Altcoins faced the wrath of the market after Bitcoin slid from $9,000 to $4,000. This brutal dip in the value of Bitcoin came following the sudden correlation with the stock markets. However, for altcoins, such falls are usually due to their correlation with Bitcoin.

With Bitcoin being the most widely traded cryptocurrency [excluding stablecoins], it is inherently linked to all other altcoins. All altcoins are traded with Bitcoin as base pair and the reason behind this is to get the profits from altcoins into Bitcoin. Hence, the correlation of altcoins with Bitcoin is an inherent feature of cryptocurrencies.

So, logically, when Bitcoin collapsed, it would make sense for altcoins to do the same too.

Source: TradingView

However, following the aforementioned market crash, it was up to the altcoins to record recoveries of their own. Along these lines, while OKB did record a 54% surge since the dip, ETH and BAT have both struggled to cope and surge.

Ethereum

Source: ETHUSD TradingView

At the time of writing, Ethereum was forming a bullish pattern on the charts, an ascending triangle. However, the price had managed to drop by 12% over the last 24 hours, especially as the 50 DMA [Yellow] moved closer towards the 200 DMA [purple].

At press time, Ethereum was priced at $128.54, with a 24-hour trading volume of $11.4 billion, having fallen by over 6% in the past 24 hours

OKB

Source: OKBUSD on TradingView

OKB has been moving sideways after it broke out of the rising wedge – a bearish pattern. Like ETH, OKB also fell, recording a fall of 11% over the last 24 hours. The MACD indicator remained uncertain, with the signal line heading for bearish drops.

At the time of writing, OKB was priced at $4.10, with a 24-hour trading volume of $187 million.

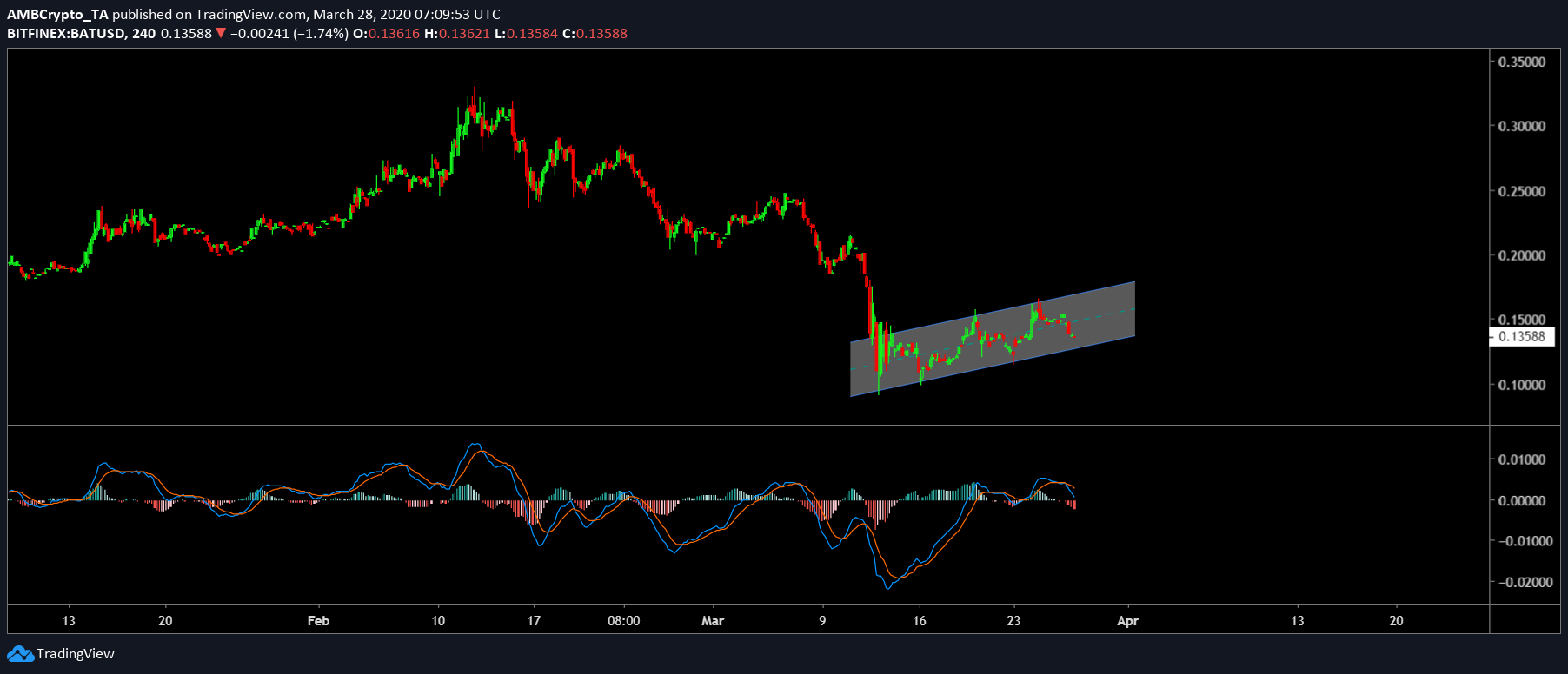

BAT

Source: BATUSD TradingView

Basic Attention Token aka BAT‘s charts were indicating the formation of a bearish pattern, with the MACD clearly showing the formation of a bearish crossover. The rising channel was also an indication of a bearish move to come in the near future for BAT.

At the time of writing, BAT was priced at $0.13, with a 24-hour trading volume of over $69 million.