The narrative around decentralized finance (“DeFi”) has strengthened this year. While Ethereum is up nearly 90% since the beginning of 2020, some DeFi tokens, including Aave (LEND), have skyrocketed over 1,000%.

Investors’ interest seems to be shifting towards this market sector. Yet in the long-term Ethereum will benefit the most, according to Skew. The crypto derivatives analytics firm maintains that these DeFi tokens running on top of Ether seem to have a “more sustainable” product and market fit than the ICOs of 2017.

Along the same lines, John Todaro, head of research at TradeBlock, said that the smart contracts giant would eventually “hit escape velocity.”

“There’s a lot of excitement around new DeFi tokens. A reminder that most of that collateral locked up across those platforms is in Ethereum. As that outstanding Ether supply comes down and demand from DeFi platforms hits escape velocity, ETH will rally hard,” affirmed Todaro.

The upcoming ETH 2.0 upgrade adds more fuel to high levels of optimism around the second-largest cryptocurrency by market cap. As the network prepares to transition to a proof-of-stake (PoS) consensus algorithm, whales have been enjoying the lackluster price action to grow their positions.

Nonetheless, investors and market participants alike could be getting ahead of themselves from a counter-sentiment perspective.

Be Fearful When Others Are Greedy

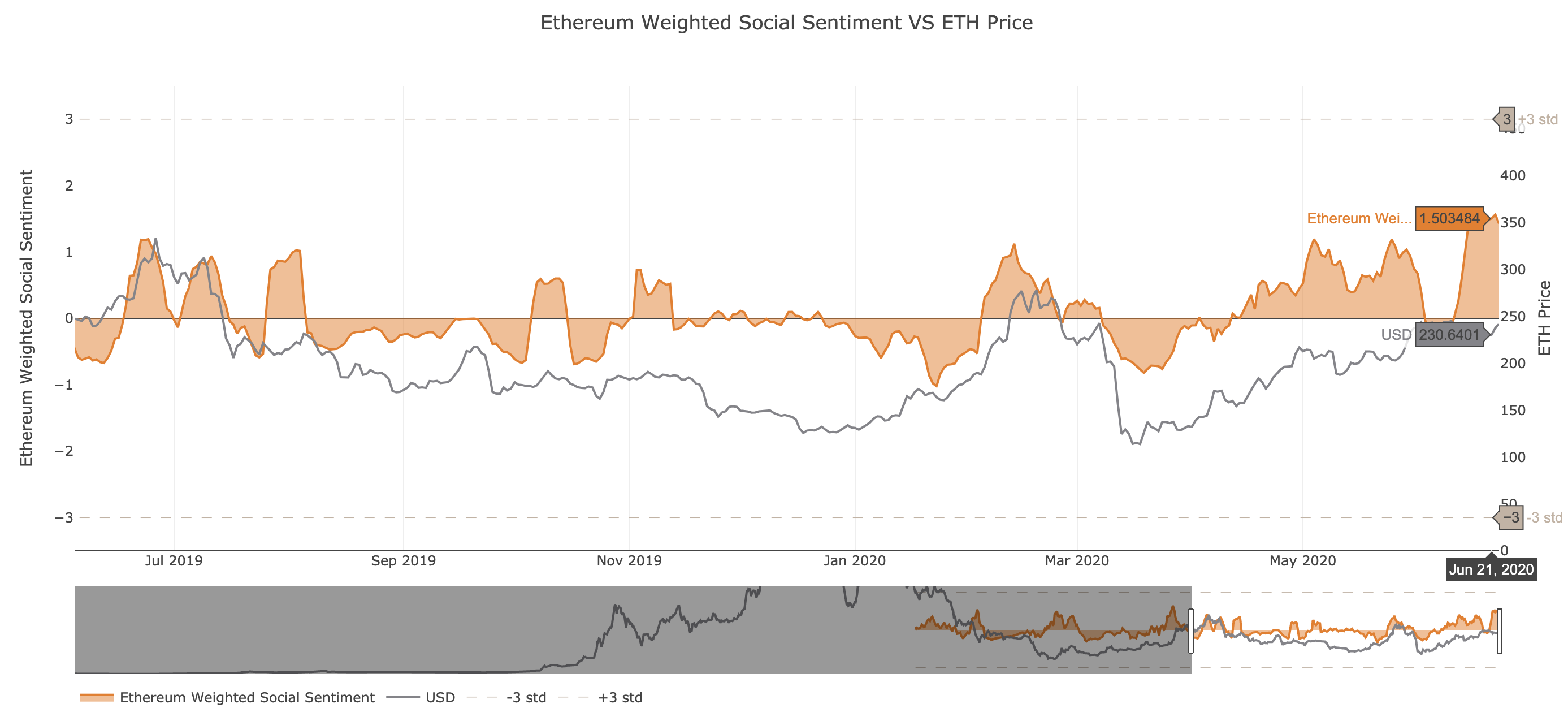

In spite of the hype around DeFi and ETH 2.0, the social activity around Ethereum surged to levels not seen since May 2019. The sentiment volume consumed of the smart contracts giant rose above the 1.5 mark as investors grow overwhelmingly bullish about the future.

