Ethereum kickstarted 6 April with a strong green candle; by the eleventh hour, ETH had managed to acquire 8.38% of its value and marked a daily peak at $155.78. The second-largest cryptocurrency was able to hold this price and was being traded at $155.79, at press time.

Source: ETH/USD on Trading View

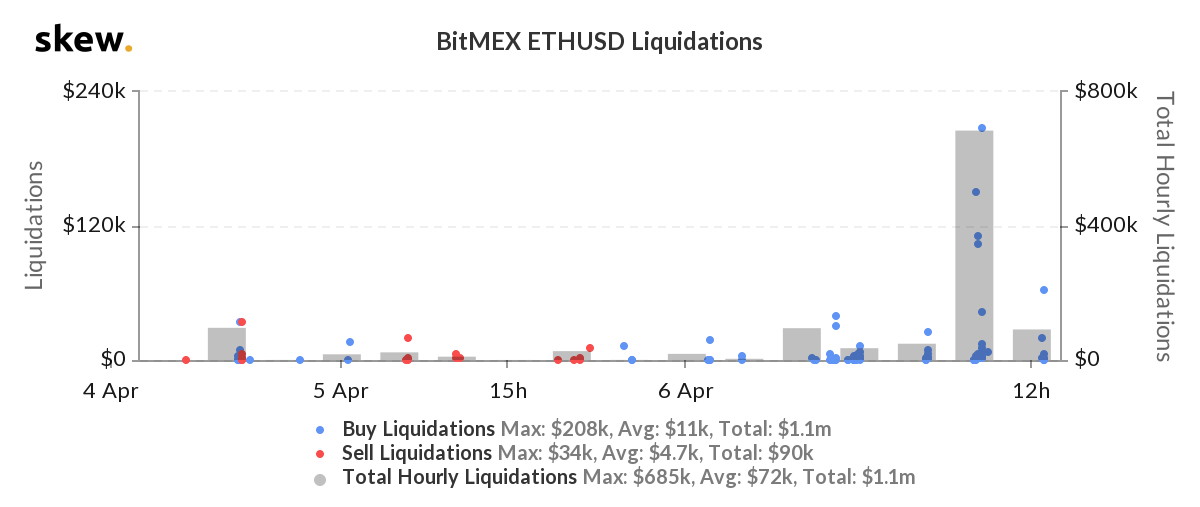

As the price started to appreciate, heavy liquidations were noted in the Ethereum Futures market. According to data provider, Skew, BitMEX ETHUSD liquidations amounted to $1.2 million within the last 24-hours. The highest liquidation was worth $685k on 6 April at 0900 UTC, with the buyers shorting the price of the digital asset. The highest hourly liquidation through a single transaction was worth $208k.

