Key Takeaways

- Instead of paying centralized managers or parting with your cash via a robo-advisor, dHedge decentralizes and removes the middlemen in asset management

- The project has earned additional attention thanks to an ongoing trading competition on the platform.

- dHedge is backed by notable DeFi investment funds and lead by a team with a rich background in traditional finance as well as blockchain development.

Share this article

dHedge is working to decentralize and render permissionless traditional asset management services. It takes the idea of robo advisors, adds a community, and lets anyone in the world become the robo. Plus, you never hand over your funds.

The objective falls in near-perfect alignment with the rest of Defi: Oust the middle man and let everyone participate.

The team behind dHedge is also making another unique bet on Synthetix. The entire protocol is built on this DeFi darling, meaning it has also bootstrapped one of the most active communities in crypto these days and a lucrative crypto token to boot.

This community has come alive most actively during the latest testnet trading competition.

The project’s second trading competition is already underway on Ethereum’s Ropsten testnet, with 125,000 DHT, dHedge’s native token, and 6,600 SNX are up for grabs. Traders who finish in the top 20 will receive tokens as a prize.

There are over 450 participants, and the competition will extend to early September. Mainnet will launch soon after the conclusion of the trading competition.

But before that happens, let’s dig into this week’s Project Spotlight: dHedge.

What Is dHedge and How Does It Work?

dHedge is an asset management protocol built on top of Synthetix. Anybody can set up their own investment fund on the Ethereum blockchain or invest in a fund managed by someone else in a completely non-custodial manner.

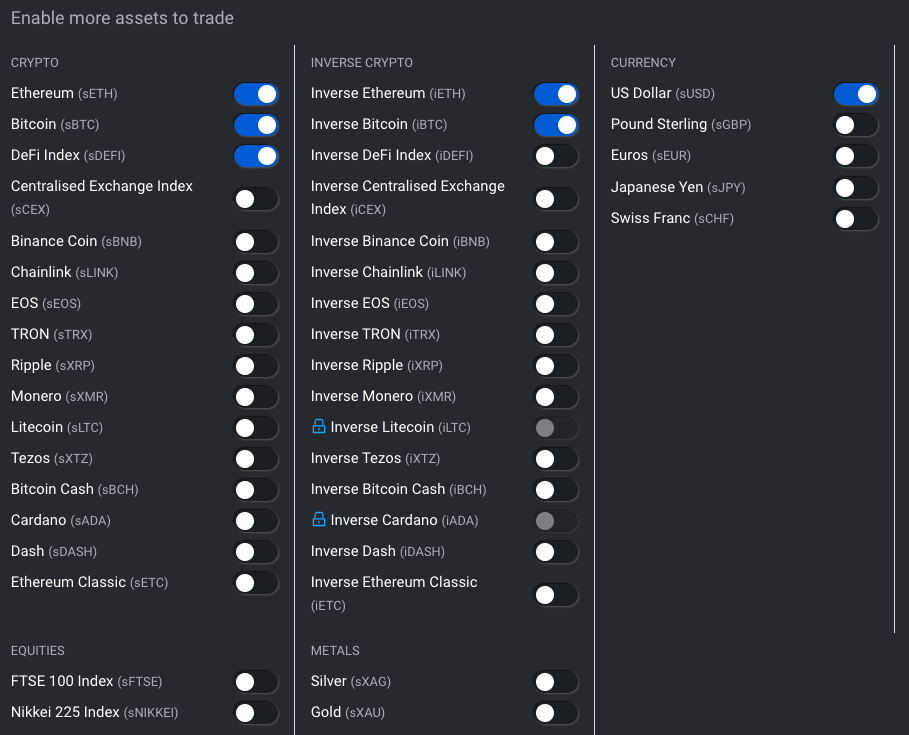

Synthetix is a synthetic asset issuance protocol that supports a wide range of assets. Crypto assets like BTC and ETH, commodities like Gold and Silver, and even equity indices are part of Synthetix’s suite of offerings.

dHedge’s investment pools, thus leverage the entire Synthetix stack. The platform will support futures and limit orders when Synthetix rolls them out later this year.

