The cryptocurrency market noted speedy recovery following the significant losses it faced after the crash in March. After a period of steady consolidation, the Bitcoin market soon broke above $8k, with the king coin, at the time of writing, wavering between $8.8K and $9.2K. The coin noted a cumulative gain of 16% over the past week, closely followed by Ethereum [ETH] with 7% gains.

However, according to Coin Metrics’ Bletchley Index [CMBI], major assets aren’t the only ones performing well; in fact, the top 70 assets are all performing uniformly.

Although low-cap assets were underperforming over the past month, this week, the assets picked up the pace and returned close to 13%. The CMBI Bitcoin index noted weekly returns of 6.9%, whereas its monthly returns registered returns of 36.4%. However, Ethereum’s monthly returns beat Bitcoin and other indices with a whopping 58.7%. This was its second-best month in the last two years.

Thus, an early investment in Ethereum may have resulted in investors yielding higher gains than any other crypto.

The world’s second-largest crypto-asset has been a preferred alternative for Bitcoin and other cryptos, while also acting as a safety net to move funds when the BTC bubble has been at its peak. Despite there being no consensus on what to benchmark returns to, Ethereum has been considered by many to be a proxy for altcoin returns.

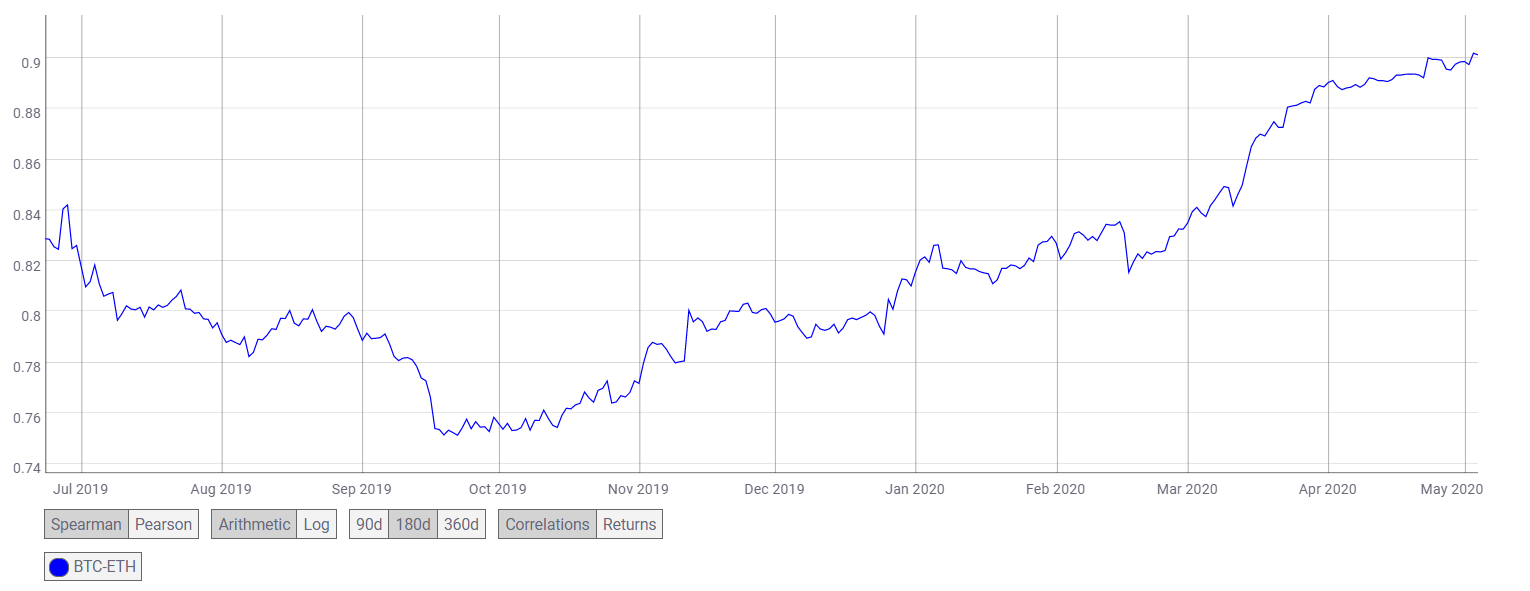

Even though Bitcoin, Ethereum, and other altcoins have been moving in harmony, somewhat, there has been a divergence speculated.

This divergence could be a result of the Bitcoin halving that is less than a week away. Despite such speculations, however, the ETH-BTC correlation has been very strong in 2020.

In fact, on 3 May, the correlation spiked to 0.9020, a peak never seen before.

The Ethereum ecosystem has been prepping for Ethereum 2.0 lately and it marked a major milestone recently. The Ethereum blockchain mined its 10 millionth block, which was 9.270 million more blocks than Bitcoin. The mining of blocks has also increased pace to 20 seconds per block, whereas, Bitcoin, on average, takes 10 minutes to produce one block.