Ethereum is having a favorable April.

Over the course of the past two weeks, Ethereum has scaled by 20 percent in the charts as its valuation jumped from $129 to $154. After a catastrophic March, the largest altcoin was showing significant signs of recovery but a recent analysis indicated a minor trend reversal could be on its way.

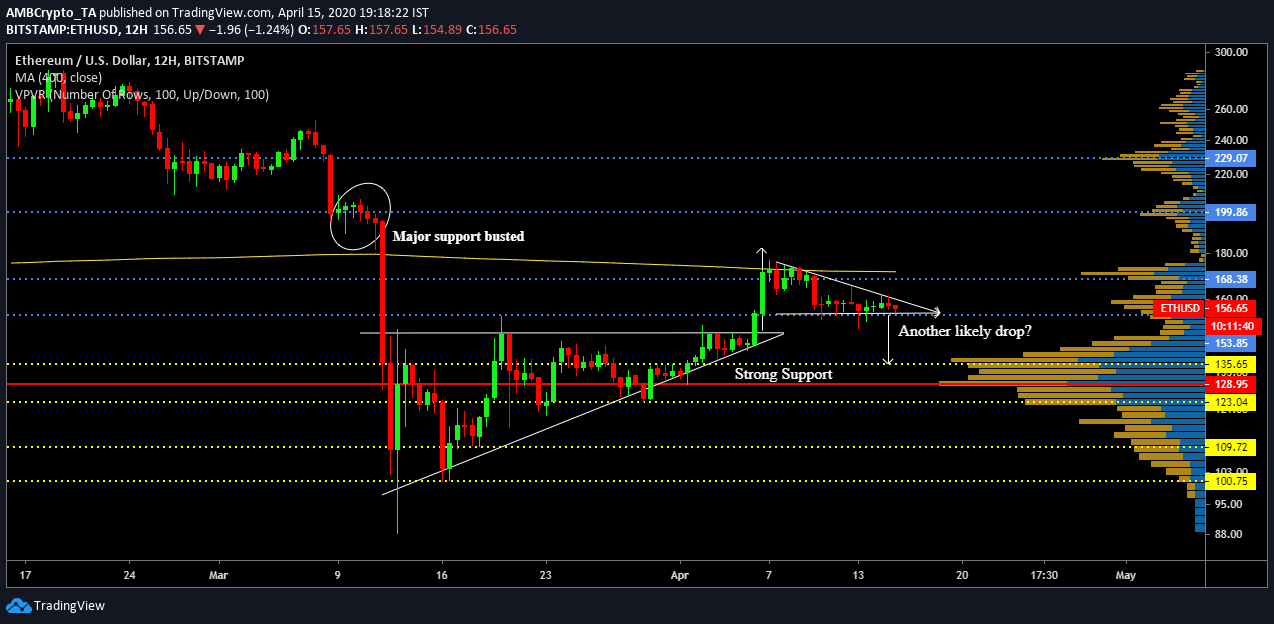

On observing Ethereum’s 12-hour chart, the recovery period since the collapse of 13th March is fairly evident. After dropping below $100 on the 13th, the token has periodically breached key resistance at $109, $123 and $135.

Between 13th March and 6th April, Ethereum’s price movement paved the way for an ascending triangle in the charts. The upper trend line at $147 was tested on 20th March and 2nd April. The price continued to build on this momentum and on 6th April, a bullish breakout enabled Ethereum to successfully breach major resistance at $154.

The token also briefly crossed $168 but a quick pullback has seen Ethereum consolidate between $168 and $154 over the past week.

Currently sitting at $156.65, Ethereum’s price has started taking the form of a descending triangle at the moment, which may have bearish implications. Any bearish pullback over the next week, may see Ethereum drop down to re-test support at $135.

However, According to the VPVR indicator, the support around $135 was significantly strong. The Point-of-Control was also stretched at $128, indicating a strong base.

These factors may suggest that Ethereum could necessarily bounce back sooner than later to its current levels if a correction takes place over the next few days.

The 200-Moving Average continued to act as resistance at $170, which should be Ethereum’s long term target over the next month.

Ethereum Correlation dip with Bitcoin

Over the past week, an absence of major price movement has also allowed Ethereum to reduce Bitcoin’s dominance on its value. It was previously reported, that the Ethereum realized volatility in terms of Bitcoin suffered a massive slump which suggested that the altcoin could be moving away from Bitcoin at the moment.

ETH was strongly correlated to Bitcoin after the collapse on 13th March, which had the entire community devastated as Ethereum dropped by more than 50 percent.

With Bitcoin’s halving approaching, Ethereum is cleared from another price turbulence but for the time being, market fundamentals remain healthy for the 2nd largest virtual asset.