In brief:

- After breaking $12k and $400, Bitcoin and Ethereum fell hard to $10,500 and $325.

- Crypto traders were caught off guard with over $1 Billion in liquidations.

- The volatility might just prove that we are in a crypto-wide bull market.

The month of August opened on a high note in the crypto markets. Earlier today and according to Coinmarketcap, the total crypto market capitalization experienced a one-year peak value of $363 Billion before dropping hard to $336.3 Billion in a matter of minutes. During the same time period of the record-breaking crypto market-cap, Bitcoin (BTC) and Ethereum (ETH) tested levels last seen years ago with each momentarily trading at $12,138 and $415 respectively.

Bitcoin and Ethereum Dip Fast and Furious, Causing over $1B in Liquidations

However, the move up above Bitcoin’s and Ethereum’s resistance levels of $12k and $$400 was short-lived as both dropped to $10,500 and $325 in a matter of minutes. The Fast and Furious dip caught many crypto-traders off-guard.

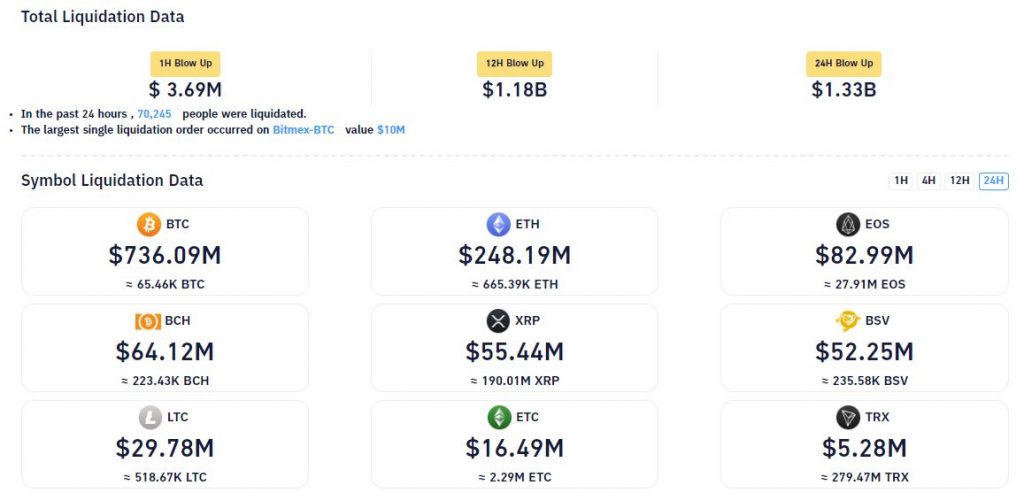

As a result, the move down caused over $1.33 Billion in liquidations in the last 24 hours. A total of 70,245 crypto traders were affected by the sudden drop in the value of digital assets with the largest liquidation being worth $10 Million.

Below is a screenshot providing a comprehensive overview of the total liquidations that occurred.

Crypto Exchanges Respond to the Sudden Dip

The fast and furious dip in the crypto markets also caught the attention of teams at multiple crypto exchanges who provided took to Twitter to express their views of the situation. In the case of Deribit, the exchange admitted that the move was too sudden for strategic option trades. The team at the exchange further explained this as follows.

1) BTC wick (12.1-10.5), ETH (415-325) were too sudden for strategic option trades. There were some ‘unintended’ prints (Aug28 14k Calls printed nr 200%). IVs have quickly settled back to 70% (only a couple % points up from pre-wick), ETH 110%. Sunday volumes low + now hesitant.

In the case of Binance, CZ took to Twitter to explain that Bitcoin futures contracts do not have Auto-Deleveraging.

No ADL in #btc futures, but some ADL in ETH and other alts.

— CZ Binance (@cz_binance) August 2, 2020

Furthermore, and at the FTX exchange, some stop losses were not triggered resulting in some crypto traders experiencing unintended loss. The CEO of FTX, Sam Bankman-Fried, took to Twitter to explain that those affected would be compensated.

1) FTX today:

No big wicks, no crazy liquidations, but it was really throttled for a bit and some stops were missed and some ADLs that weren't necessary. If you had one please email support@ftx.com. Really sorry about that!

As always, no clawbacks.

— SBF (@SBF_Alameda) August 2, 2020

Conclusion

Summing it up, Bitcoin, Ethereum, and the entire crypto markets experienced a massive dip that caught many crypto traders off guard. As a result, over $1.33 Billion in crypto trading positions was liquidated.

On the bright side, the fast and furious volatility is reminiscent of the 2017/2018 crypto market thus providing evidence that it might be bull season after all.