Quick take:

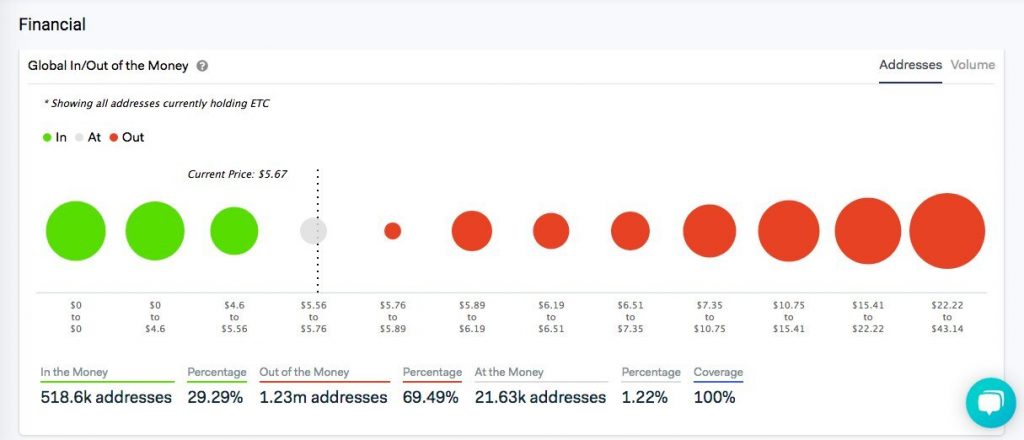

- Hodlers of over 1.23 Million Ethereum Classic addresses bought ETC at or near the all-time-high in January 2018 of $47.

- This translates to roughly 69% of Ethereum Classic holders.

- Ethereum is currently valued at $6.40 and the drop in returns could be a contributing factor to the negative sentiment surrounding ETC.

According to a recent tweet by the team at Ethereum Classic, 69% of all ETC hodlers bought the digital asset at or near the 2018 top of $47. The team at Ethereum Classic highlighted this fact by retweeting a similar analysis by @ClassicIsComing which explained that 1.23 million ETC addresses bought the digital asset around the time when Ethereum Classic experienced its all-time high value.

Over ~69% of all ETC accounts bought at or near the top… https://t.co/Xva3jiF2PL

— Ethereum Classic (@eth_classic) July 6, 2020

Buying ETC at the Top Could Be Why There is Negative Sentiment Towards Ethereum Classic

Taking a second look at the chart shared by @ClassicIsComing, and keeping in mind that the analysis was done with ETC at $5.76, approximately 29.29% of ETC holders are in profits with their investments.

The fact that such a high percentage of ETC investors bought around the top could explain the general negative sentiment towards the digital assets. This is further illustrated by ETC’s Sentiment Momentum on BittsAnalytics.com. According to the latter platform, ETC has a sentiment momentum of -1.6. For comparison purposes, the sentiment momentum of Bitcoin is 98.7 on the same platform.

Brief Technical Analysis of Ethereum Classic (ETC)

Switching attention to the daily ETC/USD chart, the following can be observed.

- Ethereum Classic has experienced a brief resurgence in the crypto markets.

- Trade volume is in the green and the MACD has crossed in a bullish manner below the baseline.

- MFI is also indicating some bullishness at a value of 47.

- However, ETC’s current price of $6.40 is below the 50-day and 200-day moving averages.

- These two moving averages printed a death cross around the 21st June and could foreshadow a bleak future for Ethereum classic.

- ETC, therefore, needs to push higher above these moving averages to confirm the bullishness.

- Short term resistances include $6.42, $6.53, $6.60 and $6.66.

- On a macro level, the 200-Day moving average provides another area of strong resistance around $6.90.

Conclusion

Summing it up, 69% of Ethereum Classic hodlers bought at, or near the January 2018 top of $47. This translates to roughly 1.23 million ETC addresses. The fact that Ethereum Classic is yet to reclaim these levels in the markets, could be a contributing factor to the negative crypto market sentiment towards ETC.

Taking a brief look at the charts, Ethereum Classic still has a long road ahead in reclaiming the 2018 high of $47. ETC is currently valued at $6.40 with the daily chart indicating some bullishness that will be confirmed once Ethereum Classic’s price pushes above the 200-day moving average.