Key Takeaways

- Manic yield farming events and sky high token valuations make identifying top DeFi projects difficult.

- Crypto Briefing has created a framework that draws on governance and token distribution to measure which protocols are the most decentralized.

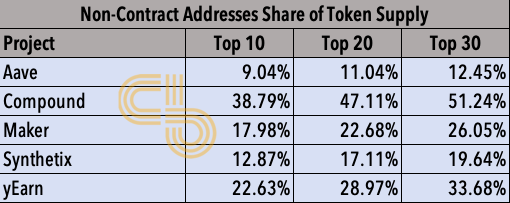

- The critical obstacles facing most projects is that of token concentration and attracting token holders to participate in developments.

Share this article

Identifying the top DeFi projects from most decentralized to least decentralized can be difficult. The task is made more challenging following meteoric token prices and bubble-like folly throughout the ecosystem.

From thousands to billions of dollars in just two years, projects that buckled down to build a resilient product have reaped their hard work’s rewards.

Despite this fantastic growth, however, addressing core obstacles that stand between DeFi and real adoption is necessary. The primary blockades? Governance and decentralization.

In its current state, decentralized finance only lives up to the second half of its name. Achieving true decentralization has yet to truly materialize, but for good reason.

At a time when these protocols are nascent and iterating core functionality, the founding team needs adequate control to be able to push upgrades in an instant. What emerges is a spectrum; decentralized iterations, some more successful than others.

There are protocols like Uniswap, for example, where the founders relinquished their control from the get-go. This means nobody can shut down Uniswap, but upgrades aren’t possible either. Conversely, protocols like Compound and Maker need their smart contracts to be upgradeable. Keeping the network’s development static is not a viable option.

Stani Kulechov, founder of Aave, believes on-chain governance via a native token is the middle way for these iterative protocols to move forward:

“There is nothing wrong with off-chain governance and most of the things in life are governed off-chain. However, when it comes to DeFi protocols, on-chain governance does have value propositions as it allows the governance of executable code without any interference, empowering true communities.”

As these protocols start to mature, transitioning governance and power from a team of ten to a community of hundreds is vital. But for this to work, community members must have a strong incentive to act in good faith.

While influential community members are bound to exist, implementing measures to mitigate their control over the network is required. Thus, limiting their ability to form a cartel and capture the system.

With this in mind, there are two primary governance risks facing crypto protocols: Regulators stepping in to shut down a centralized feature of a project, or whales conspiring to stage a network takeover via a native governance token.

A final concern facing DeFi protocols is that of regulation. Unlike their centralized counterparts, most decentralized platforms don’t ask users for formal identification or other personal details.

Jake Brukhman, founder and CEO of CoinFund, told Crypto Briefing that:

“I don’t believe that DeFi and regulation are mutually exclusive. At the same time, I don’t think protocols themselves will need KYC: I see protocols as the information technology for transactions, and they will simply delegate compliance to the edges (users).”

By taking all of this into account to build a coherent framework to evaluate governance, three key aspects help determine where a particular project stands on the decentralization spectrum:

- A method of gauging a community’s opinion and enforcing a decision that achieves consensus. The easiest way of doing this is by voting in a decentralized autonomous organization (DAO).

- Incentivizing the community to vote in good faith. A native token that holds monetary value helps align the individual’s desire for profit with the protocol’s best interest.

- Equitable distribution of tokens to prevent concentration in the hands of a few actors who can collude and capture the network.

Let’s apply this framework to the top DeFi protocols to determine which is the most decentralized, and which is the least.

Ranking DeFi Protocols by Decentralization

1. yEarn Finance (YFI)

Launched by Andre Cronje in February 2020, yEarn Finance is one of the most gripping projects in DeFi. The excitement revolves principally around the astonishing yields on yVaults, but it’s the grassroots governance movement that sparked further involvement.

YFI, the platform’s token, is perhaps had the most equitable token distribution since Bitcoin. There was no pre-mine or token allocation to developers and investors. Instead, the entire supply was up for grabs during yEarn’s liquidity mining initiative.

Whales with large amounts of capital to spare always dominate token farming events. YFI was no stranger to this as token concentration with large entities is reasonably high.

yEarn Finance doesn’t have a DAO for protocol governance but does use the YFI token for on-chain voting. Instead, yEarn relies on a 6-of-9 multisig held by various community members to implement proposals. Executing decisions through a multisig wallet isn’t the most capture-resistant way to manage the treasury.

