In the traditional world of finance, paramount significance is placed on trust and centralized models of governance. When the idea of cryptocurrencies like Bitcoin was conceived, it sought to present an alternative form of finance, one that was trustless and dependent solely on code. However, in the years since, even the world of crypto has had many pitfalls. Despite all these pitfalls, it continues to represent a decentralized and trustless system, when compared to the types of money offered by nation-states.

On the latest episode of the Epicenter podcast, Ryan Sean Adams, Founder of Mythos Capital, highlighted how cryptocurrencies are a digital alternative to centrally-banked fiat currencies like the U.S dollar, while also expanding on the role of Ethereum in such an ecosystem. He said,

“I do think that as the world develops a digital alternative because we’ve had physical alternatives to Fiat money before in the form of gold and commodity assets like that. But crypto is the first time we’ve had a digital alternative to a centrally backed digital US dollars.”

According to Adams, this new form of currency will inevitably gain traction as more and more users migrate to it. Noting that the existing fiat-run system can be a ‘back-up,’ he said,

“Funds and capital will flow from this old traditional world to this new traditional world. It could take decades, it might take generations, but you know, future generations will have an alternative to the traditional system and hopefully, that restores a bit more balance.”

Over the years, with Bitcoin positioned as the digital asset that will make fiat currencies obsolete, Bitcoin’s scalability problem emerged to become a barrier to the argument. However, Ethereum as an ecosystem and Ether as its currency holds promise, according to Adams.

“To have a bankless financial system to have a bankless store of value at the base layer, I think that Ether as a store of value asset in Ethereum is probably the most important money lego in the entire stack”

Source: Bankless

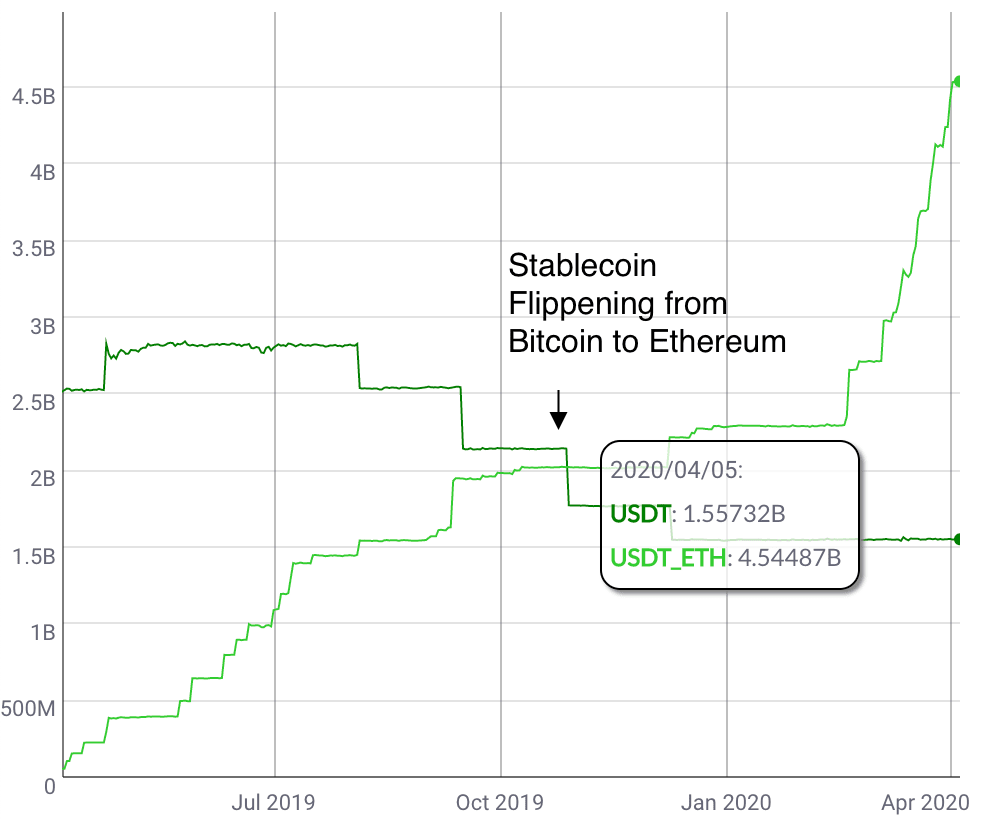

In a recent blog post by Adams, he had elaborated on the growing role Ethereum is playing in the stablecoin ecosystem. He had also highlighted the growth of stablecoins vis-à-vis Bitcoin v. Ethereum and how the latter settles over 75% of the entire crypto stablecoin market.

Commenting on the growing economic bandwidth for crypto-assets as the base layer and how it can onboard more people, Adams argued,

“Within the borders of Ethereum – the digital nation-state and the digital economy, I would argue Ether is used as money across all of those dimensions.”