Key Takeaways

- Curve’s liquidity providers don’t actively participate in the governance process, which leaves decision-making in the hands of a few powerful stakeholders.

- While the latest reward boosting initiative improved the situation, it doesn’t solve the fundamental governance problem.

- Non-financial incentives are important for building long-lasting decentralized communities.

Share this article

Several yield farming schemes this summer have made many users rich. But when it comes time to vote on protocol improvements with their newly-earned governance tokens, many farmers have been silent.

The idea of liquidity mining assumes that reward tokens are used to steward the evolution of DeFi protocols. But the sector’s obsession with profit poses challenges to this assumption.

The example of Curve DAO shows that users aren’t willing to stick with the project after receiving short-term gains. Consequently, only a handful of large players are left to govern the project, which creates an environment for hostile power grabs.

The issue is not Curve-specific; its roots are in the community itself. Human nature eagerly seeks the path of least resistance on its way to riches. Hence, DAOs should find ways to harness greed for the benefit of their protocols.

Misalignment of Incentives

While the DeFi platforms have been growing since 2018, their popularity exploded after Compound launched its governance token COMP on Jun. 16, 2020.

The introduction of COMP ignited the yield farming movement, where users provide liquidity to help the lending function for rewards. Curve followed the same path with its CRV token.

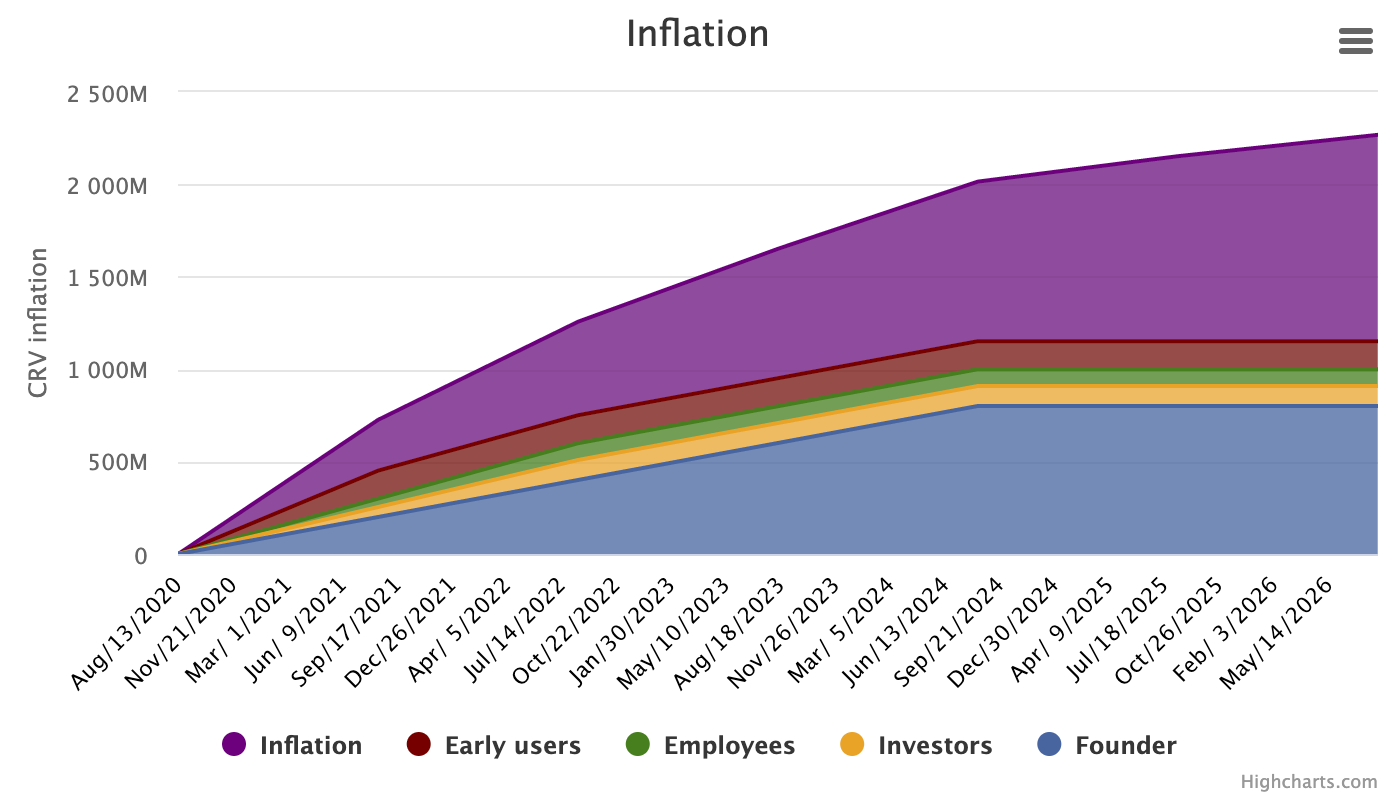

The overarching idea of decentralizing Curve’s governance is to give tokens to liquidity providers through inflation, as stated in the protocol’s guide:

“The circulating supply at the end of year one should be around 750m CRV. The rate of inflation is there to help put the DAO’s control in the hands of liquidity providers on the Curve Finance protocol.”

