The Ethereum network seems to be cracking under pressure as stablecoins and the DeFi ecosystem continue to expand. As a result, gas usage has skyrocketed to new highs along with network fees—so how can this be positive for Ethereum?

As DeFi markets near $3 billion total value locked, the strains on the Ethereum network are clearly showing. In its current state as a proof-of-work blockchain, it simply cannot scale to cope with this level of usage. The net result has been a surge in the costs of using the network and an all-time high for gas consumption.

Another unexpected twist is that Ethereum has now surpassed Bitcoin in terms of daily value settlement, though this is largely due to stablecoin usage. The ‘flippening’ was observed by developer Josh Stark [@0xstark];

The biggest story in crypto this year is Ethereum unseating Bitcoin as the world’s most-used cryptocurrency,

Stepping on the Gas

2020 has undoubtedly been the year for stablecoins and decentralized finance. Tether issuance has surged, resulting in a 125% increase in the USDT market cap since the beginning of 2020. The demand for ERC-20 based stablecoins has outpaced the demand for ETH itself as they now consume more of the network than Ethereum itself.

Ethereum locked up across DeFi platforms is also at an all-time high of 3.8 million ETH according to DeFi Pulse. This equates to around 3.4% of the entire supply, a figure that has increased over 30% since the beginning of the year.

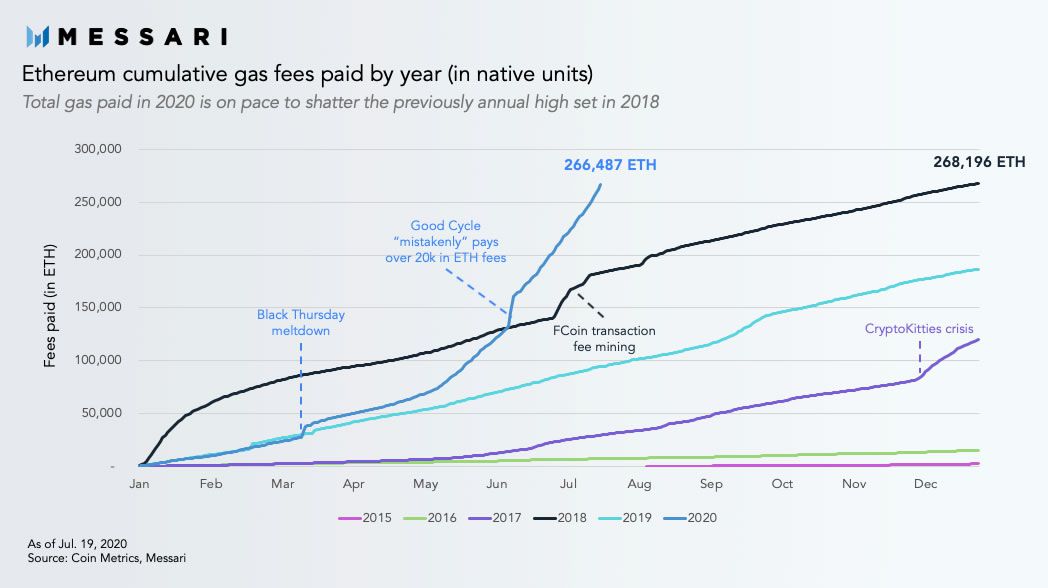

Messari researcher, Wilson Withiam [@WilsonWithiam], has taken a look at the possible implications of this on Ethereum network fees.

Ethereum is on pace to shatter its previous annual record for total gas spent (in native units). The rise of DeFi and Tether’s continued invasion of Ethereum have, in part, increased network activity as well as the demand for block space,

The chart clearly shows a steep spike in network fees this year, even eclipsing the network clog-up caused by CryptoKitties in late-2017. The network fees paid in 2018 totaled 268,196 ETH. In just the first half of 2020, these same numbers have already been reached.

