Key Takeaways

- Curve Finance began as a crypto swapping platform, offering traders low slippage trades across major stablecoins

- Hype around the imminent release of the protocol’s native token has pushed the project into the spotlight

- The team behind Curve are far from newcomers: It’s founder continues to work on NuCypher, an encryption protocol for smart contracts

Share this article

Curve Finance began as one of the most efficient stablecoin swapping protocols in DeFi. Now, with a governance token in the works, it has become one of the most popular projects in the space.

Following the launch of various tokens like COMP, BAL, and YFI, DeFiers are eager to get their hands on Curve’s CRV token.

Due to its various integrations around the DeFi space, you may likely have used Curve without knowing it. 1inch exchange, for instance, aggregates liquidity from Curve pools to ensure that users on their platform are getting the best prices possible. Depending on the size and tokens a trader is moving, it’s likely the trade is executed through Curve.

Another integration with various DeFi lending and borrowing platforms like Aave, dYdX, and Compound, also see Curve users earn interest on top of their trading fees. So, on top of the 0.04% on fees that LPs collect, they are also earning healthy interest rates.

In many ways, Curve Finance fulfills the “Money Lego” meme by interacting with other legos in the ecosystem. Even without this composability, Curve still serves arbitrage traders better than many of its competitors.

What Is Curve Finance? How Does It Work?

Curve Finance is an automated market maker (AMM) designed to facilitate low slippage swaps between tokens with similar prices. Dollar pegged stablecoins like DAI, USDT, and USDC or BTC-pegged tokens like sBTC, RenBTC, and WBTC can be traded for one another at the best prices.

Just like Uniswap and Balancer, anyone can deposit tokens in Curve and become a liquidity provider. Users who do this are rewarded with fees accrued from token swaps.

Of the many DeFi protocols in existence, Curve is one of the few to achieve true product-market fit by fulfilling a specific purpose that market participants have come to value.

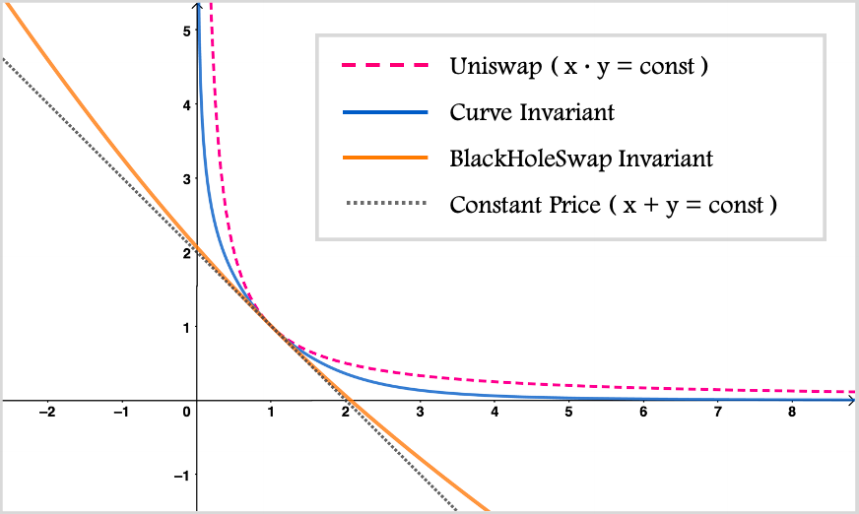

The math behind Curve is complex, but the concept is simple.

Curve was developed as an alternative to trading stablecoins on general-purpose DEXes like Uniswap, whose algorithm isn’t optimized for such trades. The introduction of Curve created deeper liquidity and competitive prices for stablecoins. DeFi lenders could thus quickly and efficiently switch from supplying, say, USDT to USDC as the interest rates in money markets changed.

Anybody who’s been yield farming since June is already aware of Curve. Yield farmers on Compound use stablecoins like DAI or USDC, rendering Curve Finance the best place to trade one stablecoin for another as yields change.

When yEarn Finance announced liquidity mining, there was a burst of activity on Curve. This is because yEarn users had to liquidity mine with the yCRV token. yCRV is the pool token for the Curve market consisting of yEarn’s wrapped DAI, USDC, TUSD, and USDT tokens.

At the peak of the mania, Curve’s trading volumes eclipsed Uniswap, with DAI and USDC leading the way. Curve benefited from the liquidity mining burst without even issuing its own token. However, Curve’s native token, CRV, is slated for release in the coming few days.

