Key Takeaways

- Participating in Proof of Stake networks can be tedious, complex, and be highly capital intensive.

- Services representing node operators quickly emerged to help laymen enjoy passive income on their PoS tokens.

- Now, a new wave of projects, led by Stafi, are emerging to unlock the final frontier of PoS networks and solve their liquidity woes.

Share this article

Stafi emerges alongside the growing excitement around staking protocols and the launch of Ethereum 2.0. To understand this staking service, it is first necessary to know how staking serves specific blockchain networks as well as the current design flaws that may hinder further adoption.

Though the DeFi movement has stolen the spotlight as of late, staking protocols are quietly gaining steam. Like the yield farming craze, crypto stakers can also enjoy relatively high returns for assisting in the decentralization of the protocol.

For the uninitiated, staking protocols like Cosmos, Tezos, Dash, Cardano, and a handful of others offer users staking rewards. This mechanism differs from Bitcoin’s, which leverages Proof of Work (PoW). Ethereum also uses a PoW consensus mechanism, but the network will shift to a Proof of Stake (PoS) mechanism in the next few years.

The principal difference between these two approaches revolves around how a network’s blockchain confirms transactions. PoW networks task so-called “miners” to run large scale, highly-specific industrial computer farms day and night to earn the network’s block rewards. These miners also help to secure the network from malicious attacks.

It is expensive, energy-consuming, and challenging for hobbyists to join and earn a buck. PoS networks differ in almost every way.

They are typically less expensive to join, consume less energy, and boast high levels of security too. There has been some contention within the community as to how much more secure this mechanism is, however. That subject is beyond the scope of this article.

Despite the alleged advantages over traditional PoW blockchain networks, PoS still suffers from a handful of unique problems. Companies like Stafi are thus emerging to solve some of these problems.

Services Emerge to Make Staking Easier

Several staking services exist in the crypto space. Some, like Bison Trails, cater to institutional clients, while others like Staked, Chorus One, and Dokia assist retail users. Centralized exchanges like Bitfinex and Binance are also offering a suite of attractive staking services.

But, let’s first break down why these services exist.

The focus of such services is to remove the friction of setting up a staking node or validator. The technical know-how, as well as the constant maintenance needed to enjoy attractive rewards as a validator, can be daunting for many. Consider the hardware needs to become a full staking node on the Cosmos network.

Users will need a medium-grade server, a backup server, a hardware wallet, and firewalls installed for each server. The more robust each of these items is, the more robust your node will be. Offering a user access to a reliable node means that they will be more likely to stake their ATOM tokens with you. With more users staking on your node, you will be awarded proportionally.

Nodes in the Cosmos network are also penalized each time their node drops offline. This can hurt your rankings as a top node, and thus negatively affect your reputation and rewards potential. To ensure that your node remains up at all times, many call upon the utility of large server centers, further adding costs to the venture.

Then there is the technical knowledge needed to activate sentry nodes via AWS or a similar service to prevent DDOS attacks on your node.

And if a node operator wants to remain relevant and attractive to stakers, they will also need to make a healthy investment in ATOM tokens too.

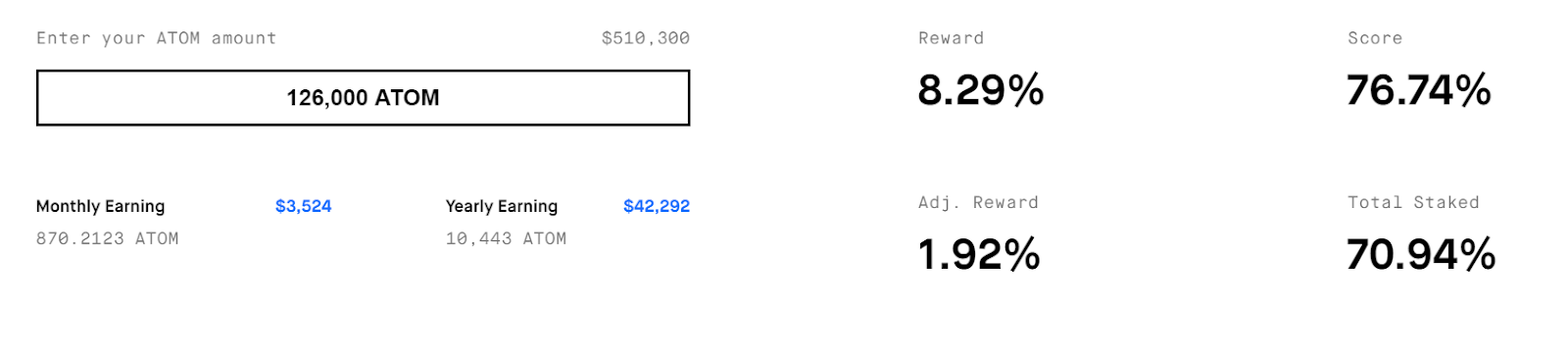

Though some nodes have staked as little as 3 ATOMs, this isn’t substantial enough to cover costs. Staking 3 ATOMS will earn you roughly $0.08 per month and cost you $12.15 to purchase those three tokens at today’s prices.