Even in a DAO, 5-10 elected members enforce decisions. However, a meaningful difference is that plans to decentralize via a DAO will allow the token holders to veto executive decisions and remove DAO members.

For its fair distribution, alignment of governance and financial incentives with a token, and use of a community-owned multisig, yEarn Finance is the top DeFi project based on decentralization.

2. Synthetix (SNX)

A top DeFi protocol with over half a billion dollars of locked collateral, Synthetix is taking extensive measures to decentralize control of the system.

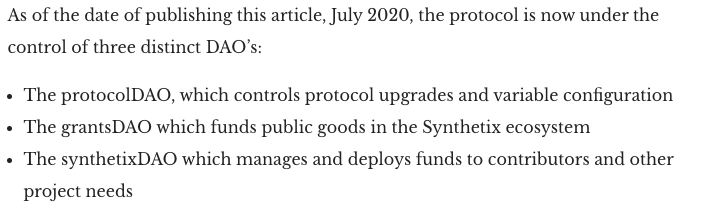

After two years and multiple pivots, Synthetix decommissioned its governing foundation. In its place, the core team set up three distinct DAOs to ensure the smooth sailing continues.

The ProtocolDAO is the owner of all Synthetix smart contracts and is responsible for upgrades and new deployments. A few core members are responsible for executive decisions of this DAO.

The SynthetixDAO was initially just a multisig but transitioned into a full-fledged DAO in June 2020. This DAO is set to be fully operational in 3-6 months and will be responsible for treasury management. Compensating contributors, paying for Chainlink price feeds, and other such activities fall under this DAO’s purview.

Finally, the GrantsDAO funds public goods in Synthetix, such as campaigns for public awareness or intuitive dashboards for users.

The SNX token will soon be at the center of these DAOs, giving individual token holders power in the governance process. Token holders will be able to vote out elected DAO members, even overriding their decisions in certain circumstances.

On the topic of token issuance, the concentration of SNX tokens is not drastic, but it isn’t ideal either. Synthetix raised funds via a public sale, and all VC investors involved with Synthetix bought their stakes directly from tokens allocated to the treasury.

3. Aave (LEND)

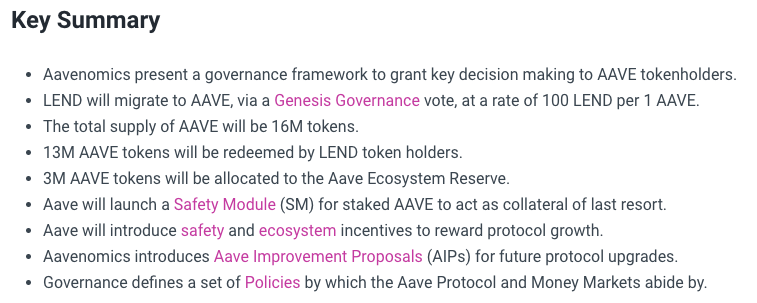

A sweeping revamp to Aave promises to put governance in the hands of token holders while improving the alignment between the native token’s value accretion and the protocol’s sound management.

The current LEND token is being migrated to AAVE with a reverse token split (like a reverse stock split) to reduce supply from 1.2 billion to 12 million. Additionally, three million new tokens will be created as ecosystem reserves, diluting existing investors by 25%.

Aave’s next era marks a DAO launch. The DAO allows for the implementation of proposals that reach consensus through on-chain voting. Staked AAVE tokens act as a backstop in the event of a deficit. Doing so entails receiving protocol fees as a reward for absorbing this risk.

Staked AAVE is sold in the market to the extent of the deficit to protect the protocol’s longevity.

This process will begin in the coming weeks, and Aave will no longer be governed solely by the founding team. This shift earns Aave a spot as a top DeFi project.

4. Maker (MKR)

The original DeFi protocol, MakerDAO, is an established player and a pioneer of on-chain governance. Recently, the Maker Foundation migrated control of the MKR token over to the community.

Unlike the Synthetix Foundation, the Maker Foundation didn’t dissolve. Instead, it was demoted to being just another governance participant.

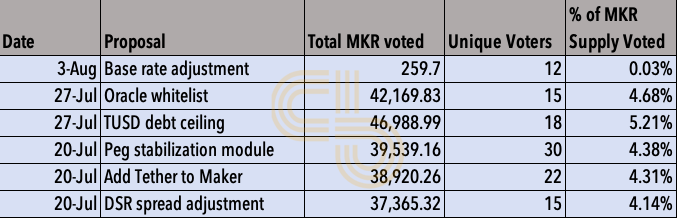

Changes to the Maker protocol is in the hands of token investors. Implementation of a proposal is only possible after ratifying it with on-chain votes. The DAO is now the sole decision-maker for Maker’s risk parameters and collateral asset inclusion.