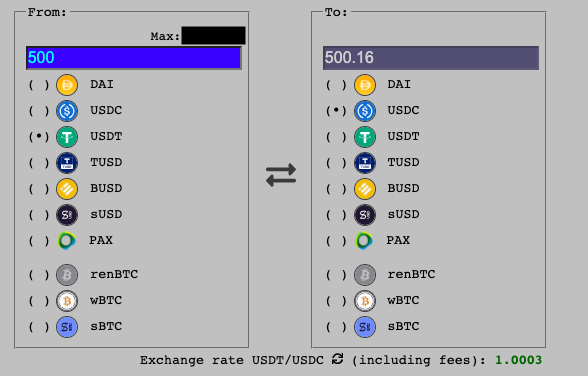

Using Curve is very simple. Like most DEX frontends, the asset swapping interface is on the homepage where users can swap between any of the seven dollar-pegged stablecoins or the three BTC-pegged tokens.

As with most DEXes, users must first approve the contract through their browser wallet, after which they can swap tokens at their leisure.

Curve’s Competition and Core Differentiators

Until very recently, Curve’s only competition were other DEXes like Uniswap, Kyber, 1inch.exchange, and other similar platforms.

However, during the end of May 2020, the first real competitor to Curve emerged – mStable.

mStable is a pegged asset swapping protocol that shares many similarities to Curve. It has a basket for each asset (USD, BTC, etc.) and has tokens pegged to that asset inside the basket. Both mStable and Curve serve the unique market of swapping pegged tokens for one another.

mStable claims to offer “zero slippage swaps.” This is because of the protocol’s model prices each asset in a basket against every other on a one-for-one basis. Effectively, this means 1 USDT can be swapped for 1 DAI, even if the price of a single DAI is 1.02 USDT in the open market.

Hence, prices on mStable are independent of the market, creating a ton of unique arbitrage opportunities.

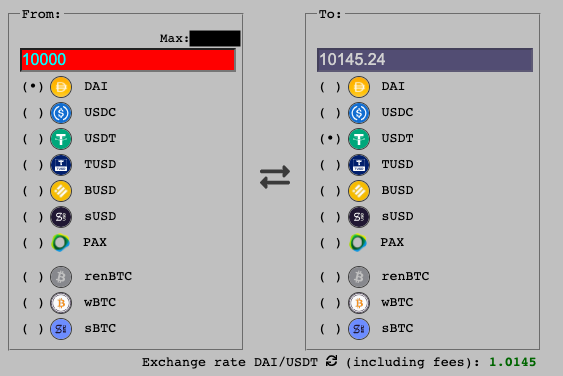

Curve, on the other hand, incorporates the active market price for an asset. Let’s look at swaps of different sizes to identify which protocol is superior.

Note: Shell Protocol is a similar protocol and a contender to both Curve and mStable. However, Shell is not live on mainnet yet, so any benefits of using it cannot be practically assessed at the time of press.

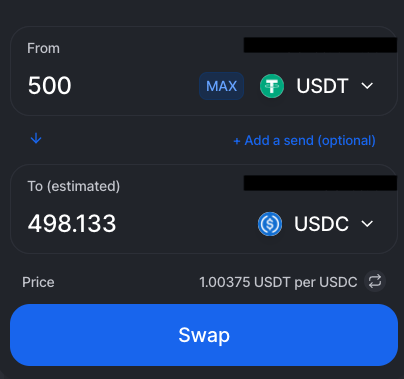

On Uniswap, swapping 500 USDT yields just 498.133 USDC as the price of USDC was marginally higher than USDT at the time.

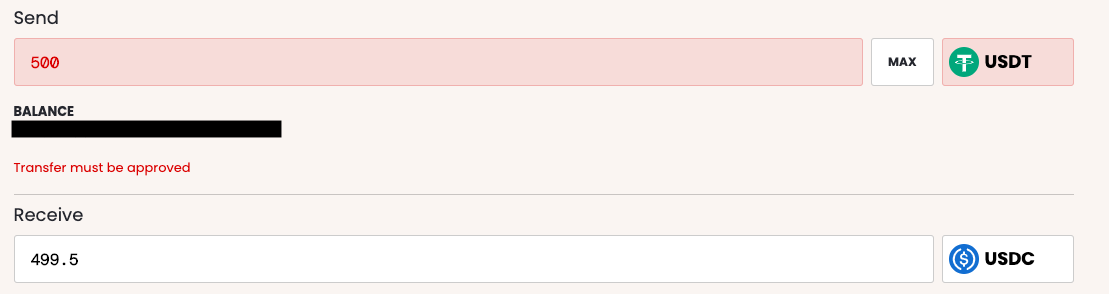

On mStable, this same trade results in 499.5 USDC, which means it’s more efficient to execute this trade on mStable over Uniswap.