By giving out governance tokens, the team distributes control over the network. Users can lock their CRV in the system to influence Curve’s future by proposing ideas or voting for other proposals.

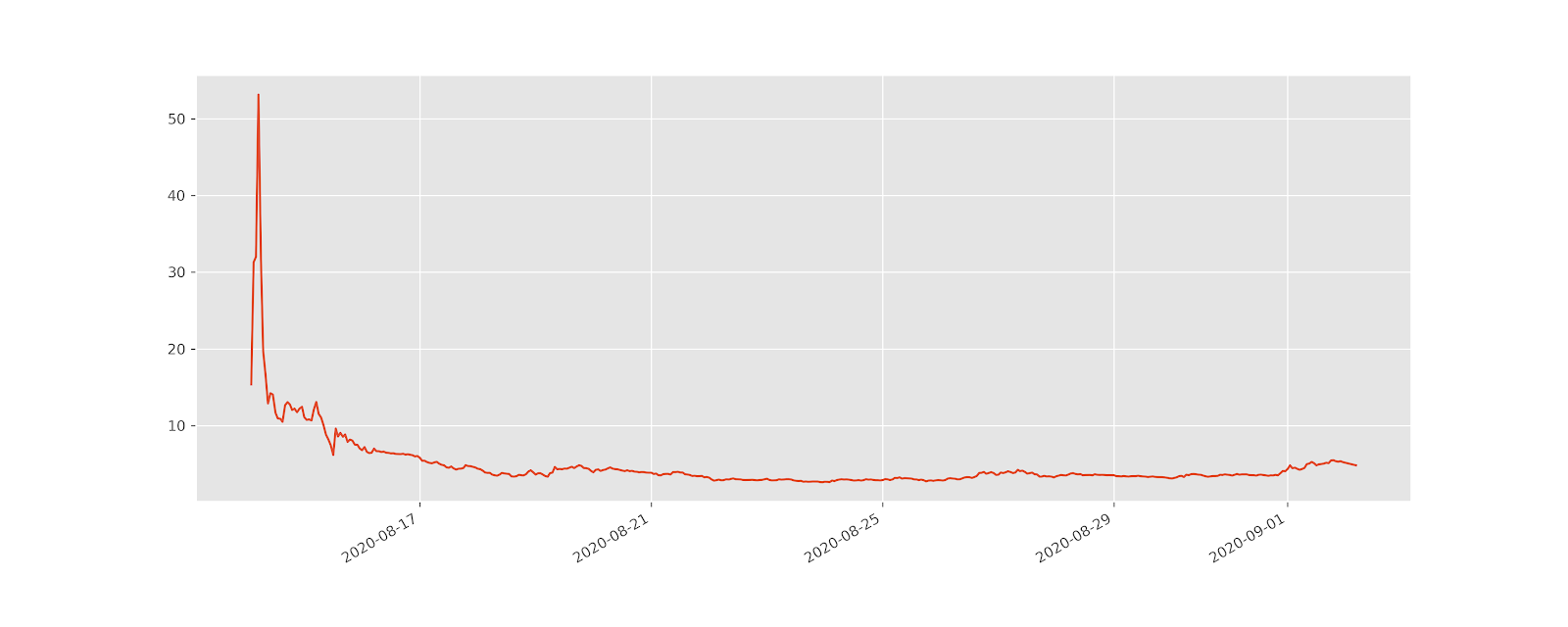

However, holders of CRV bear an opportunity cost when they lock-up their tokens because tokens are tradable. If the price moves up or down, the tokens are stuck in the protocol and can only be sold or bought after spending hefty gas fees to remove them from lock-up. Besides, high inflation will negatively affect CRV’s price in the upcoming years.

Consequently, using rewards for governance means passing up on lucrative gains.