But let’s say you want to break even.

To bring this together in dollar terms, it will cost users roughly $20,000 to cover all equipment needed and another $2,000 per month to keep it all operating smoothly. That comes to a grand total of $42,000 a year to run a node.

To make that back in one year, you would need to stake 126,000 ATOM tokens or roughly half a million dollars.

From this brief outline, many retail users looking simply to earn on their idle staking assets have been scared off. For those who are looking for more information on setting up a Cosmos node, however, please review this guide.

Due to how capital intensive running validators for a PoS network can be, whole companies have formed to offer users their services. Visit any one of these services for a quick outline of how each one works.

This introduction has revealed how staking has moved from the complex and capital intensive node operations to the formation of easy-to-use staking services.

We can think of each iteration as the first and second generation of staking, respectively. Moreover, the second wave of staking improved and made more accessible staking to the average user.

Though these services are compelling for their ease of use, there are new risks associated with using them. This is because of the governance features that many of these tokens hold.

This became an issue earlier in 2020 when Tron founder Justin Sun attempted to overtake the blockchain-based social media platform, Steemit.

As many exchange platforms offered staking services for large amounts of Steem tokens, Steemit’s native asset, Sun allegedly convinced exchanges to help route out undesired block producers in the Steem network, the blockchain upon which Steemit was built.

The Third Generation of Staking

After the risk of centralized governance, another key drawback of many PoS networks, as well as the various services that underpin them, is that of the un-staking or unbonding period. This period refers to the time during which tokens are withdrawn from their staking position.

On the Cosmos network, this period lasts three weeks. Users are not able to sell or use these tokens for any reason during this period, either.

In the volatile world of cryptocurrencies, this can pose significant issues. Herein lies the third generation of staking services, like Stafi.

Unlike many of its counterparts, Stafi is built using Polkadot’s Substrate technology rather than Ethereum. That being said, the staking protocol will build a bridge with the number two blockchain network to take advantage of its deep liquidity.

Stafi allows token holders to stake their assets while also providing them with tokens that represent their staked positions. ATOM tokens become rATOM, Polkadot’s DOT tokens become rDOT, and the same holds for Tezos, EOS, many other PoS networks.

These rTokens act like receipts for stakers and can be traded throughout the crypto ecosystem on centralized and decentralized exchanges. At least, that’s the vision.

