Even after the halving event, volatility in the space has continued to persist.

Two days ago, it was identified that Ethereum was noting massive bearish sentiment from investors as the 3-month and 6-month skew moved under zero to -11.1% and -8.4%, respectively, on 10 May, indicating that the panic of the fall contributed to many opting out of the ETH Options market.

However, the tides of sentiment have changed direction once again.

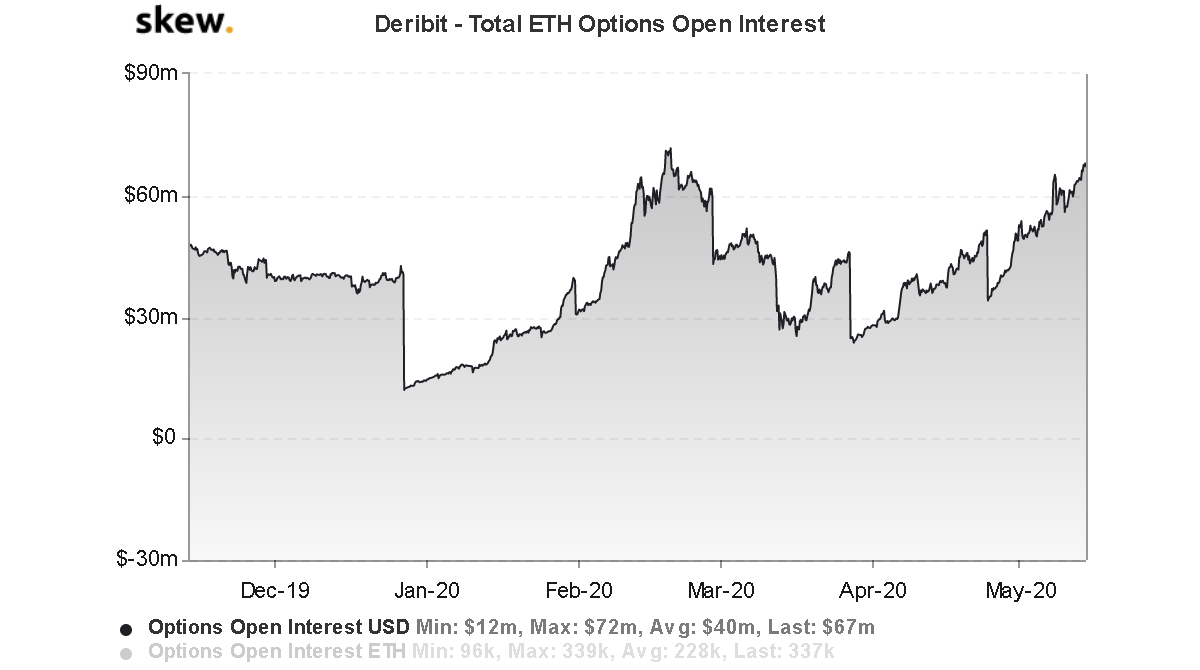

Source: Skew

According to data from Skew markets, the total Ethereum Options Open Interest on Deribit exchange reached its 6-monthly high range, a level that was last seen in February 2020. It is also important to note that Ethereum was valued at $284 back then, in comparison to the press time price of $202.

