Ethereum fees are skyrocketing and developers, exchanges, and investors are scrambling to find ways to prevent the growing problem.

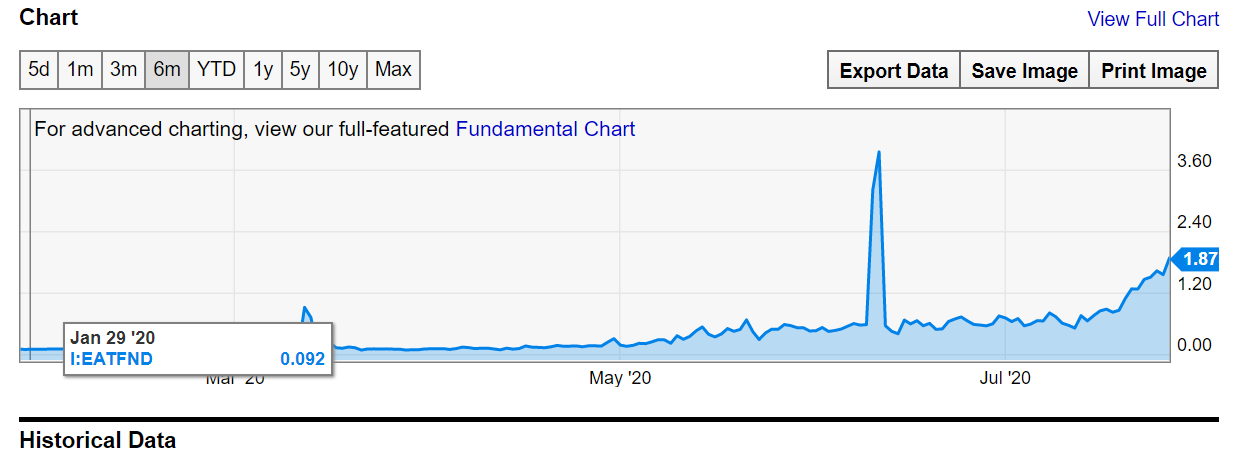

Nothing gets under your skin like an Ethereum transaction that doesn’t go through. You can even lose your transaction fee even if no transaction takes place. The loss is nothing to sneeze at since the average fee has jumped from $0.634 to $1.92 in less than a month.

The Elephant in the Room

The DeFi craze has fueled much of this growth. Stackin’ ฿its, a self-proclaimed “real pirate” explains the problem eloquently:

DEX is cool. I like using it. Huge problem that no one wants to talk about with ETH right now is how fucking expensive the fees have been.

Defi is awesome… but it costs more to transact on DEX than doing transfers with a bank or PayPal right now.

— Stackin' ฿its (@StackinBits) July 25, 2020

On the other hand, Blockchain developer Eric Conner called out the hypocrisy of these so-called high-fee woes. Despite these high costs, trade volume at decentralized exchange (DEX) Uniswap has climbed dramatically.

"Gas fees are too high, no one likes using Uniswap. Check out our VC solution we're calling a DEx to swindle retail!"