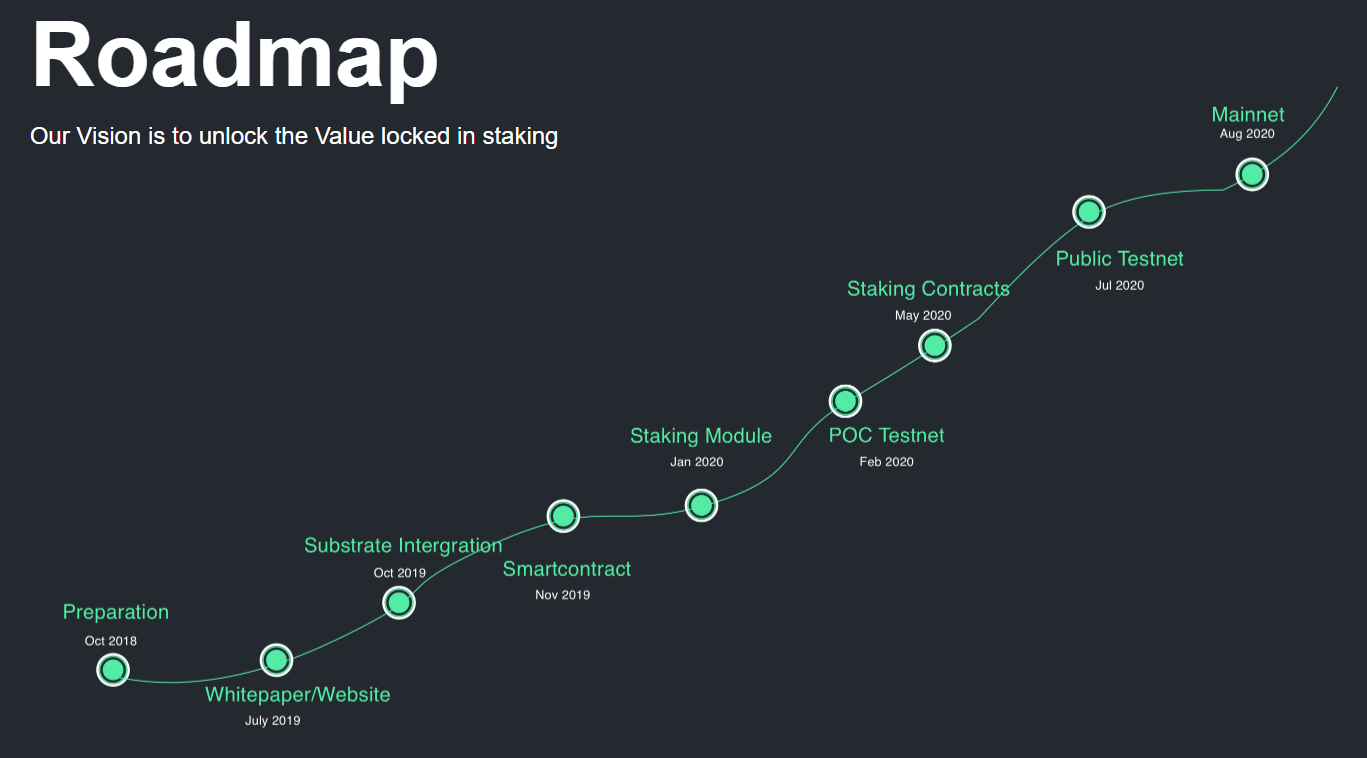

The team has yet to launch its mainnet.

These rTokens are themselves secured by two kinds of node operators: Stafi Validators (SVs), and Stafi Special Validators (SSVs). The whitepaper reads:

“SVs are responsible for the security of the whole protocol while SSVs guarantee the safety of all Staking Contracts.”

And like many other PoS networks, these validators will need to stake native FIS tokens to be elected.

Stafi Team, Investors, and Community

Stafi was founded by Liam Young and Tore Zhang, specialists in product management and blockchain development, respectively. Liam is an avid Proof of Stake researcher and previously developed Wetez, a wallet specifically built for users who want to stake their tokens via delegation.

Tore is a smart contract developer that runs the technical side of Stafi’s operations. Supplementing him is a team of four engineers who combine over 20 years of experience in software development.

According to Pitchbook, Stafi raised $600,000 of seed capital in July 2020 from the likes of Bitmax, Spark Digital Capital, and Focus Labs. Bitmax is a cryptocurrency exchange based in Singapore, and Spark Digital is a DeFi-focused fund with investments in crypto protocols like Matic, Algorand, and Elrond.

The Stafi team also picked up a grant from the Web3 Foundation, joining more than 40 crypto projects around the world.

As a nascent protocol still in the testnet stage, Stafi has done an excellent job of building a community. The project’s Telegram group has over 5,500 members.

To get the word out about the product and expand its horizons, Stafi is also working with Frontier, Harmony, and Matic Network.

Closing Remarks

From an economic perspective, the biggest issue with staking has always been the effect it has on a token’s free float and liquidity. If a significant portion of tokens is locked up in staking contracts, liquidity in the open market tends to suffer.

This dynamic has positive and negative implications.

A large number of tokens locked for staking indicates strong sentiment towards the token’s prospects. Further, it hinders the possibility of a large-scale dump, as whales would need to withdraw tokens from the staking contract, which would set off alarms within the community.

But the negative side is that with a low free float, even a relatively small amount of tokens being bought or sold has a lasting effect on price. Simply put, the volatility of the token is permanently high. This puts off larger investors as they cannot build a position without taking on significant price slippage.

Stafi’s rTokens fix these liquidity woes and allow tokens to secure the network through staking without depriving the market of liquidity. This, of course, hinges on the Stafi team’s ability to execute on their vision and attract market participants.

As a bonus, using a decentralized protocol as a means of liquid staking means one need not rely on centralized exchanges like Binance or Coinbase to stake tokens.

Stafi’s permissionless staking, coupled with a non-custodial marketplace to trade rTokens, can make liquid staking a reality.

Just like Treasury bills are debt notes that represent a certain amount of dollars owed to the holder, an rToken like rATOM is a debt note that constitutes a fixed amount of ATOM owed to the holder.

Disclaimer: This author is not invested in Stafi. However, one or more members of Crypto Briefing’s management team invested in Stafi.