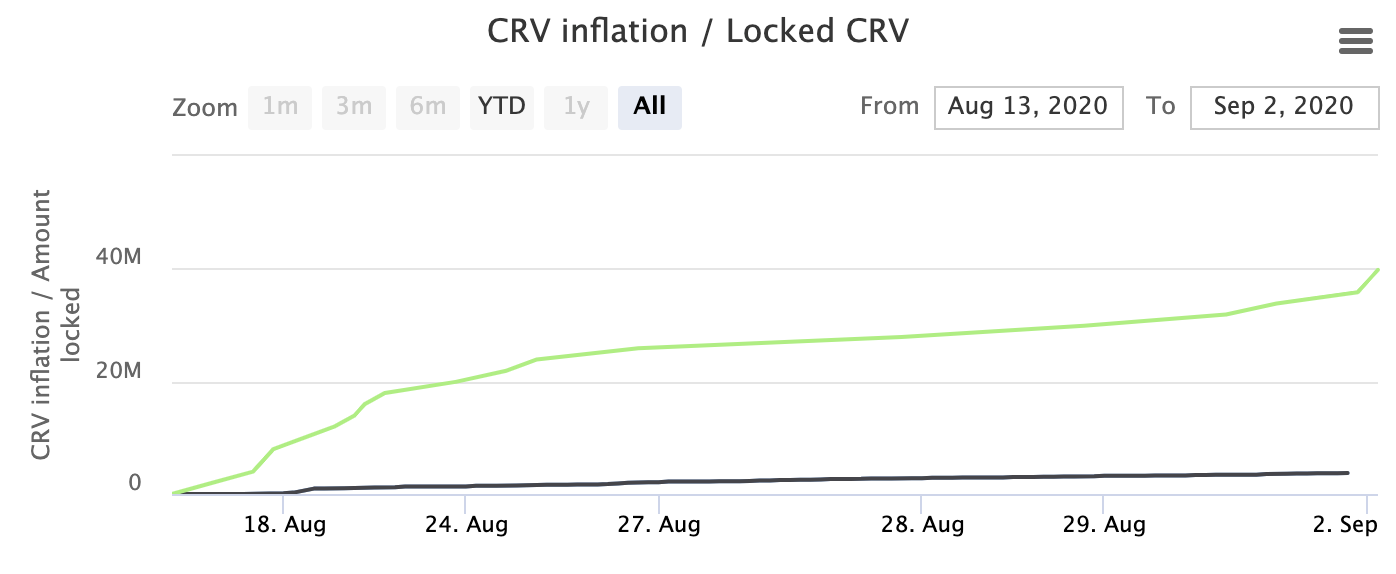

In reality, Curve’s governance model shows that users prefer instant profits over having a say in the project’s governance. After farming the CRV, rarely do liquidity providers lock up their tokens.

Total vote locked CRV (black) vs. circulating supply (green). Source: Curve.fi

CRV price. Source: CoinGecko

The Curve Cartel

Low governance participation is not unique to Curve, but that doesn’t change the outcome—it makes power grabs easy.

