Ethereum has made up the basis of demand for the recent DeFi boom, and the network is feeling the pressure. Things could be very different for the platform in six-to-twelve months, depending on how its planned protocol changes play out.

The DeFi boom has seen total value locked across various platforms and protocols double in less than a month. Today it has hit another all-time high of $2.07 billion according to DeFi Pulse. The amount of Ethereum locked into this financial landscape is also at its all-time high of 3.2 million ETH, which equates to 2.87% of the entire supply.

Naturally, this massive surge in DeFi has taken its toll on the Ethereum network, upon which the ecosystem is largely based. Although Ethereum on-chain metrics have improved, an increase in transactions has hiked gas fees beyond acceptable levels for most minor operations.

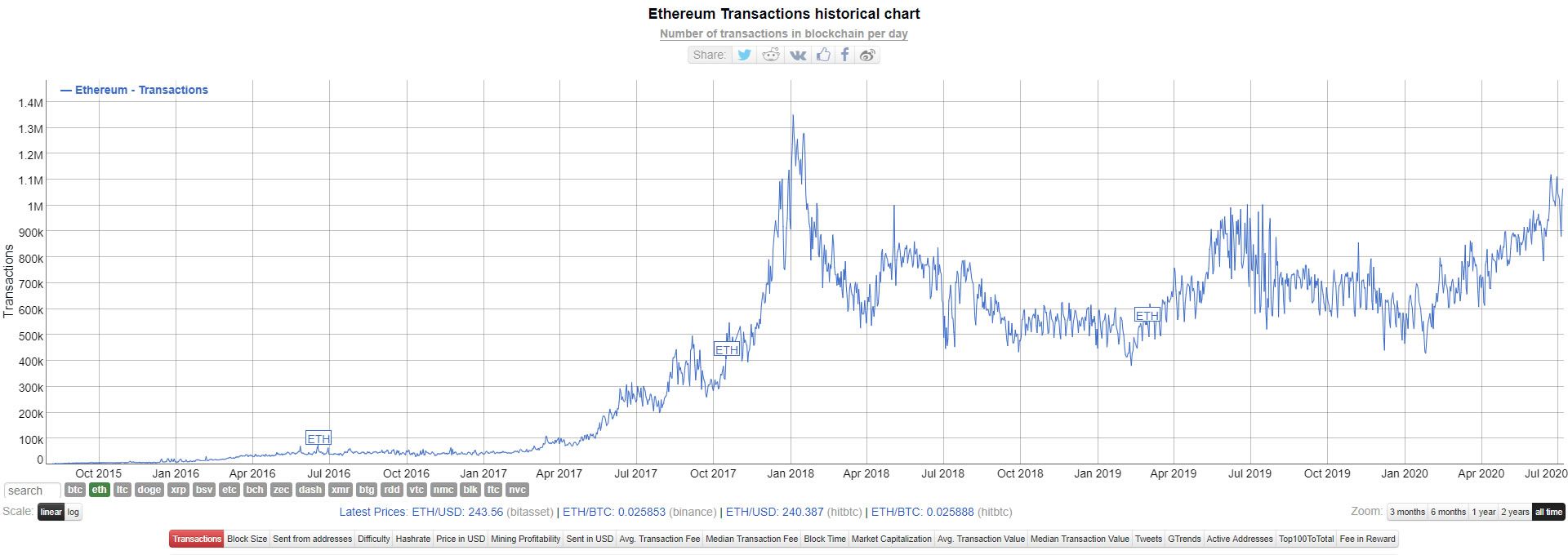

Average transaction fees are back at the same level they were during the ICO boom in early 2018 according to BitInfoCharts. Average transaction values, however, are down over 90% from that period, which indicates that the network is being used for minor operations rather than moving large amounts of ETH. This notion is confirmed by the number of transactions on the Ethereum network which hit its second-highest ever level of 1.1 million late last month and remains very close to that level today.

The trend is clearly unsustainable, and there are plenty of digital detractors snapping at its heels with the promise of better blockchains and ‘Ethereum killers.’

However, Ethereum will be hard to topple as it is currently the industry standard. Those that have adopted it are unlikely to switch to something smaller and largely untested while having to re-write all of their smart contracts and dApps.

Ethereum has become a victim of its own success and needs to evolve, the next six-to-twelve months are going to be interesting for the ‘world’s computer.’