Curve wins this round, offering 500.16 USDC for 500 USDT. For clarification, all three swap prices were determined within a 30 second period, so there’s no scope for prices to have significantly changed.

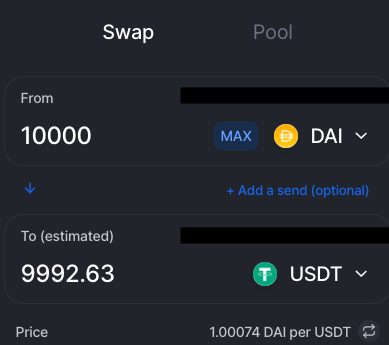

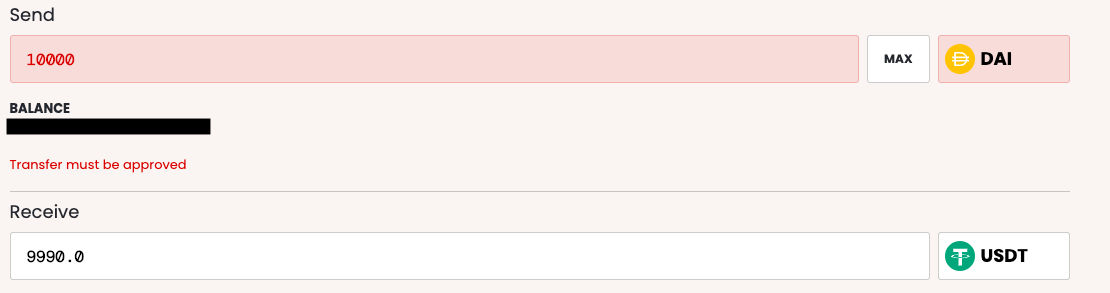

But what happens when the size of the transaction is increased, from $500 to $10,000? For this example, let’s look at a trade swapping 10,000 DAI for USDT.

On Uniswap, once again, you are getting less bang for your buck despite DAI trading at $1.01 and USDT at $.999 at the time. This highlights the need for DEXes that facilitate low slippage swaps between similarly priced assets.

mStable offers less USDT per DAI than even Uniswap. This figure, however, is net of fees, unlike Uniswap. Currently, fees on mStable are fixed at 0.1%, so the 10 fewer USDT a trader would receive is a result of that fee.

Curve once again offers the best rate because it incorporates market prices rather than a one-for-one peg. If we flip the assets and swap from USDT to DAI, Curve offers approximately 9,991 DAI for 10,000 USDT while mStable will still offer 9,990 DAI for 10,000 USDT.

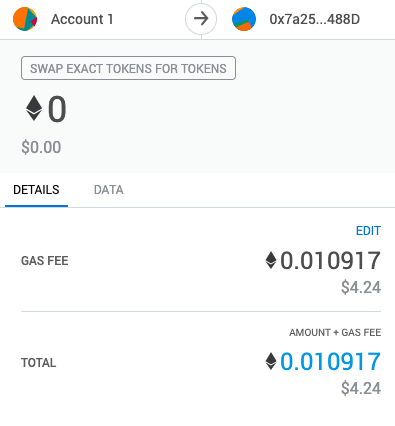

Notably, both of these figures are net of protocol and LP fees but do not include gas costs. When swapping DAI to USDT, Curve’s rate is far better than mStable’s, so gas is not a concern. But from USDT to DAI, gas costs make or break the difference.

At the time of writing, it costs 72 gwei per unit of gas.

Using the fast option (76 gwei for gas), the cost of the trade is just $4.24 in gas on Uniswap.

