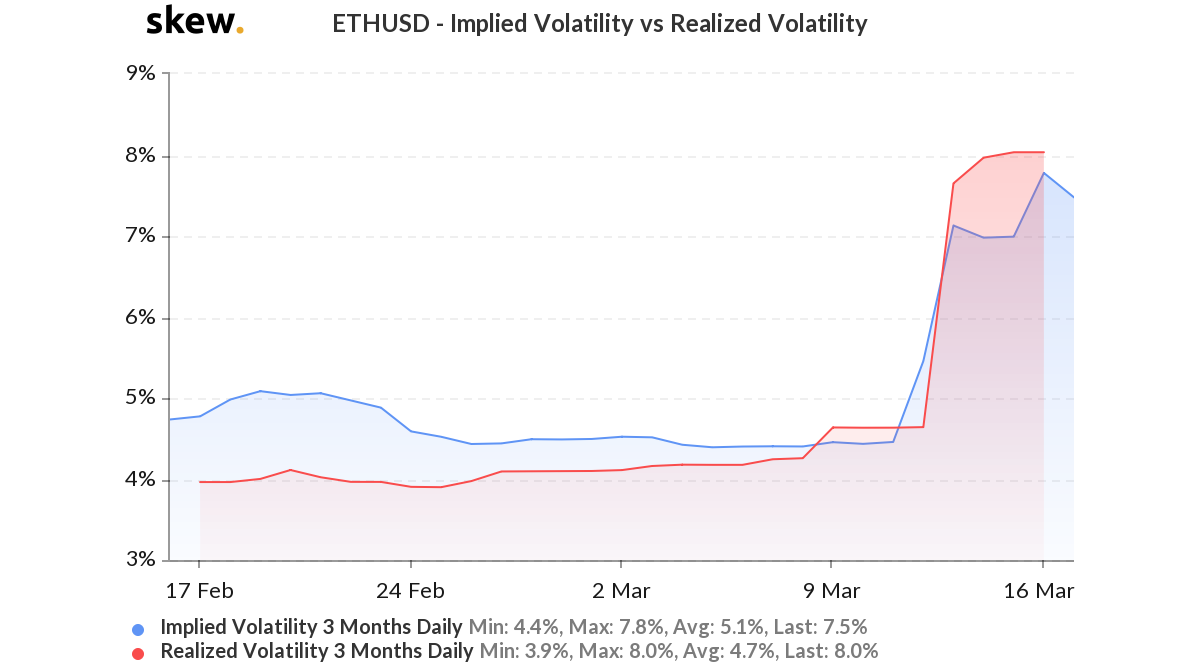

The volatility continued to be part of an unsettled market as the attached chart suggested that realized volatility remained above implied volatility, at the time of writing.

Source: Skew

Realized volatility, a metric which usually highlights the volatility surfacing in the market, was for a long period of time, under Implied Volatility on the charts.

Considering the fact that realized volatility remained above volatility implied at press time with 8 percent to 7.6 percent implied, the potential of another bearish price swing was not out of the question.

Source: Skew

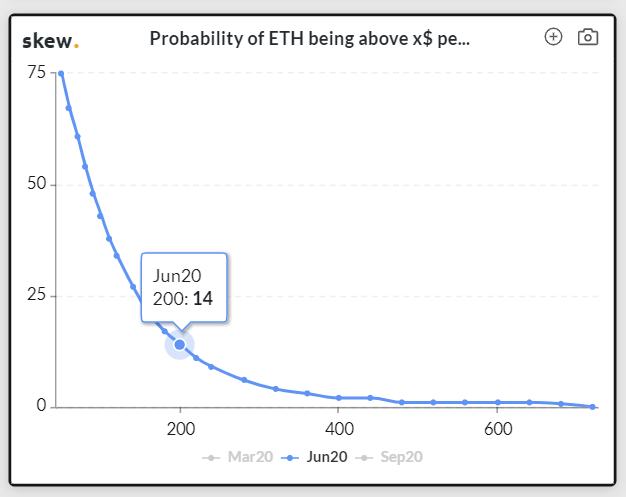

The downward momentum over the past few days has also impacted the probability index for Ethereum.

The index, at the time of writing, suggested that the chances of Ethereum crossing $200 by 20 June were about 14 percent, which is a stark difference from the earlier projection of 50 percent back in early-February.

With the spot markets currently nursing the damage of the past week, the derivatives industry continued to record mixed sentiments that may change in the near future as well.