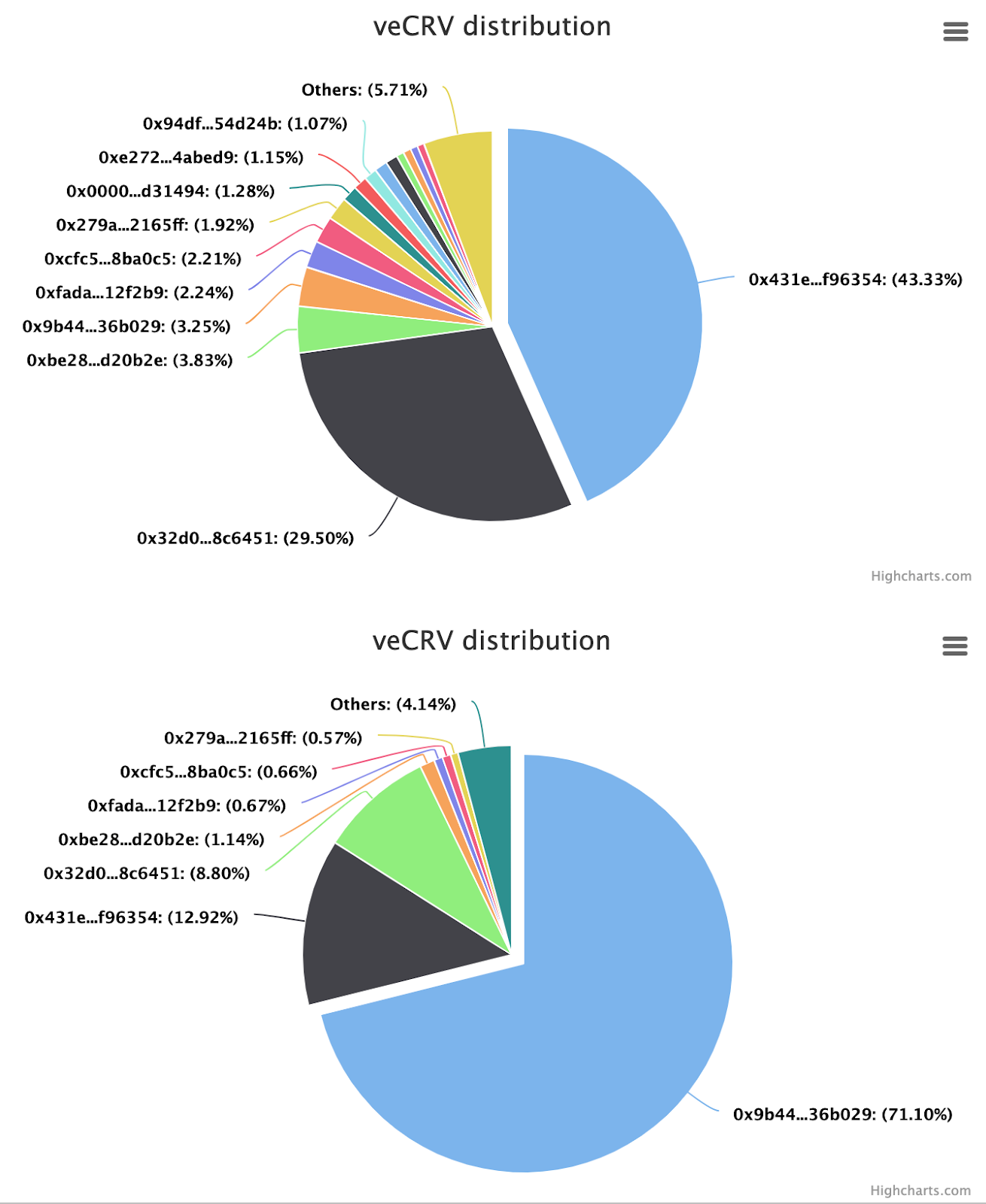

The first Curve DAO war occurred on Aug. 23, when the project’s CEO, Michael Egorov, captured over 70% of the DAO’s voting power. As Egorov commented, he “over-reacted“ to balance out the growing influence of yEarn, lead by Andre Cronje.

Egorov’s intervention put the DAO in a predicament.

Voting on the platform requires a 30% quorum, so the founder has to participate in the voting process. Hence, he theoretically could influence decisions on the platform in his favor. While in reality, Egorov acted professionally, the situation showed how a single actor could easily hijack the DAO.

The second war was connected to CRV inflation. The protocol distributes inflation across its liquidity pools according to how users vote each week. By having substantial voting power, a large player can direct the majority of inflation to a pool of their liking.

