Recent data on the cryptocurrency derivatives market indicates that there is still steady growth despite the economic crisis that the world is facing. Trading volume is up from 2019 and many entities are planning to bolster their infrastructure and services.

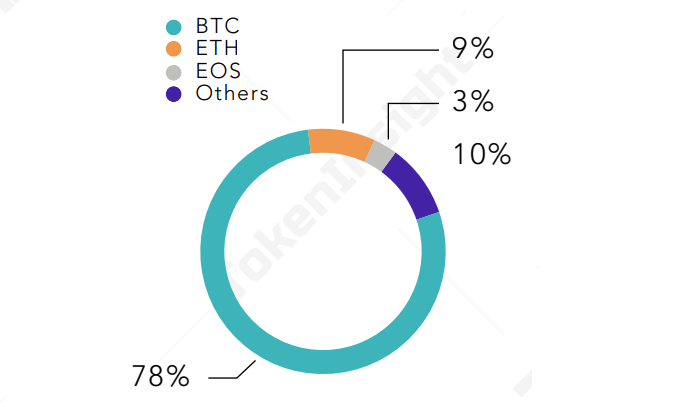

TokenInsight’s most recent 22-page report indicates that, despite the economic fallout as a result of the COVID-19 pandemic, the derivatives market is holding itself together reasonably well. Bitcoin (BTC), Ethereum (ETH), and EOS (EOS) have accounted for more than 90 percent of the market’s turnover.

The large volumes being reported are due in part as a result of the number of exchanges that have launched related investment vehicles. Both NASDAQ and JP Morgan officials have even indicated that they will move into offering cryptocurrency futures and options, a development that will underscore the conviction driving this niche market forward.

Cryptocurrency Trading Volume Data Points to Growth

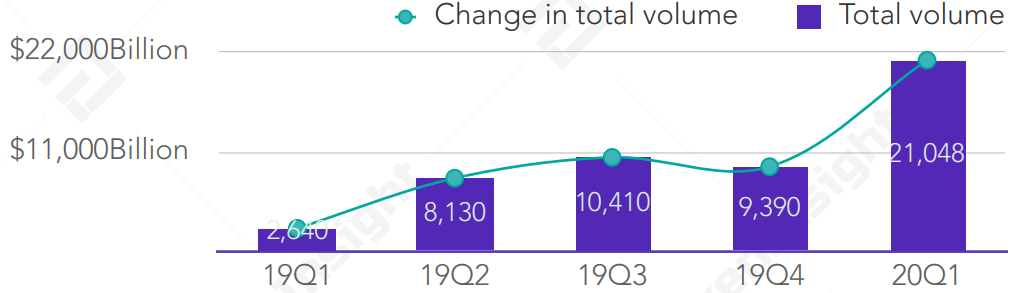

The most notable statistic from the report is a staggering $2 trillion turnover of the cryptocurrency derivatives market in Q1 2020, exceeding the 2019 quarter average by 314 percent.

