Key Takeaways

- The yield farming trend has spread across nearly the entire DeFi space.

- Though financial incentives are important, poorly designed rewards can hamstring sustained user adoption.

- Reserve Protocol and Terra are two examples of DeFi projects building outside of the liquidity mining hype.

Share this article

Though DeFi projects have been hastily launching various yield farming schemes, they may end up overlooking the end goal: Sustainable adoption.

Yield Farming Dominates Attention

There’s no single recipe for success when it comes to bootstrapping a crypto network.

But in recent months, the concept of yield farming and liquidity mining as a means of enhancing a network’s adoption has taken off.

So far, it’s clear that financial incentives play a huge role in bringing users to a system.

The euphoria around DeFi can be traced back to the launch of Compound’s liquidity mining program.

After Compound, liquidity mining was used for fair token distributions, as seen with YFI and YAM. While investors are enamored by these projects and the prospect of earning a new token, liquidity mining isn’t ideal in every scenario.

The goal of these schemes is to create long-lasting liquidity on the protocol and build a dedicated user base. If poorly designed, however, they can quickly turn into speculative pump-and-dumps with little staying power.

Compound’s liquidity mining event offers a perfect case study. According to DeFi Weekly, the top COMP miners have been selling their earned tokens daily – a sign of speculators dominating the scene. Still, this has been paramount in building liquidity for the protocol.

But what happens when token distribution ends?

Compound issues 2,880 COMP a day out of a total of 4.3 million tokens, implying the incentive can run for a little over four years.

Without a capital lockup or token vesting, speculative yield farmers looking to farm and sell tokens will account for a lion’s share of liquidity. Eventually, whether this will enrich the protocol over the long-term remains to be seen.

Instead of allowing one form of adoption to dominate mindshare in DeFi completely, investors should keep close tabs on protocols bootstrapping in different ways rather than those flocking to the crowded idea.

Sustainable adoption is what the industry needs to flourish for years to come.

The following two projects are working on precisely this. And they’re aiming at one of the least penetrated, yet most essential elements of DeFi – payments.

Reserve Protocol

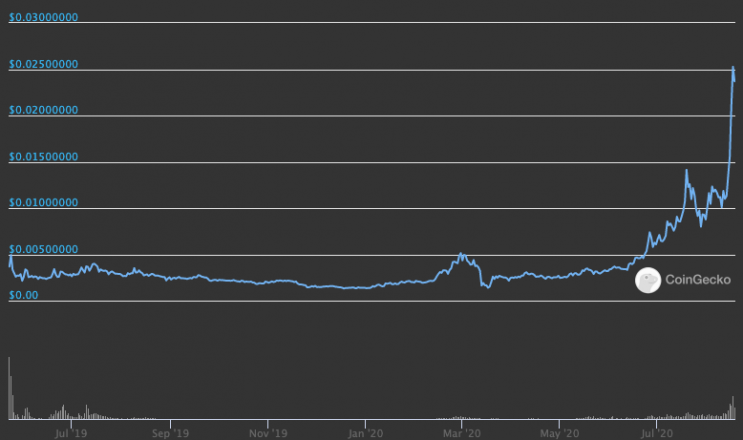

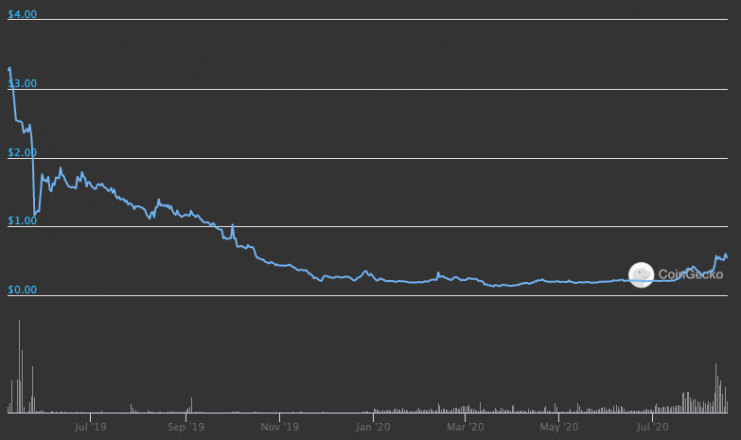

Reserve is primarily a stablecoin issuance protocol built on Ethereum. Reserve’s token structure consists of a hybrid governance-utility token, RSR, and a native stablecoin, RSV.

But mechanics aside, Reserve’s approach to adoption is a rarity in crypto. Rather than jumping on the stablecoin and DeFi hype, Reserve is bringing stablecoins to those who need them.