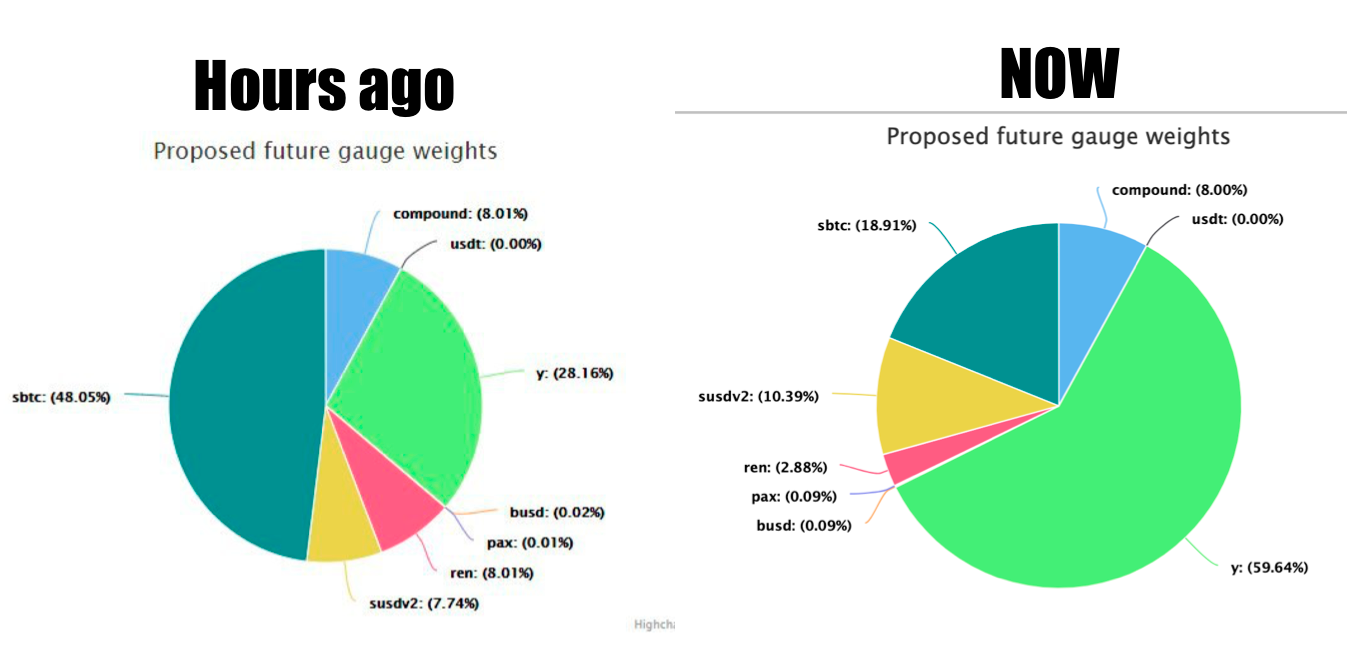

On Aug. 26, almost 50% of the CRV inflation was proposed to go to the sBTC pool. However, the distribution changed dramatically in favor of the Y pool shortly after.

The rapid shift in the votes’ distribution not only confirms that Curve’s DAO is small and volatile but also shows that financial incentives are the key influential factor in the platform’s governance.

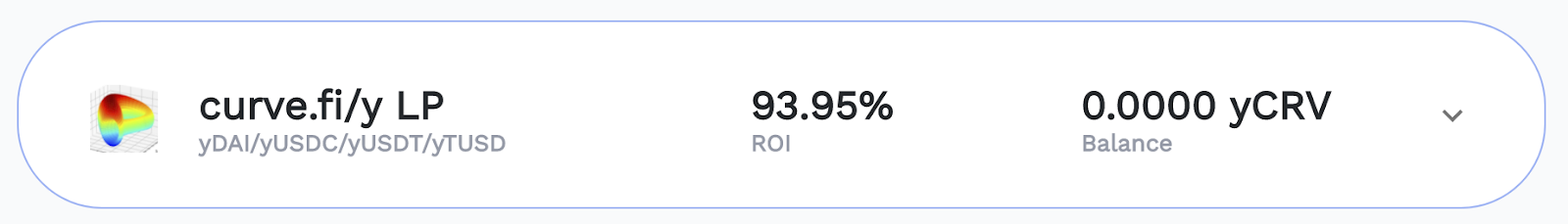

yEarn and Y pool dominate the governance because they offer lucrative rewards. Notably, the rewards come from the yEarn platform instead of Curve.

When liquidity providers lock their stablecoins on Curve’s Y pool, they receive ownership tokens, which they can take outside of Curve and lock on yEarn for over 90% ROI.

By using yEarn as a proxy for earning profits, Curve’s liquidity providers form a cartel. They combine their governance power to adjust Curve in a way that maximizes yEarn’s returns, which is not necessarily beneficial for other Curve users.

Besides influence within the DAO, there’s some questionable activity coming from the outside. Namely, the team extends the product without asking for prior approval from the users.

Ideally, the Curve DAO should decide which extensions should be built and deploy capital for development. However, the recent move from Curve’s core team broke this relationship.

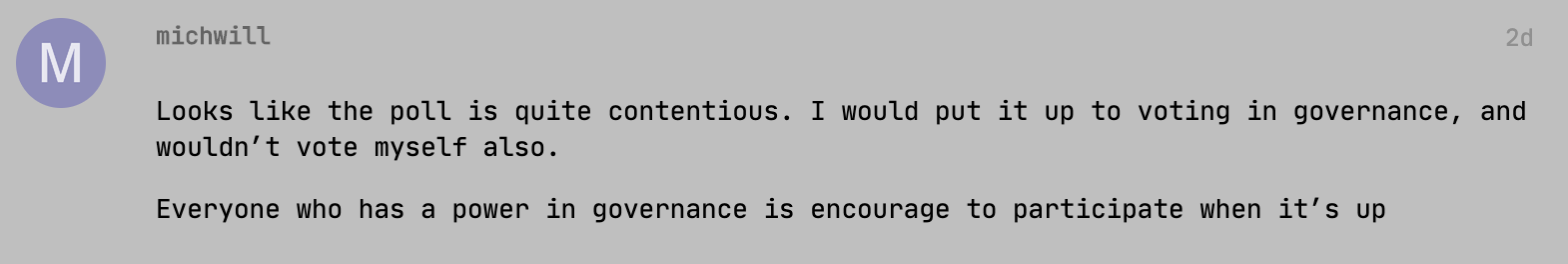

On Aug. 25, the team added a new pool to the platform before polling token holders, going around their governance process. After getting backlash from the community, Michael Egorov proposed on-chain voting, which technically should have been done in the first place.

