Bitcoin and Ethereum, both are capable of becoming the world’s first non-sovereign digital money, however, both coins have to deal with a few shortcomings to reach that position. A recent report analyzed the different paths taken by BTC and ETH to ‘moneyness’.

The root of the different paths taken by the top two coins depends on the very way they define ‘money’. The report read,

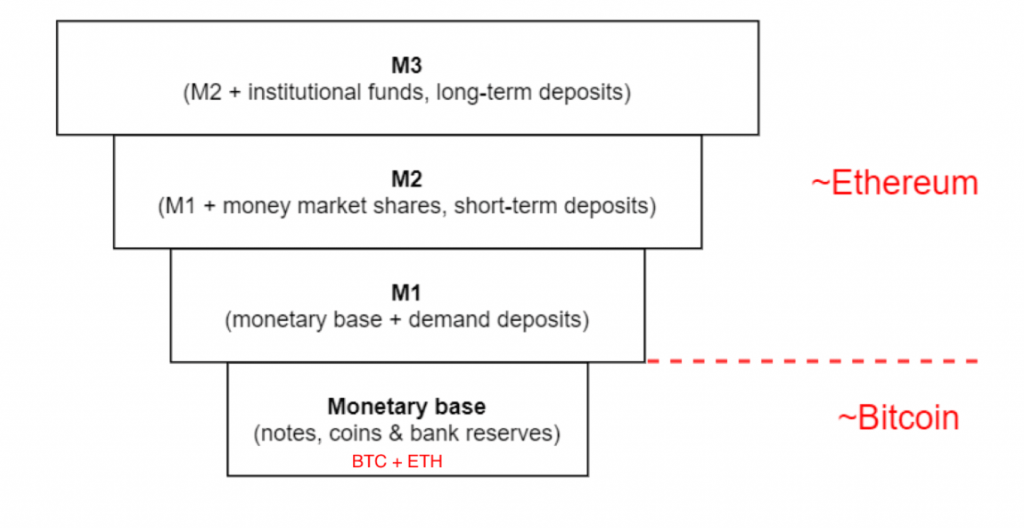

“Bitcoin’s approach is to focus on solidifying the foundation of the monetary base while Ethereum’s approach is to aim at further monetary aggregates.”

The report noted that money has no single definition and that it is a spectrum of various levels of trust and liquidity across individual layers. As seen in the above diagram, while the monetary base is the first thing BTC is focusing on, Ethereum mostly looks at the monetary utilities.

Anthony Pompliano, BTC promoter, in his recent blog post, claimed that the idea behind the concept that ‘ETH is money’ was fundamentally flawed. He argued that Ethereum was no different than fiat currency as ETH has no fixed supply, similar to fiat. He also further noted that Ethereum’s monetary policies were determined by a small group of individuals, something that completely mirrored the functionality of fiat currencies.

In a recent article, David Hoffman, the co-host of the Crypto POV podcast, explained why he believes Ether will achieve money status. He noted that Ethereum applications will all ultimately aid Ether to become organically engineered to becoming money.

Putting things in perspective, both BTC and ETH indeed have the capabilities to become the world’s first digital money without any government involvement “if BTC survives its hard-coded monetary policy and Ethereum can prove that it can achieve moneyness on a constantly shifting monetary base.” The upcoming ETH2 upgrade might also add to ETH’s future path to moneyness.

The report concluded that both Bitcoin and Ethereum had to create pockets of circular economies, without dependence on the fiat on/off-ramps. “This is especially true for Bitcoin—in order to establish itself as a future monetary base, its users need to start thinking in bitcoins/satoshis as a natural unit of account,” it read.

All fiat currencies are centralized and cannot really compete with a fixed supply of 21 million. Thus no other currency can possibly match Bitcoin; one that will not change and that does not rely on trust. Thus the question ‘What exactly differentiates Bitcoin from all other forms of money?’ continues to be debated over.