However, voter apathy runs rife in the Maker ecosystem, with an average of less than 5% of tokens taking part in votes. Most votes get unilaterally swung in a particular direction because of whales with significant influence. Funds like a16z and Polychain Capital hold a substantial amount of MKR supply.

Information regarding the issuance of MKR tokens is hazy. Maker didn’t conduct an ICO. Instead, they slowly sold tokens into the market through various means.

Maker set the tone for DAO-based governance backed by a native token. However, the value accretion mechanism is to use cash flow from stability fees to burn tokens instead of rewarding users. So far, the burn mechanism hasn’t proved all that effective, as evidenced by MKR’s price.

MKR issuance does not have a cap, further eroding the value of burning tokens. New tokens are issued and sold to cover any protocol level deficits. A single instance of such a debt in March 2020 led to more tokens’ issuance than the protocol has ever burned since launching in December 2017.

The risk of dilution is serious for MKR investors unless they bid on the new tokens themselves.

This mechanic causes a minor disconnect between token holders and the governance process. The resulting mismatch between incentives and MKR holders is possibly the root cause of low voter turnout.

5. Curve (CRV)

A recent DAO and governance token launch brings Curve one step closer to decentralization. CRV holders can vote to introduce an admin fee to the protocol and back the tokens with steady cash flow.

From a governance perspective, the DAO will facilitate on-chain voting for proposals. Employees and shareholders hold the majority CRV voting power at commencement. While LPs account for 62% of total supply, it will take years to accrue more votes than seed investors and employees because of Curve’s slow token release mechanism.

As a result, the team and shareholders will control the network with the majority vote in the early days. This dynamic is very likely to reverse over time, giving LPs more power in the future. Unfortunately, the botched token launch and concentration of critical votes place Curve low on the list of top DeFi projects.

6. Compound (COMP)

The launch of COMP kicked off the liquidity mining circus this June and was a prime catalyst for the rise of DeFi.

Despite Compound’s startling growth in the past few months, there are concerns regarding decentralization.

Token distribution is almost the exact opposite of Synthetix. Instead of a public sale and allocation to VC funds from the treasury, Compound issued tokens directly to investors to raise capital; its liquidity mining program distributed tokens in the treasury to the community.

The distribution is an excellent idea from a business perspective but is not ideal for decentralization. Liquidity providers get the biggest piece of the pie with 42% of total supply, but shareholders and employees (current and future) also have a combined 49% supply.

Like MakerDAO, whales dominate voting on Compound. The top five voters own 10.12% of total votes; the top ten account for 15.1%. For reference, the network needs a minimum of 400,000 votes (4% of total votes) to pass a proposal.

Collusion between any three of the top ten will allow them to capture the network unless other whales step in to oppose them—this critical dynamic limits Compound’s ability to scale up this list of top DeFi projects.

More participation offsets this risk, which is not a flaw of the model but rather a result of COMP farmers sitting on their tokens without voting. Passing a proposal to give COMP holders a portion of protocol fees could vitalize governance.

As token holders’ financial incentive converges with Compound’s long-term growth, more COMP owners can be expected to vote.

DeFi: Minimizing Governance, Maximizing Decentralization

The ideal governance mechanism for a protocol is zero governance. But this isn’t sustainable in an environment that relies on innovation to attract new users.

DeFi’s big brands are starting to implement some form of decentralization. Obstacles are sure to arise soon, but mitigating them will help separate the wheat from the chaff.

Still, as it stands, the top DeFi projects based on decentralization are yEarn Finance, Synthetix, Aave, Maker, Curve, and Compound.

Most whales are publicly known investment funds and crypto companies, which dramatically reduces the risk of acting in bad faith. The ensuing reputational risk outweighs the benefit of seizing power in a crypto ecosystem.

But the point of decentralizing finance is to make sure no one can gain undue control of a system. So, while measures to avoid this scenario seem excessive today, they instill public faith in a protocol by guaranteeing nothing adverse happens tomorrow.

The motto of this decentralized movement is allowing access to everyone while prohibiting control from anyone. Successfully pulling this off will change finance as we know it.

Disclosure: Andre Cronje, the creator of yEarn, is an equity-holder in Crypto Briefing.