At the moment of writing, the pool is still available on the platform’s UI, and users can interact with it. If the team can modify Curve at will, it undermines the DAO’s value proposition.

Can Financial Incentives Fix The Issues?

Starting from Aug. 28, 2020, Curve launched an incentive program to increase participation in the DAO. The platform offers up to 2.5x boost of the CRV rewards to those who lock enough tokens.

Keeping the boost stable, while capitalizing on the rewards, is laborious and risky. Imagine a user provides 10,000 DAI to the Y pool. She will need over 5,000 CRV under a 1-week vote lock to maximize the boost, which means risking more than $20,000 in CRV.

One way to reduce the amount of CRV needed is to extend the locking time. However, it’s not an optimal short-term strategy, as the boost is likely to change at every withdrawal of the rewards.

The system is designed to encourage long-term vote locking, as proved by one of the team’s recent responses to Andre Cronje. Long-term vote locking without withdrawing rewards should encourage users to stick with the project and contribute to its future success.

1 week lockup != being long-term aligned with the project. That is not the idea of the votelock.

Btw, was 0x431 voting on behalf of yearn users?

— Curve (@CurveFinance) August 23, 2020

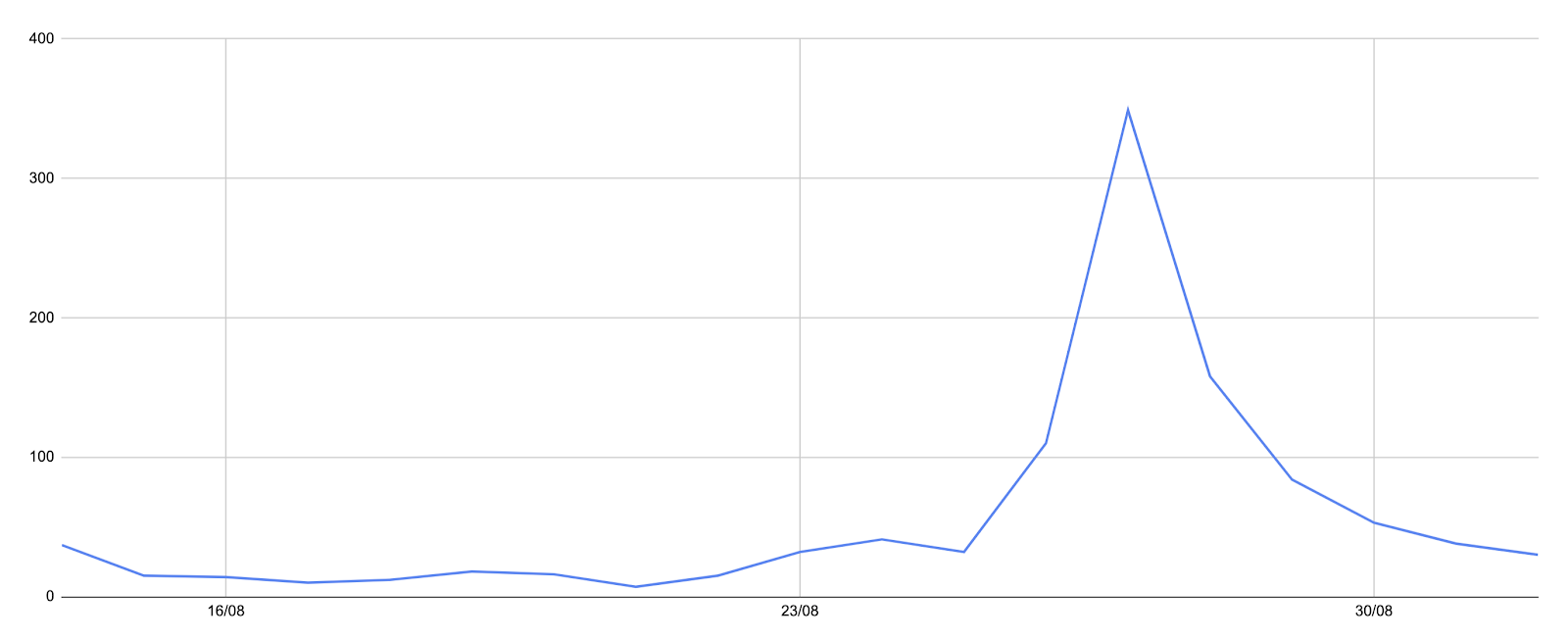

The boost incentive worked to drive the attention of users to the DAO. The day before the incentive kicked in, the number of vote locking addresses increased seven-fold. However, the interest quickly died off, most likely because of the boost’s complexity.