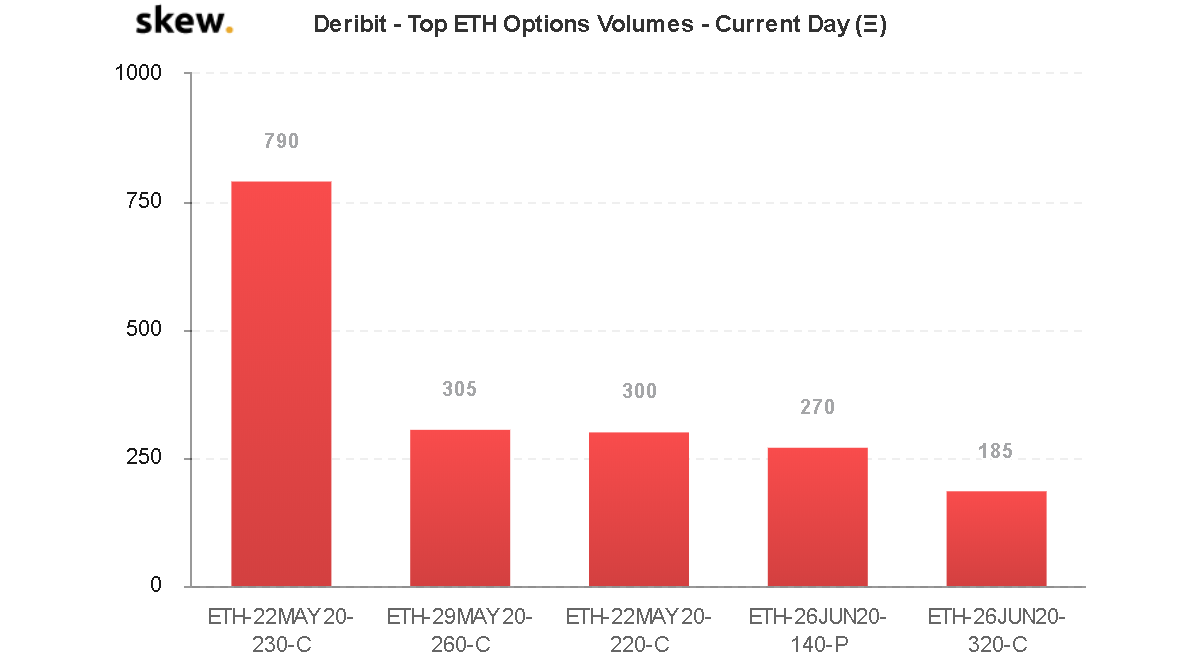

Source: Skew

Matching the spike in OI, the current ETH Options volume noted an aggressive move for traders. Setting up a completely bullish outlook, the most-traded contract had a strike price of $230 with an option to call/buys with an expiry date on 22 May. The 2nd most traded contract was also largely bullish with a strike valuation of $260. However, the expiry date of the contract was towards the end of the month.

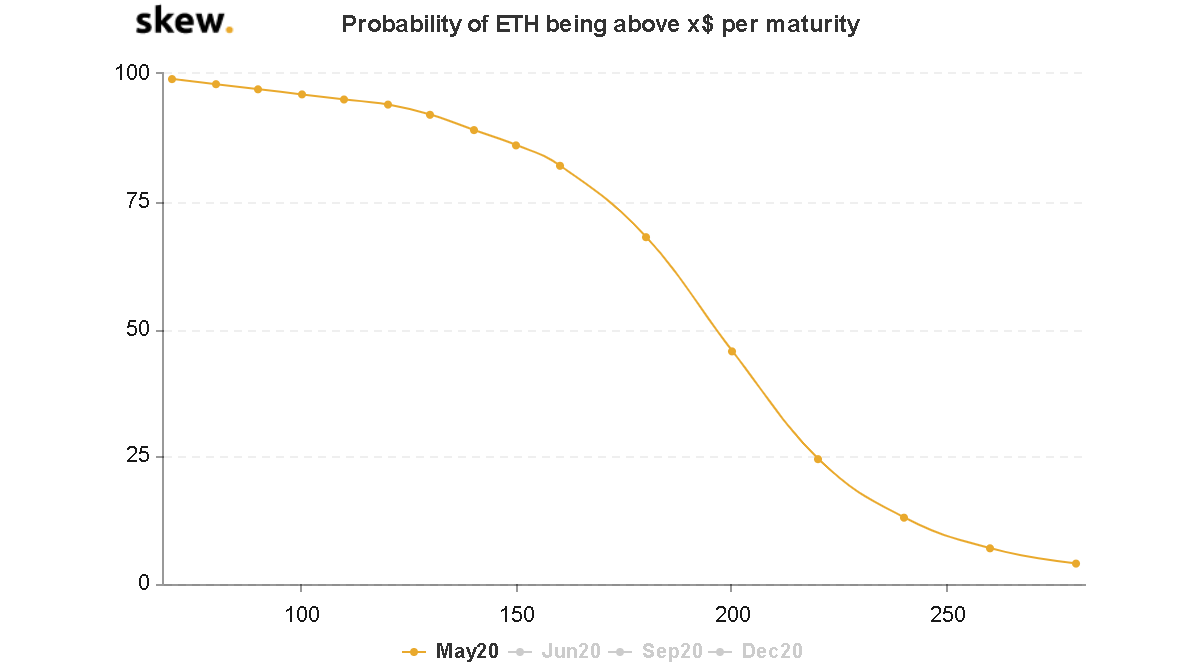

Source: Skew

Additionally, the probability of Ethereum crossing $230 in May is also high at 25 percent, a finding that completes the array of bullish sentiment from the side of the traders. However, they may not be wrong to put their bets on ETH as market analysis suggests a lucrative period for the world’s largest altcoin as well.

Ethereum eyeing a bullish breakout

Source: ETH/USD on Trading View

On analyzing Ethereum’s 1-day chart, it can be observed that the crypto-asset is presently navigating within a descending channel and it is at a prime position to go on a bullish breakout. A breakout may allow Ethereum to go as high as $230 or $215, in under a week.

Hence, the bullish nature of the traders is not out of bounds, and crypto-markets continue to remain hot in the industry.