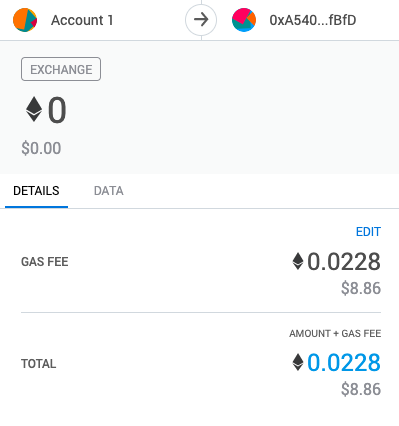

The result of the same trade is $8.86 on Curve.

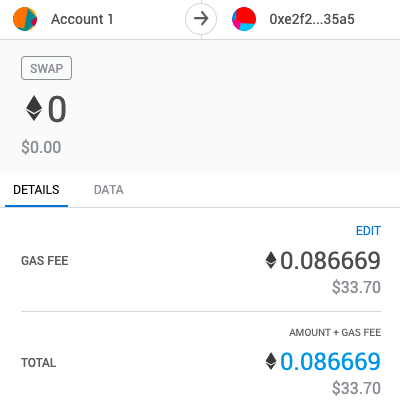

But, when users switch to mStable, the cost jumps to a whopping $33.7.

The difference is not marginal, with mStable fees sitting 8x higher than Uniswap and 4x higher than Curve.

Smaller trades may be more cost-effective on Uniswap thanks to the difference in gas, but larger trades are better on Curve. mStable only has the edge over Curve in a scenario where there is a large enough spread between prices on Curve and mStable to justify paying extra in gas.

How to Make Money with Curve

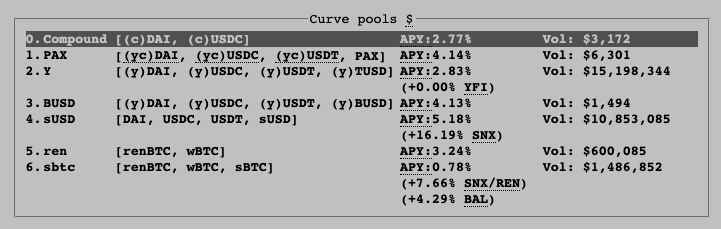

As previously mentioned, anybody can become a liquidity provider on Curve. There are six different pools in existence; four cater to stablecoins and two to BTC-pegged tokens.

Because of these pegged tokens, the risk of impermanent loss is negligible in Curve pools. Hence, LPs don’t need to worry about timing their entry and exit. There’s no economic issue if LPs indefinitely keep their stablecoins in the Curve pool.

The yield on each pool is directly correlated to how much volume each pool receives. This is because the income for liquidity provision comes from a fee levied on each swap. More volume equates to more profit.

However, as a pool grows in size, higher volume is required to maintain returns to LPs.

When yEarn launched, there was a rush for yCRV tokens to farm YFI tokens. After supplying a pool with liquidity, LPs received yCRV tokens. These tokens acted as receipts on LPs’ deposits. They could then take their yCRV tokens and stake them in the yEarn protocol to earn YFI.

Once the farming strategy was announced, yield in the yPool proceeded to skyrocket above 1,000% APY. Anticipating these trends is difficult, but getting in early as the projected return starts to rise can help LPs capture enormous profit.

Yield in the yPool has significantly dropped since the sunset of YFI farming, but it can be resurrected as YFI governance decides on whether to issue more tokens.

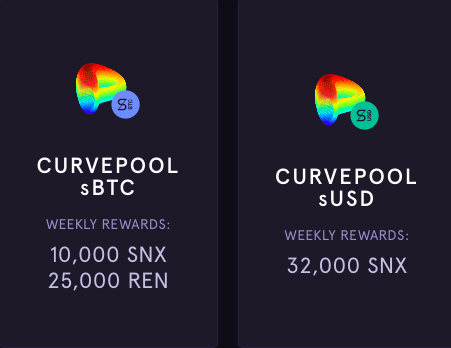

Further, some pools have incentives outside of Curve. The sUSD pool and the sBTC pool, for example, have external incentives provided by Synthetix and Ren Protocol.

LPs in the sUSD pool receive fees from trading volumes, but by staking their LP tokens with Synthetix, they are entitled to a share of 32,000 SNX every week. The sBTC pool, which includes three assets – sBTC, RenBTC, and WBTC – offers a weekly reward of 10,000 SNX and 25,000 REN to those who stake LP tokens.

