Decentralized finance projects keep gathering momentum. Many are attributing the current bull market to the boom in popularity of these protocols. From high-interest earnings to yield farming, we may be witnessing how DeFi takes over crypto.

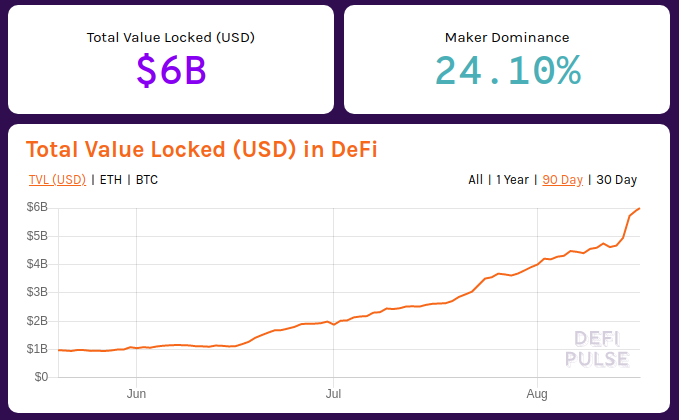

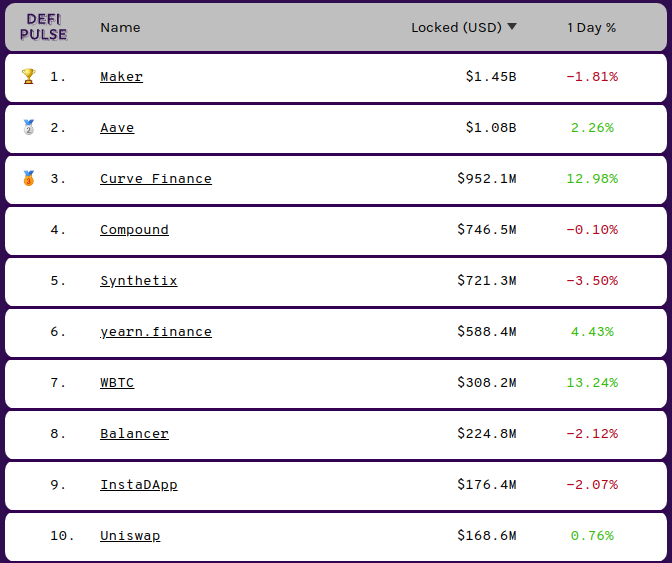

Just two weeks ago, total value locked (TVL) on all DeFi protocols combined reached $4 billion. Today, that number has topped the $6 billion mark, adding an average of one billion dollars per week.

Is This the Beginning of the DeFi Bubble?

It’s hard not to compare the current market sentiment with the late 2017 ICO-mania. Back then, a small team with a flashy website and well-edited whitepaper could grab millions through an initial coin offering.

Many cryptocurrency and financial analysts are already calling this a DeFi bubble, although the general belief is that total valuation is still too small to cause a major crash. Alex Svanevik, CEO of blockchain analytics company Nansen says:

Basically a worst-case scenario for DeFi is the ICO bubble of 2017 combined with the Great Financial Crisis of 2008. It’s also quite different from the 2017 ICO bubble in a few key ways.

He added:

It has a much more bottom-up distribution, and in fact, there are signs that retail investors managed to move ahead of the whales on this one, in stark contrast to the ICO boom where whales were getting sweet deals behind the scenes.

Crypto seems more mature now after the multi-year bear market, but the euphoria is causing plenty of dubious projects and scams to pop up.

Reminder: you do NOT have to participate in "the latest hot defi thing" to be in ethereum. In fact, unless you *really* understand what's going on, it's likely best to sit out or participate only with very small amounts.

There are many other kinds of ETH dapps, explore them!

— vitalik.eth (@VitalikButerin) August 14, 2020

The High Price of Success

One of the classic symptoms of bull market euphoria is that almost every day we have a new hot project that attracts all eyeballs. Among last week’s big winners were LINK and BAND, as well as experimental DeFi tokens like YAM.

A great part of this boom relies on the Ethereum network, which is getting clogged and expensive. The possibility of launching any token on Uniswap and accessing a big liquidity pool is causing gas prices to skyrocket.

To the boom in DeFi projects and the decentralized oracles craze, we may soon see strong competition between decentralized exchanges:

Uniswap is starting to become unusable with gas prices at 200+ gwei. The only reason people are still using it is that they think they will outperform the fees from flipping tokens (probably true). But if retail actually comes, Uniswap won't be usable for anyone but whales pic.twitter.com/2Ce01sKasO

— Larry Cermak (@lawmaster) August 12, 2020

New projects are coming up to challenge Uniswap’s dominance. BeInCrypto recently reported about 1inch exchange and Dharma, both of whose value propositions revolve around cheaper gas fees.

This may add fuel to the current uptrend in the crypto market. DeFi is growing, and those projects need oracles and decentralized exchanges. There is still lots of value sitting idle in crypto wallets, especially in Bitcoin, Ripple, Bitcoin Cash, Litecoin, and EOS.

The post DeFi Total Value Locked Tops $6 Billion Milestone appeared first on BeInCrypto.