Recent research has delved into the democratization and decentralization of DeFi protocols as more are beginning to issue tokens based on voting rights. Findings indicate that there is little difference between these protocols and corporate governance.

The yield farming craze that has literally launched DeFi into the stratosphere over the past couple of months was initiated by a platform seeking decentralized governance.

Compound Finance was one of the first DeFi protocols to launch a token distribution incentive that rewarded liquidity providers with tokens and voting rights.

Since then, a slew of other DeFi platforms have followed suit with their own governance initiatives, all with the aim of democratizing and further decentralizing their networks, or so it seems.

A report by Dragonfly Research has taken a closer look at crypto-democracy with some interesting revelations.

Enter the DAO

The research by Ashwin Ramachandran and Haseeb Qureshi begins by going back to the early days when Ethereum developers were looking at decentralized autonomous organizations (DAOs) to achieve greater decentralization.

DAOs were introduced primarily to help provide a new form of transparent governance, the total opposite of closed-door corporations.

Four years later and over 1,900 DAOs have been deployed, according to the research. However, not all are as decentralized as they should be, as many look almost identical to traditional firm governance.

An excerpt from the Dragonfly report states that:

Just last week, 5–6 parties voted to make sweeping changes to two of the largest DeFi protocols. DAOs don’t really look like decentralized democracies, much less a revolution in governance.

Both Maker and Compound Finance have been undergoing governance voting for new proposals over the past month, but it appears that a small minority of big bag holders sway more influence over the entire system than the rest combined.

The researchers continued to surmise that decentralized governance has evolved to converge with forms of centralized governance, which have evolved over thousands of years and could actually be the optimal form of governance.

Forms of Governance

The Dragonfly research explores different governance systems for crypto projects, with the primary system being founder controlled. Early-stage crypto and DeFi projects are usually controlled by their founders just like most early start-ups are. This power concentration fromt the start can result in a faster-moving and more incisive organization, though it is not ideal when the project expands beyond the control of one person.

Secondly is council control, where blockchain projects come under the governance of a few individuals who define roadmaps, the strategic direction, and propose system-wide changes. Primary examples of these early systems include Bitcoin and Ethereum where core developers are the council.

The third major form of governance used by many crypto projects is an explicit representative or liquid democracy whereby representatives are elected to vote on behalf of individuals. This is often called delegated or proxy voting and is determined by ownership of a governance token.

This system is nothing new, however, as most western nations are governed by representative democracies while private corporations use liquid democracy or proxy voting through shareholders.

The research concludes;

Blockchains improve the efficiency and coordination of these forms of governance, but blockchains did not invent them. These governance structures still mirror the forms of shareholder governance used by most public corporations.

The question remains regarding convergent evolution or a lack of innovation. Are the governance systems we have in place already the best way to do things or will something new emerge?

The researchers propose that mirroring traditional company governance is the right path forward for crypto projects, as they feel that decentralized governance has been more translation than innovation.

DeFi Markets Hit New ATH

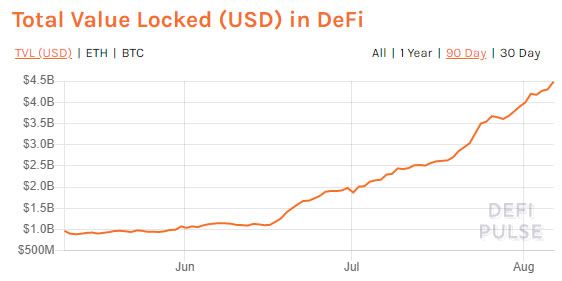

DeFi markets have again hit a new all-time high, regardless of whether protocol governance systems are perceived to be centralized or not.

The new peak today is $4.47 billion according to DeFi Pulse. Over the past 30 days, DeFi markets have grown by 85% in terms of total value locked.

A lot of the recent performance can be attributed to Ethereum’s price rise since TVL is measured in the USD equivalent. Ethereum locked in DeFi is also at its highest ever level of 4.3 million ETH, or 3.84% of the total supply. The same is true for Bitcoin with an ATH of 21,700 BTC locked into DeFi smart contracts.

Maker has added a further 3% on the day as TVL reaches $1.4 billion but MKR token prices have remained flat around the $590 level.

Synthetix is today’s top mover with 18% added to TVL taking it to an all-time high of $636 million. SNX token prices are hoveing just below their ATH, trading hands at $4.38.

RenVM and Bancor, which has been expanding its v2 pools, are also having a good day with double-digit collateral added to their platforms over the past 24 hours. Bancor’s BNT token is up 10% on the day, hitting a two-year high of $2.70

BAND Surges on Coinbase Listing

On-chain data oracle provider Band Protocol has just been approved for listing on Coinbase Pro where trading will commence on Aug 11. The announcement added that only the ERC-20 version will be supported at launch.

1/ Band Protocol ($BAND) will be listed on @CoinbasePro

, the leading licensed US-based digital asset trading platform, and begin trading on Tuesday, August 11.Coinbase users will be able to buy, sell, convert, send, receive, or store BAND.https://t.co/FIYIBdoHsK

— Band Protocol (@BandProtocol) August 5, 2020

Just like the early days of the crypto boom, BAND token prices have pumped a whopping 52% on the day to hit an all-time high of $7.90. BAND has been one of this year’s best-performing tokens with an epic surge of over 3,250% since the beginning of 2020.

Late last month, Band Protocol partnered with South Korean blockchain giant ICON to provide DeFi oracles to the platform which has plans to expand into the burgeoning sector. The Band Protocol has been largely considered as a rival to Chainlink, the current industry leader in price oracles.

DeFi tokens are still dominating the altcoin resurgence as Bitcoin’s dominance drops back to 62.3%. Other double-digit gainers today from the world of decentralized finance include REN and KAVA, both hitting all-time highs.

Meanwhile, Ethereum briefly topped $400 again a few hours ago as testing on the Medalla ETH 2.0 blockchain begins to roll out.

The post Are New DeFi Governance Models Really Decentralized? appeared first on BeInCrypto.