There are two types of pools on dHedge: public and private. Public pools allow anyone to invest in the strategy. Private pools let a set number of whitelisted addresses contribute capital to the pool.

For public pools, fund managers can only deploy and manage funds. They cannot withdraw somebody else’s capital.

Funds can be managed by active managers who themselves deploy capital, or by algorithms built to invest on a predetermined strategy. This allows for a lot of nuance, as managers can base their strategies on fundamentals, technicals, algorithms, or anything else.

The dHedge Governance Token, DHT

The dHedge ecosystem will be powered by a decentralized autonomous organization (DAO) and its native token, DHT.

The DAO is responsible for development and ensuring governance runs smoothly. This indicates the team is acting upon measures to decentralize from the starting line.

Initially, governance participants will only be able to vote on certain issues while others will be enforced with rough off-chain consensus. However, this is commonplace with nascent protocols, and dHedge isn’t even live on mainnet yet.

dHedge’s token will start with a fixed supply of 100 million tokens. Tokens will be issued to active users of the protocol through a liquidity mining strategy to reel in adoption.

However, dHedge’s token supply is subject to community consensus. While it’s unlikely to happen anytime soon, governance participants can vote to introduce more tokens.

Competitors and Product Contrast

Set Protocol is a well-known asset management protocol that has seen modest traction in 2020, and yEarn Finance is a competitor only to the automated strategies on dHedge.

This leaves Melon Protocol as the closest direct competition for dHedge.

Melon and dHedge both allow fund managers to create a public or private fund, and the former is open to everybody for investment. Melon’s pool can authorize several exchanges to deploy capital and invest in almost any ERC-20 token.

Because dHedge is so closely interconnected with Synthetix, the number of tradable assets also depends on the available assets on Synthetix.

All synth tokens, the synthetic assets that Synthetix creates, are valued with the help of Chainlink price feeds. Thus, if either of these two projects does not support a token, then it won’t be supported on dHedge either.

But given Synthetix’s pace of iteration, this is unlikely to be a long-term obstacle.

It’s difficult to compare the user experience of dHedge with its competition because the product is not yet live, and the testnet protocol is a watered-down version with fewer features.

However, there are a few aspects that already favor dHedge.

DeFi’s flagship use cases are DEXes and money markets. Asset management is a poorly penetrated vertical that has only just started earning attention from builders. And insofar as yEarn is currently limited in what it allows, this sub-niche is still waiting for its breakout product.

dHedge can be that product.

Unlike Set Protocol, dHedge is fully permissionless and allows any trader to set up their own fund. And unlike Melon, dHedge is not restricted to tokens. There are already plans to enable futures, binary options, and any other financial instrument that Synthetix creates.

dHedge also plans to integrate with a lending/borrowing product so that idle funds can be put to productive use for extra yield. Say “Fund A” has $10,000 of AUM, but $500 is sitting idle in sUSD. Lending sUSD on Aave currently yields 4.36% and can add to the fund’s return.

Synths are priced according to Chainlink oracle prices, so slippage is non-existent when trading on Synthetix. This can be a game-changer for larger funds that lose a small fortune to slippage trading illiquid crypto markets.

How Does dHedge Fit Into DeFi’s Vision?

The core value proposition of DeFi is permissionless, non-custodial finance. dHedge is building the infrastructure to make asset management open and secure.

Public pools are the equivalent of mutual funds and ETFs – anybody can invest or redeem their capital at any given time, without the friction of bureaucratic processes employed in legacy finance.

And instead of a company handpicking people to manage a fund, anybody can set up their own open-source mutual fund. There are many traders with the chops to allocate capital and manage risk better than some professionals. dHedge essentially gives them a platform to show their talent.

Private pools are like hedge funds. dHedge only lets whitelisted addresses invest in a private pool, which would let hedge funds implement their closed-source structure. An investor’s address will be whitelisted after due diligence, and terms are agreed off-chain.

The less institutionally-inclined can use private pools to set up pools employing different strategies. Instead of doing this from different ETH addresses on DeFi, managers can set up several pools from one address and have access to them from one place.

Coupled with zero-slippage trading and instruments like futures, dHedge has the potential to become a one-stop-shop for mutual funds, hedge funds, and sophisticated retail traders.

