Quick take:

- Ethereum’s price action has continued to be dull and resembles that of Bitcoin.

- Ethereum’s fate could be tied to that of Bitcoin.

- A possible postponement of ETH2.0 might have caused Ethereum to experience a local top at $250.

- DeFi could offer a reason to remain bullish on Ethereum as more ETH is locked up in Yield Farming.

Between the 1st and 9th of July, Ethereum traded between the range of $222 and $248. This range has now narrowed to between $248 and $230 in the past week. The price action of Ethereum within a tight range now resembles that of Bitcoin that has not had much to show in the third quarter of 2020.

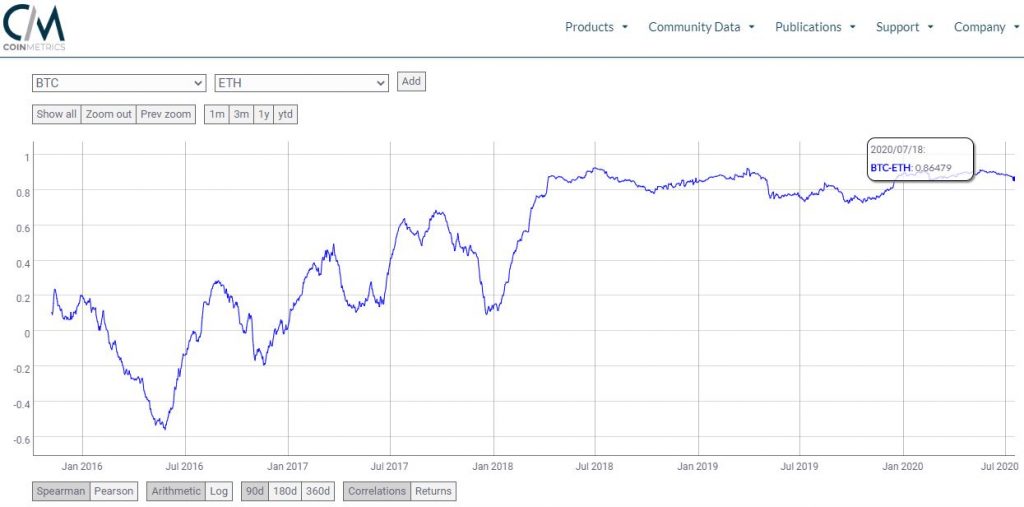

This can be attributed to the fact that Ethereum is highly correlated to Bitcoin as seen in the chart below courtesy of the team at CoinMetrics. This chart implies that the fate of Ethereum is tied to that of Bitcoin in the crypto markets.

Effects of a Delayed ETH2.0 on the Price of Ethereum

The Ethereum community has accepted the fact that a delay of ETH2.0 is inevitable. The new estimates now put the release at anywhere between Q4 of 2020 and Q1 of 2021. A delay of the Ethereum upgrade by another 3 – 6 months might not be much for long term holders, but it provides a large window of trading time in the crypto markets.

DeFi Will Boost Ethereum’s Value

However, all is not lost for Ethereum as the DeFi industry might provide the spark needed for ETH to continue gaining in the crypto markets. Earlier this week, it was revealed that approximately 3.5 Million ETH is locked up in DeFi platforms. This value is 3% of the existing 111.8 Million ETH in circulation and could continue to grow with the increased interest in Yield Farming.

As more Ethereum is locked up in DeFi, ETH could witness a gradual price increment as less Ethereum becomes available in the crypto markets. This event, coupled with an eventual release of ETH2.0 in the next few months, could provide the necessary environment for Ethereum to finally break the $250 resistance level.