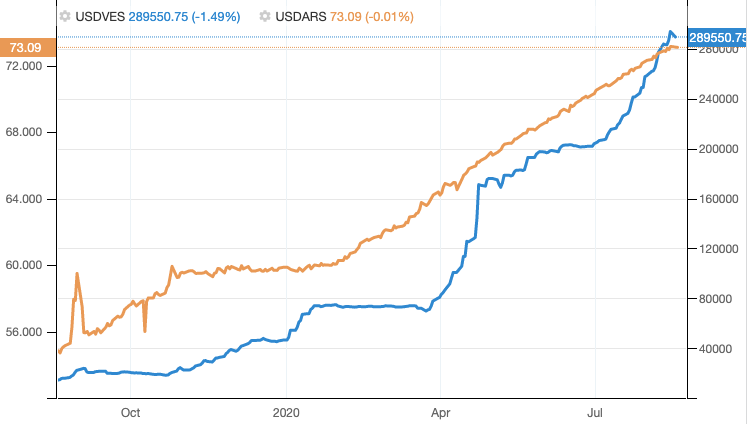

Reserve launched adoption efforts in countries ravaged by high inflation. According to TradingEconomics, the Argentine Peso lost 33% of its purchasing power against the dollar in 2020, while the Venezuelan Bolivar lost 84% of its value. Both of these currencies make up a majority of Reserve’s current user base.

Campaigns in Argentina, Columbia, and Venezuela have thus seen moderate success as the team eyes other potential markets like Lebanon.

Users in these countries don’t need a browser wallet like MetaMask to use RSV. Reserve has an app available on the Google Play Store that makes it easy to access permissionless money.

RSV is currently pegged to the dollar and can be minted against other dollar-backed stablecoins like USDC, PAX, and TUSD. However, RSV will not always be pegged to the dollar.

In the future, RSV will be collateralized against a basket of digital assets and tokenized stocks, treasuries, and other assets. Every RSV will be backed by a proportional amount of each asset in the basket. This will allow RSV’s peg to latch onto the portfolio of assets backing it.

Reserve’s approach to adoption certainly won’t make headlines nor short-sighted investors rich, but Reserve’s CEO and co-founder, Nevin Freeman, believes that, given the project’s vision, building liquidity on crypto exchanges is the least daunting task.

Freeman told Crypto Briefing:

“I do care about RSV’s liquidity on crypto markets, but that’s a well-understood path and easier to do compared to building liquidity for RSV against volatile fiat currencies that our target end-users are holding.”

He added:

“We’re doing something similar to liquidity mining by assembling liquidity providers in different countries and incentivizing them in our token (RSR), but it’s a slower and less hype-inducing process.”

Terra

Like Reserve, Terra is another stablecoin issuance protocol that doubles up as a payments network. But Terra’s focus is on consumer payments rather than remittances in emerging economies.

The project’s network topology resembles that of Reserve. Both have a governance token and native stablecoins. Terra’s native governance token is LUNA, and the protocol supports a family of fiat-pegged stablecoins such as USD, KRW, and the IMF’s Special Drawing Rights (SDR).

Validators on the Terra blockchain are rewarded for staking Luna. Users are rewarded through discounts and rebates on their purchases. Because Terra uses stablecoins, it’s easier to convince merchants to integrate Terra. And because users are given an incentive to use Terra as a payment method, the network can bootstrap the supply and demand side.

Terra’s incentives are simple and funded by network revenue rather than token issuances. This model is much more sustainable compared to poorly-designed yield farming schemes. This is because customer usage and the discounts they receive are directly related.

Chai and MemePay are mobile payment interfaces built on top of the Terra blockchain. Chai is Terra’s marquee product and boasts integrations with several Asian retail giants. Users in South Korea can download Chai from the Google Play Store.

Crypto Is More Than a Get Rich Quick Scheme

Outsized returns from yield farming can be helpful for nascent systems to earn traction. But it shouldn’t be the only model for user adoption.

While profits have become a part of Bitcoin’s culture today, it hasn’t sidetracked developers and entrepreneurs from experimenting and iterating with new business models.

Reserve and Terra are just two examples of projects bringing crypto assets closer to mass adoption. Both are doing so by making the use of permissionless money simpler for a targeted audience.

Separating money from the state is at the heart of crypto’s vision. Efforts to converge that mission with the needs of the masses offer a sustainable way to target widespread adoption.

Share this article

1Inch.Exchange Announces Yield Farming Opportunity for Its Upcoming To…

Just one week after the launch of Mooniswap and bagging $2.8 million from the biggest names in crypto investing, 1inch.exchange is taking their business a step further. 1inch yesterday has…

Understanding Position Sizing

Let’s briefly examine the most important aspect of any trading system, position sizing, or specifically how much we will bet on any one given trading idea.

Curve Finance Finds “Product-Market Fit” Yield Farming in …

In the last 24 hours, Curve Finance saw more volume than any other decentralized exchange (DEX) thanks to the latest yield farming trend. As DeFi traders look to squeeze returns…

Compound Lowers Interest Rates Amid Yield Farming Frenzy

Compound users have voted to change the rules around the distribution of the platform’s COMP token, which will ensure that markets are more evenly utilized. The change is part of…