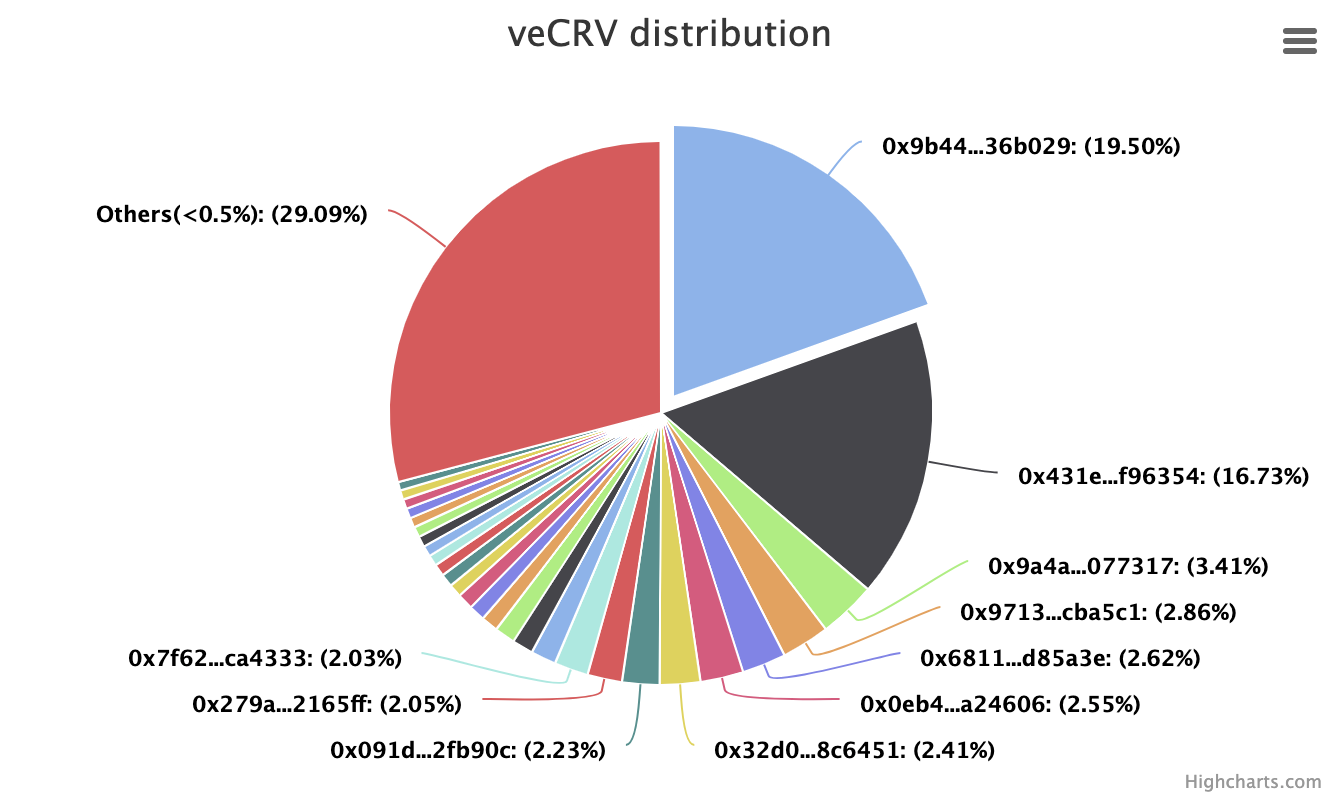

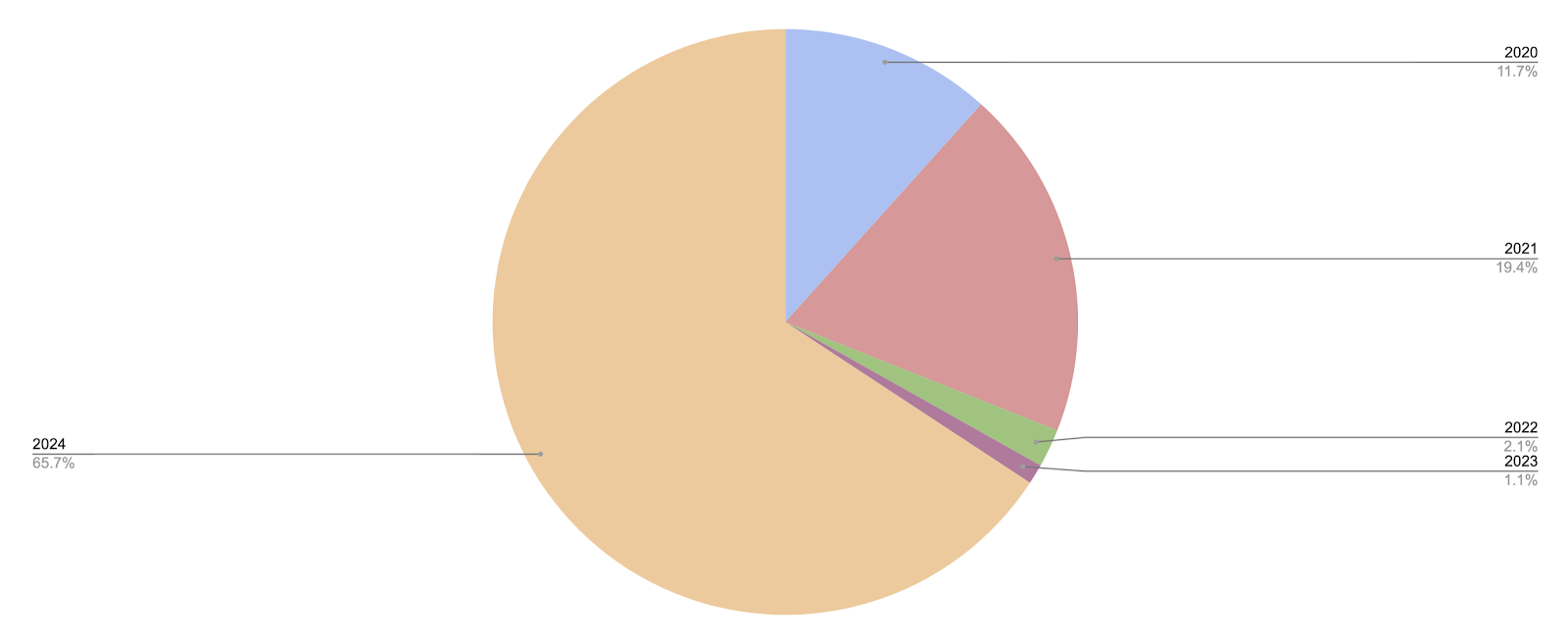

Nevertheless, the inflow of new users diminished the influence of large players in the DAO, which is an encouragingly healthy dynamic.

Importantly the distribution between short and long-term vote locks is in favor of the long-term ones. The majority of the addresses locked their tokens until 2024.

The short-term effect of the boost is promising, but it may not be enough to fix low voter turnout in the long term. Despite the initial excitement, only 1,147 out of over 8,000 holders locked their CRV since the incentive started.

In a sense, farming CRV with the boost is like staking, and staking platforms suffer from low voter turnout despite providing financial incentives. Making money via short-term trading turns out to be preferable over holding tokens and going through the governance hustle.

Curve DAO is still vulnerable to oligarchy and technocracy. It needs to grow to a critical mass to balance out the team and cartels. Whether or not it will happen largely depends on the community and the introduction of other incentives.

If most of Curve’s users will merely aim for quick profits, boosting will turn into a game of musical chairs.

The team needs to find creative ways to direct greed into meaningful governance activities to mitigate this. Money can bring users to the platform, but they will need something more to stick around, something that will make them feel they are a part of the group.

