Key Takeaways

- The price of COMP has increased over 10x since launch, augmenting yields for participants in the protocol

- Compound gives borrower an edge over MakerDAO, but fundamentals were not the reason for this rally

- If the price of COMP decreases, the incentives for using Compound will also diminish

- Whether liquidity mining is a sustainable incentive mechanism remains to be seen

The DeFi news category was brought to you by Ampleforth, our preferred DeFi partner

Share this article

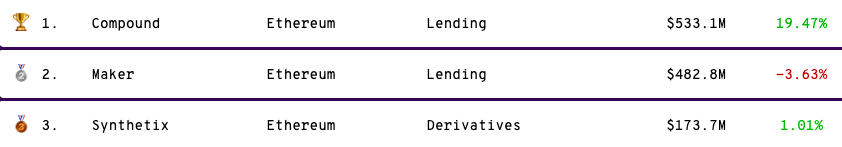

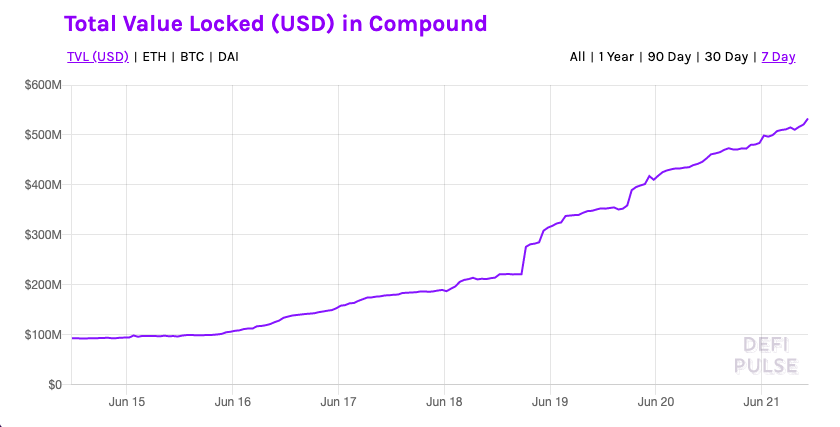

Compound has overtaken MakerDAO to become the single largest protocol in DeFi. Over the last week, Compound has grown from $93 million of value locked to $533 million on the back of a new incentive scheme.

A New Leader Emerges

For the first time since the DeFi narrative came to life, MakerDAO is no longer the most valuable protocol. At the time of writing, Compound stands tall at $533 million of value locked versus Maker’s $482 million.

Compound’s rise over the last few days is a testament to the power of incentives in a financial ecosystem. Lending and borrowing activity has been berserk. At times, the return for borrowing assets has exceeded the performance of lending assets. This is a result of COMP’s price going over 10x in a few days.

Even in terms of token market cap, COMP took down MKR to become the single most valuable DeFi token. And displacing MakerDAO just seems to be the beginning. Compound not only allows for lenders to earn a return on their non-productive capital, but the protocol also gives borrowers better capital efficiency with a lower collateral ratio and more assets to borrow against.

However, Compound’s fundamentals have remained in the backseat for the majority of this rally. It boils down to the incentive Compound’s users receive from using the protocol.

When one lends or borrows money from Compound, they receive COMP as part of the liquidity mining initiative. So along with the yield of lending a crypto asset, lenders (and borrowers) also receive some amount of COMP as compensation. By compensating users with native tokens, it boosted the earnings DeFi users can make through Compound, accelerating total value locked in the protocol.

If it weren’t for the launch of COMP, rates on Compound would’ve been the same—perhaps even lower than competitors like Aave. The introduction of COMP increased lender yields by default. Borrowers, too, were given an incentive they couldn’t turn away: the ability to milk yields by merely borrowing money. COMP’s price appreciation further augmented this.

However, these yields aren’t sustainable. The capital flowing into Compound to juice COMP yields could disappear when the next best thing shows up with annualized returns above 100%. But, if COMP maintains its price in this range, or continues its uptrend, a lot of this capital could stick around and continue to farm yields.