1inch exchange’s Chi Gastoken (CHI) promises token swaps with lower fees. The value of the token rocketed this past month, but does it do what it was designed for?

Anyone who has been chasing tokens on Uniswap or moving ETH has noticed the sky-high transaction fees. Someone even allegedly paid $400 in gas to get $TACO tokens during its presale.

$26. Someone paid $400 in the taco wars

— ฿ 𝘡𝘢𝘻𝘶 𝙻𝚎𝚠𝚒𝚜 ฿ (@dubl_inc_zazu) August 12, 2020

The Nuts and Bolts of CHI

A new way to save on gas is 1inch Exchange’s CHI gastoken. Apparently, 1inch was named after Bruce Lee’s 1-inch punch. It’s simple, it’s subtle, and it gets the job done.

1inch explains how the token was born:

To execute a 1inch punch, you need power, in Asian Martial Arts it is called as Chi / Qi, whose equivalent in the crypto space is our new Chi Gastoken. Now, any user can burn their Chi tokens and thereby save on gas.

So the CHI gastoken “takes advantage of the Ethereum storage refund.” Ethereum provides a refund for any zeroed (deleted) element from the chain. Basically, this is a way of encouraging smart contracts to free up storage.

The CHI token creates a sub smart contract with a shorter address, then burns it. It gets a bit technical, but the result is that the transaction still goes through while being be carried out using around half the gas in dollar equivalent.

CHI Takes a Trip to the Moon

The CHI gas token comes as an improvement upon the GST2 gas token. Nobody knew that ETH fees would get out of control this fast. How could anyone predict that there would be a tertiary gas token that improves on a secondary gas token?

Well, a month ago a Reddit user named 3mr_moustafa posted a thread calling CHI gas “The Easiest 5x You’ll Ever Make.”

In the post, the user laid out all the reasons for CHI’s future success. A huge spike in transaction fees and thousands of day traders rushing to DEX trading, and voila.

According to Coingecko, CHI Gas is up 337% in the past week, and that’s still a good deal off its all-time highs.

But Does It Work?

One important thing to remember is that CHI gas tokens represent the fees paid during an ETH token swap. If the price of those fees goes up, so does the price of CHI. The need for cheaper gas on the Ethereum blockchain incentivizes more people to buy or mint CHI. Either way, the price of doing business goes up.

Vitalik Buterin and other developers have pointed out the mechanism could help buffer transaction fees. Users could stock up when the coin is cheap, and use it when transaction costs are high.

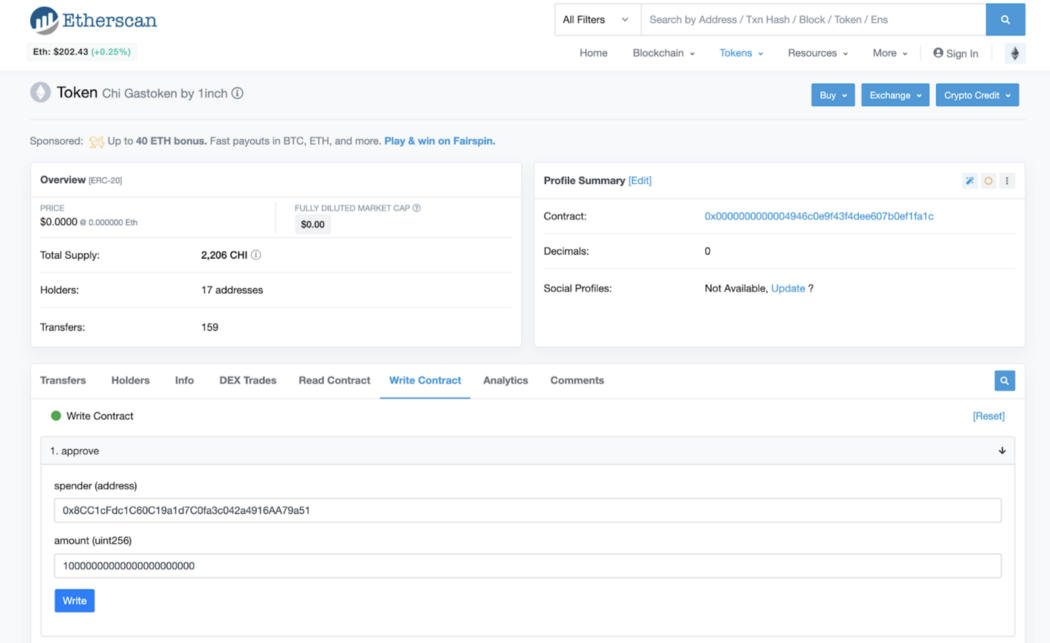

Using CHI tokens as gas does require some intermediate work—the instructions can be found here.

Similarly, the team at Dharma wallet has found a way to discount Ethereum transactions. These are all temporary solutions to a scalability problem that will hopefully be fixed in Ethereum 2.0. Until fees come down, transaction costs are going to be a nuisance to all traders.

The post Chi Gastoken Pops on Promise of Lower Transaction Fees appeared first on BeInCrypto.