Ethereum was still down by over 28% since its 2020-high. Despite all the delays in the launch of Ethereum 2.0, which was initially slated to roll out in January this year, the bullish outlook for its transition to Proof-of-Stake has not been deterred. This was evidenced by the ecosystem’s social volumes which have been on the rise for quite some time now.

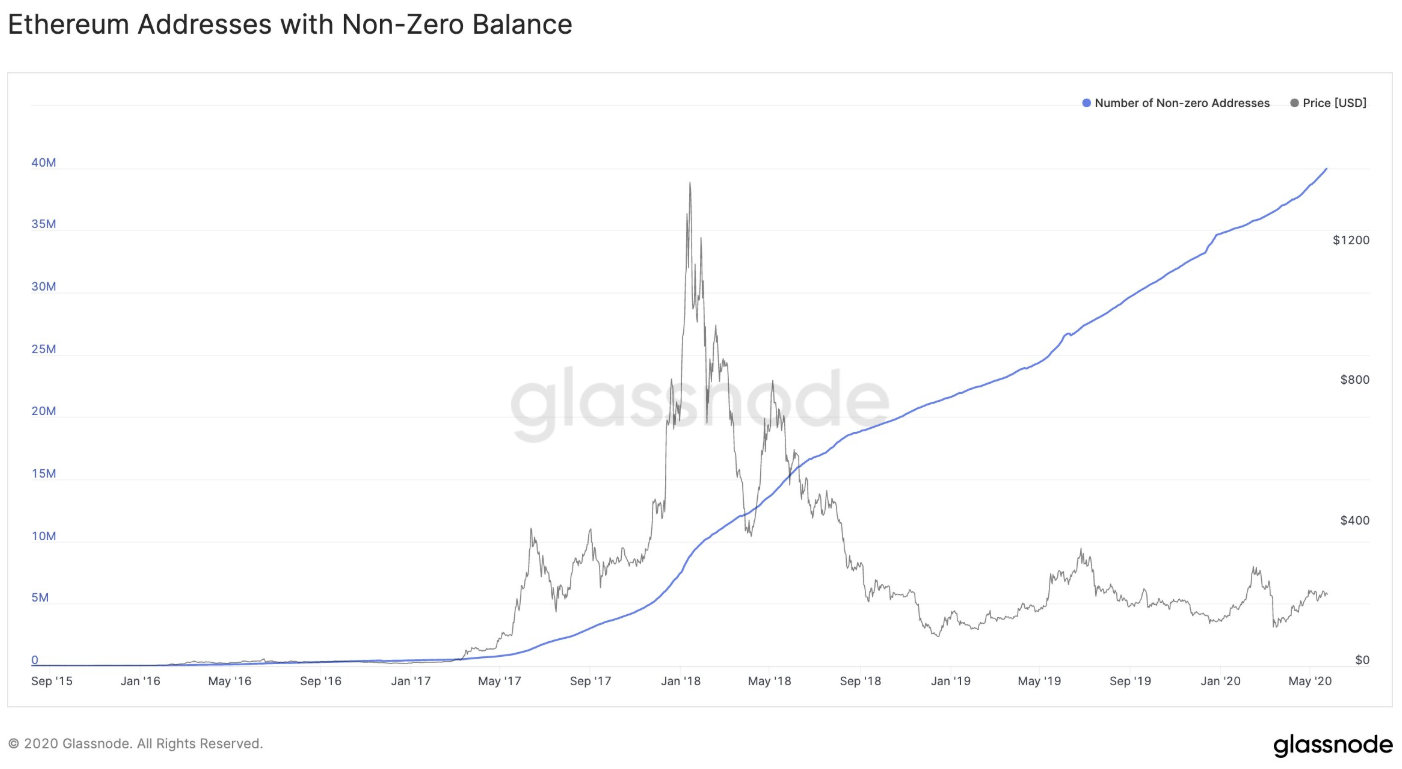

In the latest development, there are currently 40 million Ethereum addresses holding ETH in existence. According to the crypto analytic platform, Glassnode, the number of Ethereum addresses holding 10+ coins touched an ATH of 274,913.000, meaning an increase of more than 350% since ETH saw its price hit ATH in early 2018.

