With the flurry of activity in the decentralized finance (DeFi) space, the number of Ethereum (ETH) contract calls continues to increase.

As numerous DeFi projects emerge weekly, dry-runs and tests on smart contracts are increasing as developers work out bugs. The Ethereum blockchain itself is also experiencing significant congestion leading to a massive hike in gas fees.

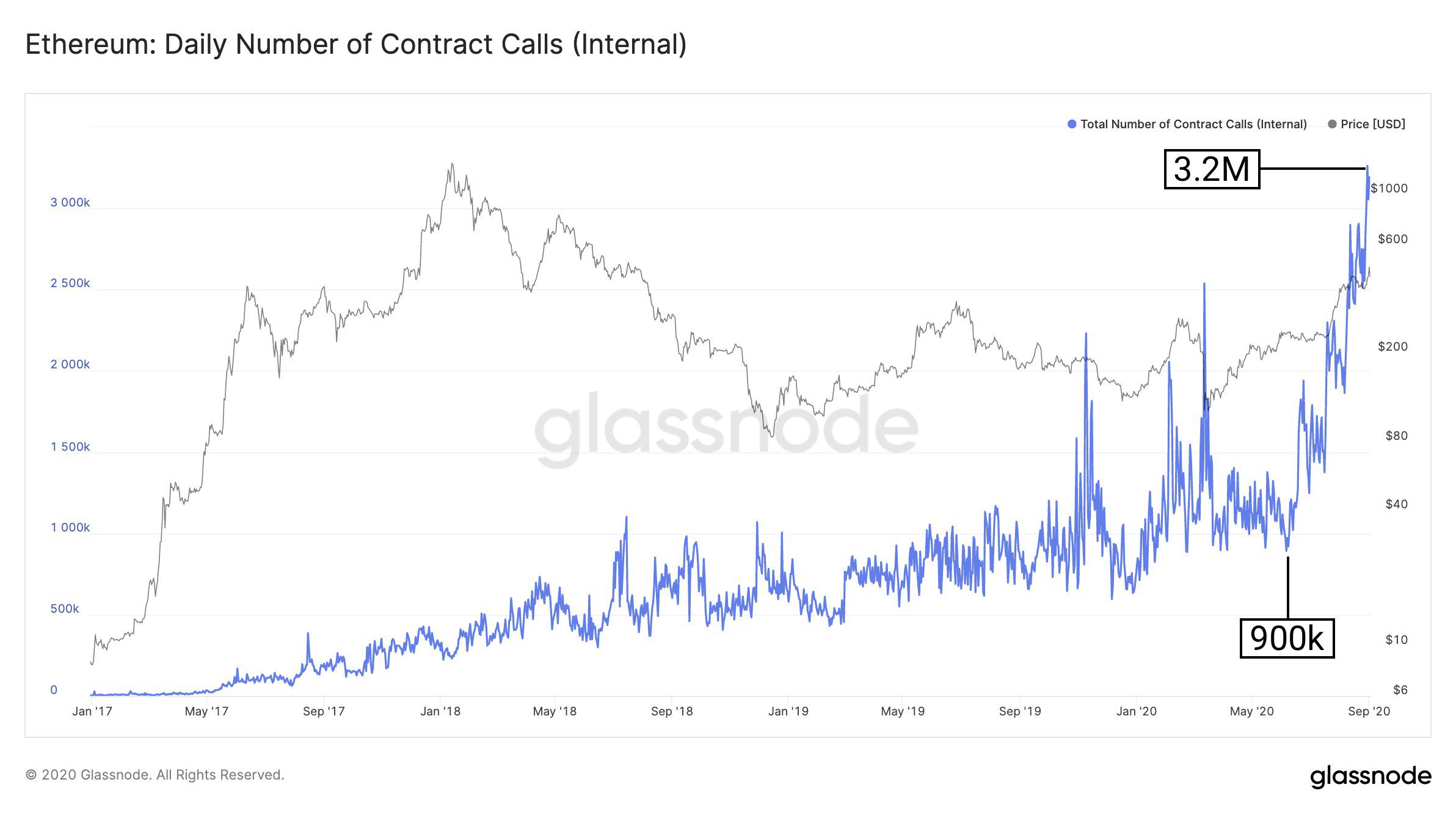

Internal Ethereum Contract Calls up 3x Since June

According to data from the on-chain analytics platform Glassnode, the number of internal Ethereum contract calls is up to over 3 million per day. This figure represents a 200% increase from the sub-one million call average seen in June.

Contract calls refer to specific non-transactional function requests from smart contracts. These calls do not leave a blockchain footprint but usually form testing protocols that precede the launch of a smart contract.

A similar trend can be seen for external calls as well. Glassnode figures show that contract calls initiated by externally owned accounts (EOAs) are up about three times year-to-date. This uptick in contract calls can most likely be attributed to the increasing level of activity in the DeFi space.

Indeed, there is an obvious spike in contract calls beginning in June which also coincides with the start of the current DeFi explosion. At the time, DeFi lending protocol Compound debuted liquidity mining which birthed the ongoing yield chasing frenzy.

DeFi Growth Continues Unabated

As previously reported by BeInCrypto, the hype surrounding the DeFi market is causing a massive increase in trading volume on decentralized exchanges (DEXs).

In August, DEX volume crossed the $11 billion mark with platforms like Uniswap seeing more trading activity than some major centralized exchanges.

However, rogue actors are weaponizing the DeFi hype to create fake tokens designed to defraud yield chasers. The ease of creating a coin and listing on platforms like Uniswap is breathing new life into pump and dump scams reminiscent of the ICO-mania era of 2017.

The post Ethereum Contract Calls Set New All-Time High Amid DeFi Explosion appeared first on BeInCrypto.