If automated investment strategies are an indicator of demand, dHedge will attract attention from small to medium-size investors. For reference, yEarn Finance has over $800 million of value locked in its yield aggregation tool and farming strategies.

And automated investing is just one aspect of dHedge’s product stack.

Risks and Threats

DeFi is still a new concept and is subject to dynamic changes over short periods of time. As with any nascent protocol, dHedge may not be able to establish a product-market fit in this environment.

Product-market fit boils down to demand for an asset management tool in the market. Some Token Sets on Set Protocol outperformed the market, which means there are definitely A-grade traders out there, and healthy demand exists.

But product-market fit isn’t the end of the line. dHedge is not yet on mainnet, which gives way to execution risks. Nobody can deny building in DeFi is difficult, and there’s a lot that can go wrong with smart contracts.

Finally, dHedge’s reliance on Synthetix creates an external risk. Synthetix’s liquidity limits dHedge’s demand and usage.

Synthetix may be slippage-free, but liquidity is a byproduct of SNX’s price appreciation and staking ratio.

There is $982 million locked in Synthetix at the time of writing. Synths are issued against Synthetix, and the collateralization ratio must be a minimum of 700%. This implies a total of approximately $140 million of synths can exist. For the overall market cap of synths to increase, more SNX needs to be staked, or the price of SNX must appreciate.

This problem is being mitigated by introducing new collateral assets against which synths can be minted. The protocol’s second trial run with ETH as collateral is underway with $167,000 in the crypto locked in Synthetix.

Investors, Community, and Users

Some of the fastest-growing funds back the dHedge project in crypto.

Naturally, betting on dHedge also means that a fund is bullish on the team behind Synthetix and the SNX token. Framework Ventures, for instance, is the largest holder of Chainlink’s LINK and SNX outside of founding team members and exchanges.

Several of these funds are also incredibly active within the broader DeFi space, participating in hands-on yield farming and governance proposals for various projects. Given this variety of experience, supporting a decentralized and permissionless asset manager aligns well.

The team behind dHedge is made up of two key members: Henrik Andersson and Radek Ostrowski.

Beyond helping lead dHedge, Andersson has a distinguished track record as an asset manager in the world of traditional finance. At present, he is the CIO of Apollo Capital, which won Crypto Fund Research’s Top Performing Multi-Strategy Crypto Fund in 2019.

To boost the technical side of the dHedge team, Ostrowski brings a rich history of data engineering and blockchain development. He has also founded several crypto-related firms, including Startonchain.com and RelayPay.

Both of them are based in Australia, adding credence to a new “DeFi valley” of sorts that’s emerging in the land Down Under.

As for the community, most of the activity is happening on the Discord channel, which has ballooned following the launch of the trading competition.

Final Notes on dHedge

Though the project has yet to launch a mainnet, its unique product, strong team, and active community means you should keep an eye on dHedge. Though it checks all the boxes, investors must also be aware of the competition and the current climate in crypto.

The broader crypto space is posting more and more bullish signals these days, and DeFi projects appear to be the epicenter of this sentiment. This dynamic means that many projects that launch in this period may enjoy higher valuations than average.

Doing your due diligence, tinkering with the protocol itself, and focusing on fundamentals are all critical components at this stage.

Share this article

DeFi Project Spotlight: 1inch.exchange, the Trading Router for Decentr…

1inch.exchange has emerged as an essential part of the booming decentralized finance (DeFi) movement. What initially began as a one-stop-shop for aggregating liquidity has morphed into a swiss army knife of…

July BTC Market Analysis

After roughly 2 months of price consolidation following its rapid recovery from Black Thursday (March 12th), Bitcoin broke out of its range following an extended period of muted volatility. Currently…

Aave Raises $3 Million From Framework Ventures and Three Arrows Capita…

One of DeFi’s fastest-growing protocols, Aave, has raised $3 million in capital from notable crypto funds Framework Ventures and Three Arrows Capital. The two will combine forces with helping Aave…

Aave and Curve Finance Join DeFi’s Billion Dollar Club

DeFi is growing exponentially, adding a billion dollars of collateral locked in a mere two days. Aave and Curve have been the most potent drivers, as each project smashed past…