Withiam added that high network fees are a double-edged sword in that they signify an increase in network utilization while adding to the network’s security budget. On the flip side, however, high fees may be offputting for new potential users, especially those making multiple small transactions for DeFi operations.

Last month, BeInCrypto experimented with liquidity mining on Compound and discovered that a week’s worth of COMP earned on a $9k equivalent crypto collateral deposit would be entirely eaten up in gas fees if taken off the platform. This makes small-scale DeFi pretty much unsustainable for the majority of users. The whales, on the other hand, are unlikely to be bothered.

Withiam continued to state that Layer-2 (L2) scaling is becoming the solution for high gas costs, adding that these solutions aim to increase the economic density of fees, thereby lowering the average cost of a transaction. He predicts a flood of L2 scaling solutions, such as optimistic rollups, to become available soon.

Ethereum might not be able to support a mass influx of new users and volume in its current state. L2 scaling must play a central role for Ethereum’s Renaissance to hit its stride.

A scaling arms race may arise if L2 gathers momentum quicker than Ethereum’s rivals—or ‘killers.’ This is likely to be the case since nothing has come close to competing with Ethereum in terms of development and adoption yet.

EthHub founder, Anthony Sassano [@sassal0x], continued with the narrative in his ‘Daily Gwei’ newsletter. He too believes that scaling solutions will drive greater growth and adoption for the core infrastructure. When gas fees are low, and block space supply is high, there is no need to deploy scaling solutions. Now that gas fees are high and block space scarce, the infrastructure needs to be updated with L2 solutions.

Sassano states that high fees are an ‘ecosystem-wide issue’ which means that every Ethereum project has a common goal:

They all want to work together and push Ethereum scaling forward in order to keep the ‘competition’ at bay – this is what I like to call ‘The Ethereum Scaling War Effort.’

High gas usage also shows that there is an incredible demand for Ethereum with all types of transactions and interactions happening on the network around the clock. Ethereum has become the platform to build upon, he added, because it is the most powerful in terms of users, liquidity, integrations, and infrastructure.

Fees on the Ethereum network have been higher than those for Bitcoin for 45 days now. This effectively increases the security of the network through fees paid to the miners. Sassano concluded that high fees over the longer term (~two years), would hurt Ethereum. Though, that is highly unlikely since there are so many projects working rapidly to deploy L2 solutions.

When ETH 2.0?

The long-awaited and highly-anticipated Serenity upgrade to ETH 2.0 will also herald in those much-needed scaling solutions, in addition to more earning potential with staking options.

Ethereum detractors and Bitcoin maximalists constantly berate the network for delays in the deployment of Phase 0 of the upgrade, but it could be closer than many think.

A final testnet for Beacon Chain may be nearing deployment within the next few days. According to a blog post by Prysmatic Labs over the weekend, developers are ‘very close’ to launching a final multi-client public testnet.

A few days ago, Sassano tweeted some recent comments from developers working on the platform;

Technically, I don’t think there is anything missing for a public testnet launch. It’s just a couple of operational things that needs to be done I believe. I expect that we can start working on that next week.

The genesis block on Beacon Chain was mined and validated in mid-April on the first testnet called Sapphire, which was a scaled-down version that successfully tested smaller 3.2 ETH deposits. Full 32 ETH nodes went live in May on the Topaz testnet and staking rewards were issued. The Onyx testnet followed in June and was running steadily with around 20,000 validators by the end of the month.

The Altona coordinated multi-client testnet for Phase 0 went live in early July to ensure stability before a public testnet could be rolled out. Blockchain security and auditing firm Quantstamp successfully audited the ETH 2.0 Prysm client last week, stating that it was ‘basically ready’ for launch.

Things are moving along for Ethereum and high gas fees could be a thing of the past by next year. Low ETH prices may also be a thing of the past if Beacon Chain can be successfully deployed on the mainnet before the end of 2020.

The post Ethereum Gas Usage Tops All-Time High Amid DeFi and Stablecoin Tear appeared first on BeInCrypto.