Curve’s Warning Sign for Others

Curve’s example is not unique. On-chain governance is a complex topic, and there’s no flawless architecture. Still, there are some lessons other projects can learn from.

A DAOs ethos is essential. The community around a project needs to have a long-term vision and active participants to propagate this vision. In such a case, financial incentives will act as oil for a well-built machine.

In other, poorly designed schemes, the project will become a cash cow to a handful of whales and tech-savvy people.

Share this article

yEarn Finance Is Turning Every DeFi Trader into a Whale

A mini-revolution is brewing in DeFi thanks to yEarn Finance, giving retail investors the chance to participate in the most lucrative yield farming opportunities. From Humble Beginnings Crypto Briefing spoke…

Top Investors Bet $7 Million that DeFi Will Move to Polkadot Network

Acala, a DAO established on the newly-launched Polkadot network, has announced a successful series A funding from 15 high profile investors, such as Pantera Capital, Arrington XRP Capital, ParaFi Capital,…

Understanding Position Sizing

Let’s briefly examine the most important aspect of any trading system, position sizing, or specifically how much we will bet on any one given trading idea.

Curve Finance Finds “Product-Market Fit” Yield Farming in …

In the last 24 hours, Curve Finance saw more volume than any other decentralized exchange (DEX) thanks to the latest yield farming trend. As DeFi traders look to squeeze returns…