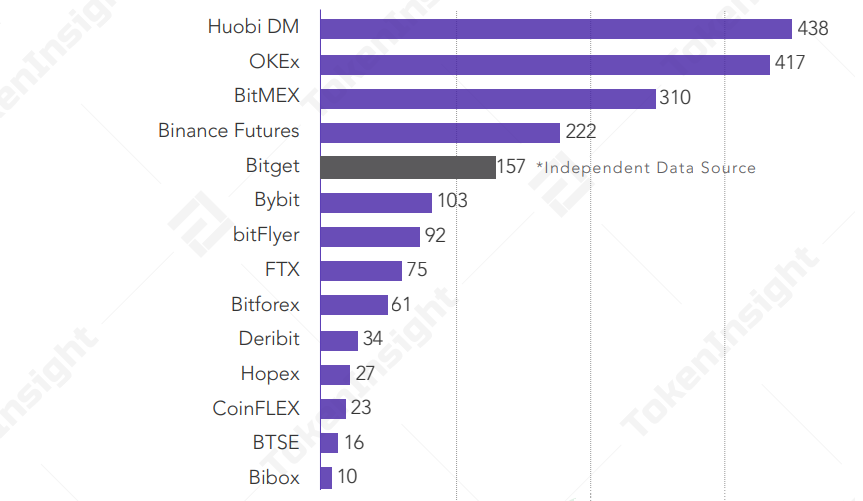

Besides a few up-and-coming derivatives exchanges, TokenInsight analyzed the trading volumes of 12 major derivatives-offering exchanges in the market, including BitMEX, OKEx, Huobi DM, Binance Futures, Deribit, and JEX to arrive at these figures.

Daily trading volumes are also indicative of greater interest in the cryptocurrency asset class, with an average of $23.4 billion and a high of $62.5 billion.

As previously mentioned, Bitcoin (BTC), Ethereum (ETH), and EOS (EOS) account for 90 percent of futures contract volumes, with Bitcoin itself taking up 78 percent of the market.

The firm makes note of the risks that investors must face in an uncertain market that has been exacerbated by the COVID-19 pandemic and that the March 13 plunge could have been the result of a lack of liquidity.

Consequently, it advises against trading non-major futures pairs and sticking to those with sufficient liquidity.

As for the most active derivative platforms, Huobi DM and OKEx take the top two spots at $438 billion and $417 billion respectively. They have dethroned BitMEX, which now stands in third place with a volume of $310 billion, while Binance Futures, a relatively recent addition, came in fourth at $222 billion.

Other notable conclusions include expecting the futures trading volume for 2020 to be more than double the spot market as well as the resilience of the cryptocurrency futures market. The latter has shown growth even despite a worldwide trend towards cash in this time of such economic uncertainty.

Is Bitcoin Still Seen as a Safe Haven?

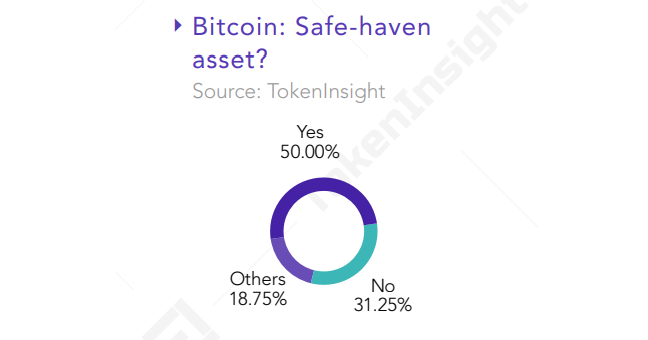

Bitcoin’s safety as a store of value has been a talking point which has seen much contention in recent times, exactly half of those surveyed still believe that BTC remains a safe haven.

The market crash has engendered much discussion about what investment platforms can do to weather extreme market conditions. The general consensus seems to be that risk control, limiting the scale of leverage, and bolstering infrastructure should be key priorities going forward.

Infrastructure Development, Standards, and Compliance

A theme of overall improvements being made to the foundation of this market is clear in the report.

Sam Bankman-Fried, Chief Executive Officer (CEO) of FTX, believes that the industry should focus on improving risk control, user interface, fiat currency support, and data quality — a view shared by officials from Deribit, Bitget, and OKEx.

The latter’s Chief Strategy Officer (CSO), Kun Xu, believes that the market has yet to establish a unified standard, which will be an important development as the market matures.

Similar to the lack of stock index futures and index ETFs in traditional markets, the reason is that there are too few basic assets with qualities, and the classifcation and tracking ratings of basic assets have not established a unifed standard for the entire market.

However, Greg Dwyer, who heads Business Development at BitMEX, claims there is a tentative return to normalcy:

All asset classes took a riskoff approach, however in the cryptocurrency derivative space we are starting to see open interest pick up again and spreads tighten to pre-crisis levels that indicates confdence is coming back into the wider cryptocurrency markets.

The post Cryptocurrency Derivatives Market Sees Daily Trading Volumes Exceeding $20 Billion appeared first on BeInCrypto.