Meanwhlie… pic.twitter.com/7Y81FeA5MZ

— eric.eth (@econoar) July 27, 2020

Crossing a Bridge

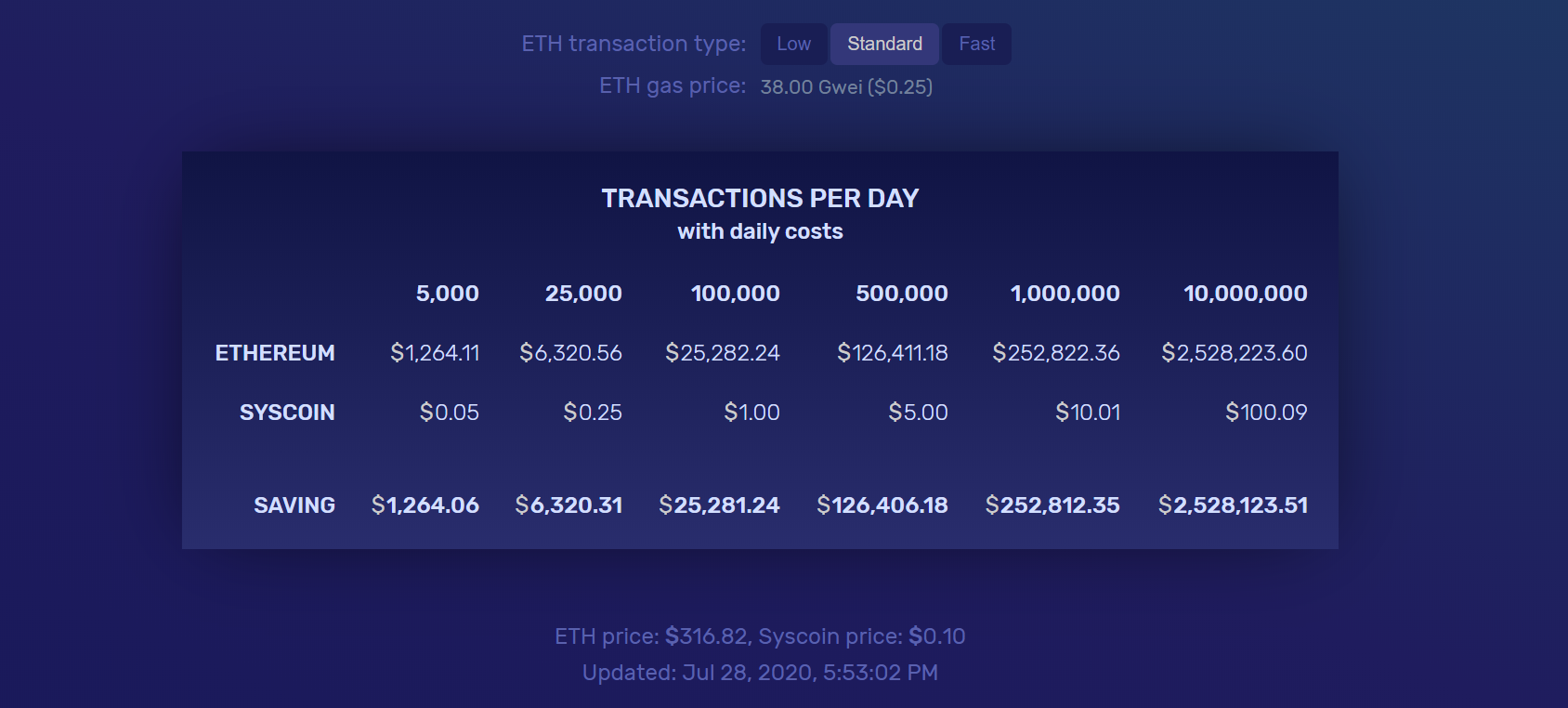

The situation is punishing for high-volume traders. Exchange giant Binance has decided to use a Syscoin Ethereum Bridge to transfer its proprietary stablecoin BUSD.

In short, the Syscoin bridge allows smart contracts to bounce between blockchains. Blockchain Foundry, the consulting firm that developed Syscoin, claims this will reduce fees and speed up transactions. This workaround should save Binance money while attracting penny-pinching traders.

Ether, the Next Generation

Vitalik Buterin has already proposed a solution as part of Ethereum 2.0. Today’s proof-of-work model is limited by the block size, causing bottlenecks.

Competitive trading platform, Interdax, explains why PoW is not sustainable:

Ethereum can only process 7–15 transactions per second — any ‘killer app’ that gains adoption can bring the network to a halt and push transaction fees higher.

Once proof-of-stake is added in version 2.0, an optimized fee scheme could emerge. And if Ethereum Improvement Proposal 1559 is implemented with the use of a base fee and “tip” fee, costs should plummet.

Not All for the Best

But some think ETH 2.0 is not all it’s cracked up to be. There is a vulnerability in which miners could manipulate the supposedly stable base fee (though they probably wouldn’t want to).

Plus, version 2.0 will take years to fully implement. During that time, other vulnerabilities may be discovered. Last month, Buterin even begged people to stop unnecessarily moving tokens around:

Anyone who's *just* moving ETH / ERC20 / ERC721 tokens around should be looking at how to get onto a rollup today. Gasprices on base chain would probably fall greatly if it was only used for the more complex stuff.

— vitalik.eth (@VitalikButerin) June 30, 2020

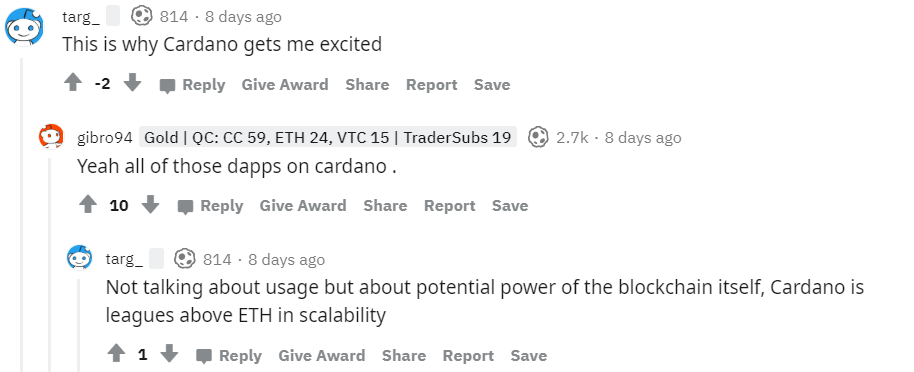

On social media, many are beginning to argue the case for other smart contract blockchains. Decentralized apps can, of course, also use tokens like EOS, Neo, or Cardano (ADA). It’s just that most people are used to Ethereum.

Other technologies offer unrealized solutions. This paper from 2019, for example, outlines an 11% saving that could be achieved using nanotechnology. Elsewhere, Upvest shared its technology in May which claims to efficiently predict transaction costs.

Is Ethereum the undisputed smart contract champion? In this fast-moving industry, another blockchain could easily rise to the top. For now, you may have to wait… and pay for it.

The post Solving Ethereum’s Skyrocketing Fee Problem appeared first on BeInCrypto.