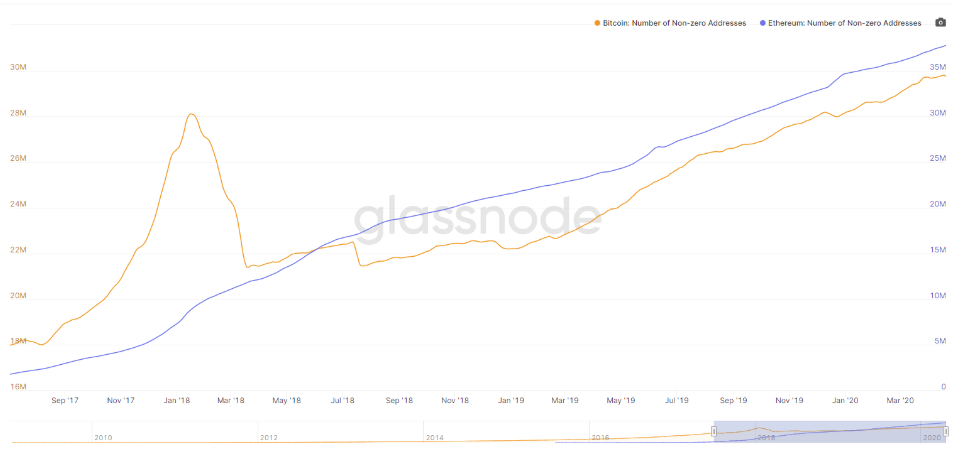

In addition, Ethereum has overtaken Bitcoin in terms of the number of non-zero addresses and at the time of writing, has roughly 10 million more than Bitcoin. This was indicative of the fact that small-holders and traders have upped their game as the launch neared and are more inclined to invest in Ethereum than Bitcoin.

Source: Glassnode

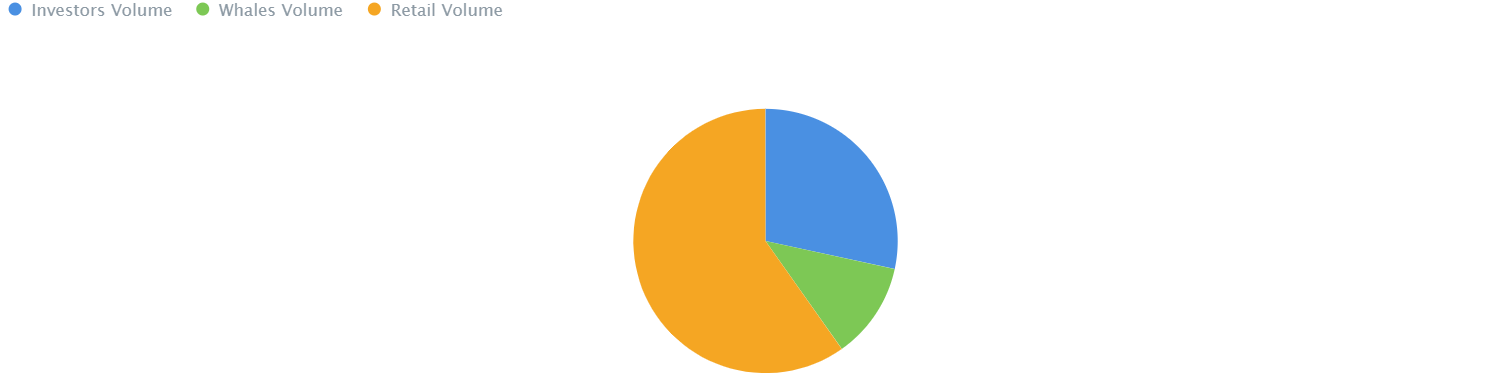

With respect to ownership, the number of ‘Whales’ on the network was just 5 who held 11.82% of the total ETH in circulation while there were 143 investors which accounted for 28.40% while the rest 59.78% were held by the retail users. Besides, Ethereum ‘hodlers’ [addresses with a holding period of more than 1 year] were also on the rise. As of May 24th, it surged all the way to 21.7 million addresses with a volume of 61.21 million ETH, according to the IntoTheBlock’s charts.

Additionally, in a recent blog post, well-known analyst Adam Cochran found that the top 10,000 Ethrereum addresses held 56.7% of ETH while the top 10,000 Bitcoin wallet addresses held 57.44% of BTC. In terms of equity of distribution, according to the analyst, no other coin comes “within the order of magnitude of ETH and BTC” considering the high centralization in coins such as XRP, LTC, BCH, and BSV. Only 16 addresses hold 55.2% of XRP, 1100 addresses hold 56.8% of BCH, 1250 addresses hold 55.6% of BSV and 300 addresses hold 54.3% of LTC.

In a Twitter thread, he also claimed,

“Some maximalists my scream that this is too high and proves a “premine” and centralized control. But, that couldn’t be further from the truth. The reason ETH’s distribution seems so focused is actually smart contracts.”