However, this can be seen as a negative sign based on its correlation with price over the past year. Each time Ether’s social sentiment rises above 0, its price tends to drop significantly.

In late June 2019, for instance, Ethereum took a nearly 47% nosedive after its weighted social sentiment surged to 1.20. A similar phenomenon took place in mid-February 2020, which saw ETH plunged by nearly 70%.

Now, history could be about to repeat itself as Ether’s weighted social sentiment is hovering above 1.5.

Ethereum’s Social Sentiment Skyrockets. (Source: Santiment)

Strong Support Ahead of Ethereum

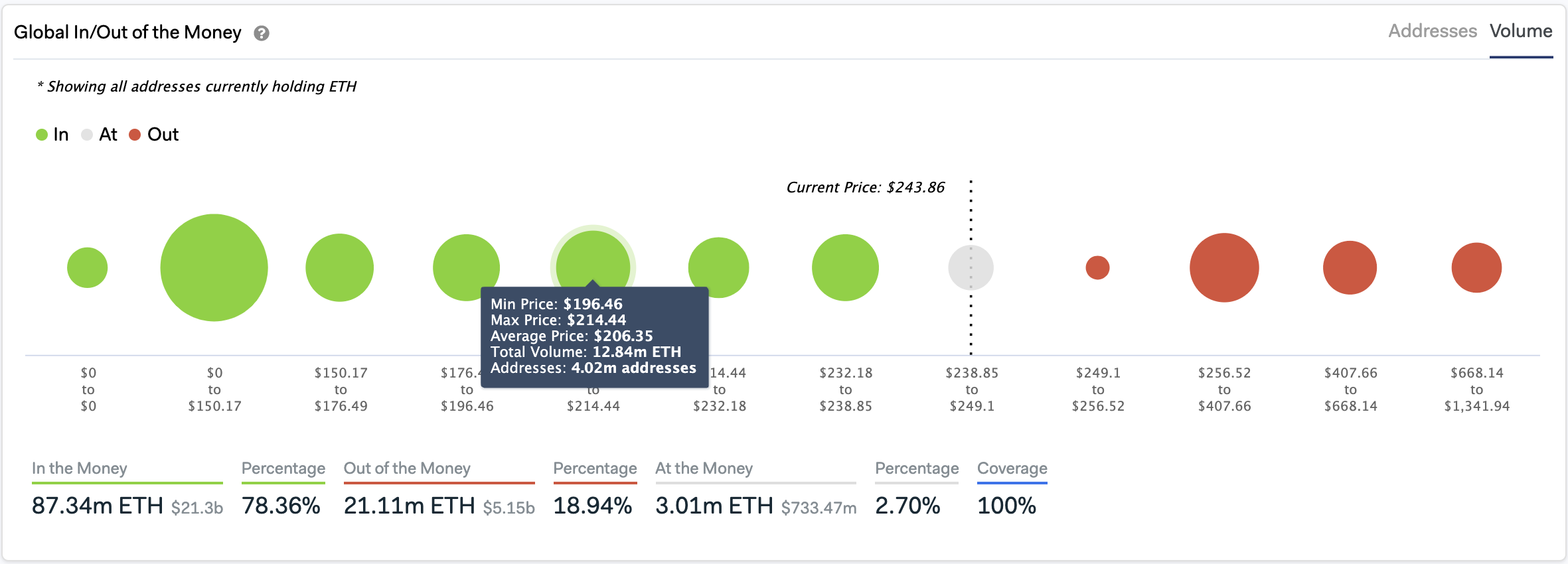

In the event of a correction, IntoTheBlock’s “Global In/Out of the Money” (GIOM) model reveals that there is a massive supply wall underneath Ethereum that may absorb any downward pressure.

Based on this on-chain metric, approximately 4 million addresses bought nearly 13 million ETH between $196 and $214. Holders within this price range may try to remain profitable in their long positions. They may even buy more Ether to avoid prices from falling below this level.

Ethereum Faces Massive Resistance Ahead. (Source: IntoTheBlock)

It is worth noting that a further increase in the buying pressure behind Ether could jeopardize the bearish outlook. The GIOM cohorts reveal that moving past the $250 resistance level could see Ethereum rise towards $300 since there isn’t any other significant barrier that will prevent such an upward movement.

Featured Image from Shutterstock Price tags: ethusd, ethbtc Charts from TradingView.com