The launch of Curve’s native governance is highly anticipated. Estimates for the initial valuation upon launch were towering, with most believing it will launch as DeFi’s most valuable token.

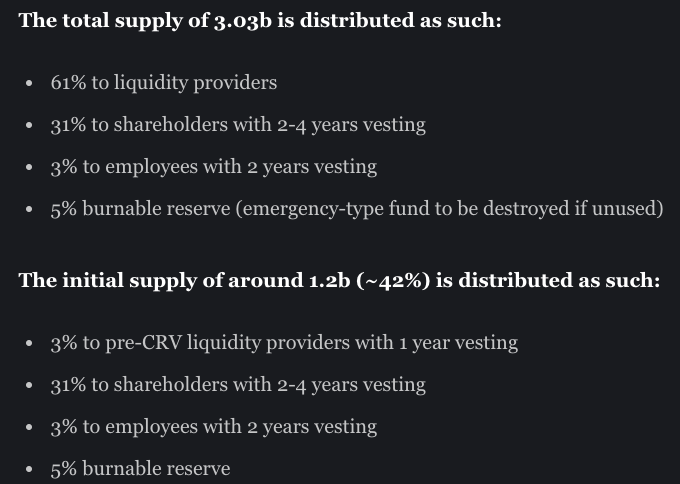

Curve’s token went live today, commencing with an initial issuance of two million tokens per day. Tokens are allocated to past and current LPs, investors, employees, and reserves for the Curve DAO.

An increase in Curve’s total value locked is due as speculators rush into various pools to liquidity mine the Curve token.

After benefitting from liquidity mining schemes from other protocols, Curve is expected to further its growth on the back of its own incentive scheme.

Curve’s Risks and Downsides

Since Curve’s pools are composed of tokens pegged to the same price, there are risks unique to the protocol.

For example, if one token in a Curve pool loses its peg and permanently stays below $1, all LPs will effectively hold their deposits in that token.

But for a stablecoin to permanently break its peg, systemic failure in its mechanics must occur first. An example of this is the SEC imposing restrictions on the redemption of USDC, or a devastating hack on the Maker protocol that kills confidence in DAI.

Both of these examples are highly unlikely, but not impossible. Like everything in crypto, users should tread carefully when investing in these emerging protocols.

The Curve Team and Community

The Curve team, like many in the DeFi space, is a small group of developers, community managers, and blockchain tinkerers. Some have also been working in the crypto space long before the DeFi trend.

In 2015, Curve’s founder, Michael Egorov, helped found another company called NuCypher. At the time, NuCypher was working in the broader encryption industry, helping healthcare and financial institutions keep sensitive data safe. The project was successful, and the team began workshopping its encryption software with various banks until eventually landing a $750,000 investment from Y Combinator in 2016.

Egorov and the NuCypher team then shifted their attention to the same objectives in the blockchain sector. This led NuCypher to a decentralized redesign of its infrastructure as well as the launch of a native token, NU. They then went on to raise $4.4 million in an ICO in 2017, built two testnets, and then raised another $10.7 million in 2019.

In 2020, Egorov started Curve Finance. Though it is still unclear the size of the team, Egorov confirmed in a Telegram conversation with Crypto Briefing that five other members join him.

These include two developers, Angel Angelov and Ben Hauser, and three community managers, “Charlie,” “Kendrick Lama,” and “Chris.” The team has been too busy to confirm too many details beyond this, however.

This article will be updated as each member has time to respond to Crypto Briefing’s queries.

Due to Curve’s utility long before the announcement of its native token, the community of investors and users is significant. As mentioned earlier, this enthusiasm can be seen in the multi-million dollar volumes that the platform enjoys.

This will likely increase as users attempt to farm the CRV token en masse.

Final Thoughts on Curve

Before the yield farming trend took off within the DeFi space, Curve was still an essential part of the ecosystem. It helped render the market more efficient by revealing key arbitrage opportunities. Not just that, but it offered eligible traders an easy-to-use platform to profit from those opportunities.

Now, more than six months since the project launch, its governance token has been one of the most hyped crypto investments in 2020. And as yield farmers flock to earn CRV, users can be sure that relevant APY’s will rise across all Curve pools.

As for the future of the protocol, only time will tell.

Similar DeFi projects like Compound, Balancer, and yEarn have all already been actively proposing changes to each system. First, however, the hype of the token launch must clear the air.