Source: Skew

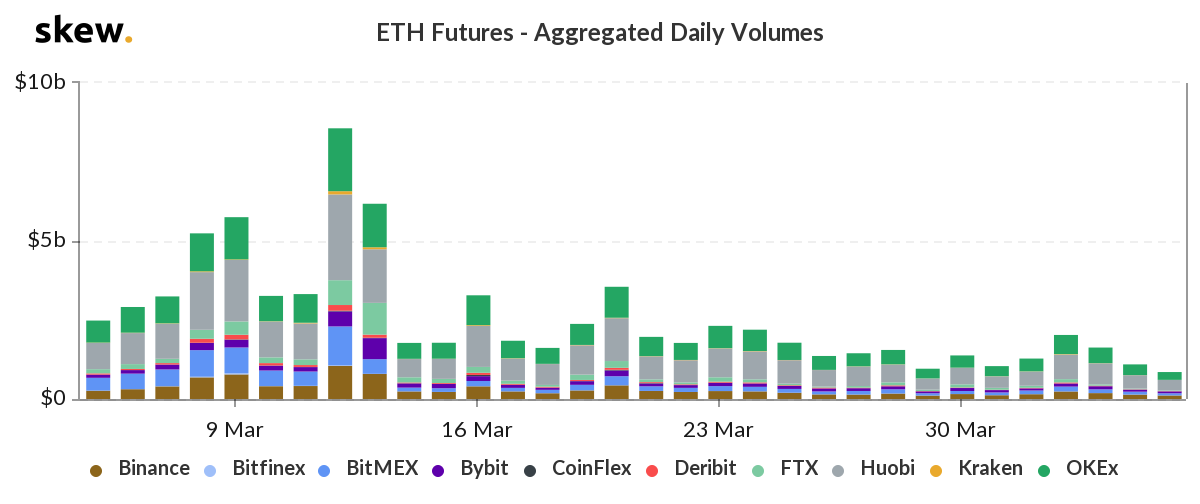

Out of the total liquidations that took place on BitMEX, the majority were Buy Liquidations. Despite a rising price, the daily volume of Etheruem futures still appeared to be restricted.

On 12 March, the volume had topped at approximately $8 billion, as the price of ETH collapsed. However, as days progressed, the volume shrunk and on 6 April, the volume was close to $854 million. A similar trend was also noted in the Bitcoin futures market, where the volume had been hovering around $8 billion. Since 12 March, the aggregated daily volume was close to $50 billion.

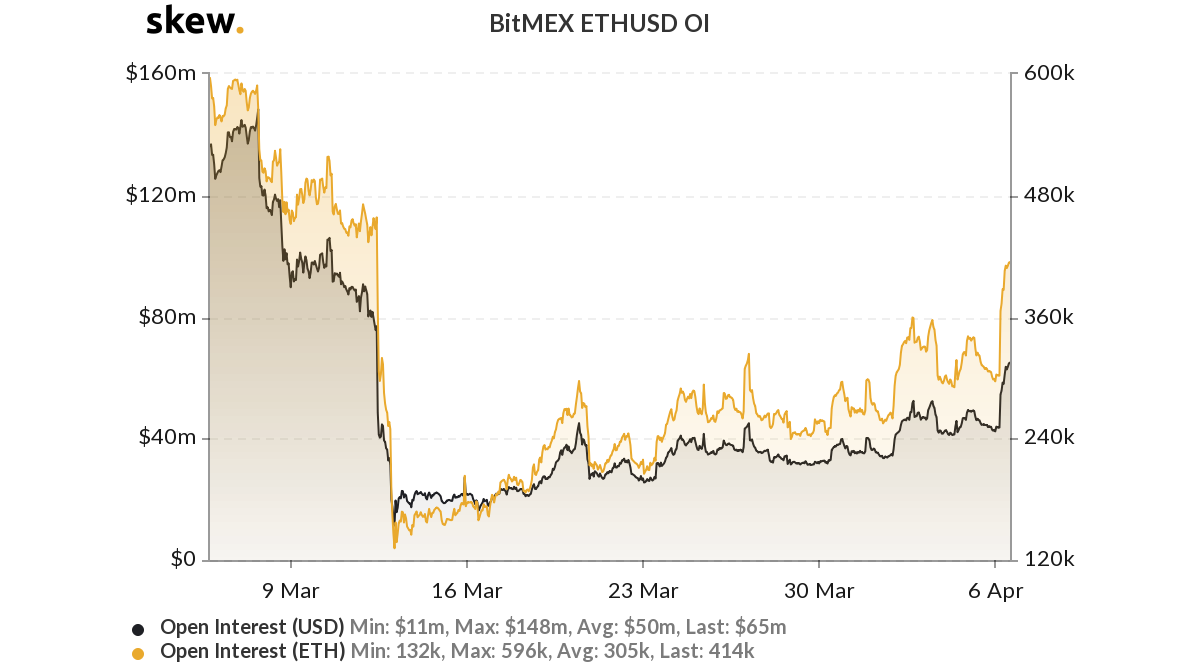

Even though ETH futures market failed to note a drastic rise in the Open Interest [OI] on other derivatives exchanges, ETH futures on BitMEX was showing an upwards spike.

Source: Skew

The ETHUSD OI had fallen on BitMEX on 12 March from $76 million to $17 million and moving sideways. However, on 6 April, the market rally hinted at the possible interest from traders on BitMEX to report a spike from $44 million to $65 million within hours.