Ethereum in 6-12 Months

Ethereum has a lot coming its way in the second half of the year. It will need to adapt to survive or be eaten by a superior blockchain in this rapidly changing world of decentralized digital finance. Testnet validator, Tyler Smith [@R_Tyler_Smith], has postulated on what could be in store for Ethereum in the next six-to-twelve months.

Scaling is the big issue for Ethereum at the moment and is also the root of the majority of DeFi disparagement from the crypto community. Smith predicts that dApps will begin adopting and implementing layer-2 (L2) scaling solutions soon, adding;

We’ve had an absolute avalanche of layer 2 projects launch in the last 2 months. The community is doing a great job of breaking down the tradeoffs involved and the advantages of certain platforms.

Last month, BeInCrypto reported on a number of L2 scaling solutions that were already being tested and deployed, such as the launch of Tether on the Plasma-based OMG network. Independent dApps will start to select their own preferred scaling solutions based on the needs of their specific service and the tradeoffs between them, Smith added.

Smith predicts that the rollout of L2 scaling will be fast, as will its adoption. Ethereum is currently restricted to a 15 transaction per second paradigm that will be made obsolete when L2 solutions become the default.

The first crypto game or dApp with over a million users will likely emerge when this happens. The first attempt at this was in late 2017 when the digital cat breeding game, CryptoKitties, was launched on Ethereum, subsequently grinding the network to a halt due to transactional demand.

Smith reckons that most will not notice this subtle paradigm change, but a stream of FUD will likely still be prevalent from Bitcoin maximalists. More will emerge from the so-called ‘Ethereum killers’ claiming that layer-1 is the way to go. With regard to transaction fees, Smith does not see them falling until ETH 2.0 is fully underway.

Slowly we will see the congestion of Ethereum layer 1 start to lessen. However, as layer 1 block space is freed up, new DApps (or existing ones converting) will take advantage and clog the chain again. We won’t see dramatic drops in transaction fees until ETH2.0 Phase 1.

Phase 0 ‘So Close’

Extensive testing for Phase 0 has been carried out on all development testnets including Schlesi, Topaz, Witti, Onyx, and Altona according to Smith, who added that the clients are adapting well and the testnets are getting smoother; ‘We are so close, so close.’

Once Beacon Chain does go live on the mainnet, major exchanges and crypto investment firms will have massive marketing drives to push staking services, from which they will naturally profit. This battle will be intense because any customer acquired during Phase 0 will be locked in until Phase 1 when transactions are enabled, he added.

Smith predicts that there will be two competing ideologies, custodial vs non-custodial services, with the first being offered by exchanges providing liquidity during Phase 0.

Regarding the prices, he states that Phase 0 must launch to mainnet in 2020 to avoid ETH prices being punished harder in an already brutal market. If this occurs, ETH prices will likely skyrocket as the FOMO takes hold again and institutional investors join the fray:

ETH2.0 Phase 0 mainnet launch will be the most pivotal event in all of crypto since the launch of ETH1.0. People talk about Bitcoin halving events… they are minor league compared to this.

Once Phase 0 proves to be stable, ETH HODLers will begin staking, causing a snowball effect which brings more in, attracted by the rewards and increasing asset prices. He predicts that taxation for staking rewards could be a nightmare, depending on how ETH 2.0 is treated by the tax authorities.

This should cause increased pressure to create an ETH 1.0-ETH 2.0 bridge. Smith added that the Ethereum Foundation currently has plans to bridge the two during Phase 1.5 when ETH 1.0 becomes a shard on ETH 2.0.

The impact on DeFi will be huge. As the past month has shown, growth has been monumental and Ethereum has suffered as a result due to its scaling limitations:

ETH 2.0 will give DeFi superpowers. I’m cheating a little since the real superpowers won’t engage until after Phase 1 when transactions become possible. Projects will create superpowered DeFi products using staking reward derivatives.

Smith concluded that the Beacon Chain will control the interest rate of a new class of assets which he has dubbed ‘crypto treasury bonds.’ These will become the cornerstone of the decentralized finance landscape, which is powered by Ethereum.

Today, Ethereum is still wallowing in the low-$200 range, pretty much on par to where it was in terms of price three years ago. Once it can scale properly, yield staking rewards, and turbocharge DeFi, another ICO surge is not beyond the realm of possibility.

The post How Ethereum Might Evolve Over the Next Year appeared first on BeInCrypto.