Key Takeaways

- Nexus Mutual insurance crossed the $200 million active coverage mark as the liquidity and demand for smart contract insurance kept growing.

- A significant portion of the surge was led by the incentive for liquidity mining of SAFE tokens.

- The lack of incentive after mining and a mistake by developers caused SAFE to dump 96%, which dragged the price of NXM down as well.

- While the development of Yieldfarming.insure has suffered greatly, Nexus Mutual’s pursuit for providing smart contract insurance is still on.

Share this article

In less than a fortnight since the Sushiwap saga, recent revelations around the SAFE token liquidity mining and NXM collapse has left the DeFi Community reeling. Now, due to the latest yield farming venture, Nexus Mutual has run out of insurance.

Though the story appears complex at first glance, yield farming, greed, and poorly-aligned incentives played a crucial role in this latest episode.

NXM Develops Secondary Demand

Nexus Mutual is a member-owned insurance mutual which provides coverage against catastrophe in the crypto space. The coverage is specifically focused on smart contract vulnerabilities. For instance, a full year’s cover of 10 ETH on a smart contract like yEarn’s Vaults products would cost around 1.2% or 0.123 ETH.

NXM tokens, Nexus Mutual’s native asset, are used as liquidity for the coverage, which earns returns from the insurance profits.

The developers took firm measures to eliminate speculation on the price of the token, as its price is determined by a formula that gauges the performance of the mutual.

It is measured by the amount of the claims made (causing a reduction in price) or coverage bought (which fuels a rise).NXM token is only available on Nexus Mutual platform for members after KYC verification.

However, DeFi chefs soon got around that rule as well. Thanks to Andre Cronje, the founder and curator of yEarn Finance, interested parties can use yEarn’s yInsure platform to earn non-KYC insurance underwritten by Nexus Mutual.

The insurance contracts were also made available on Rarible as Non-Fungible Tokens (NFTs). The sale and purchase of yNFT tokens on Rarible created a secondary market for reselling the coverage.

The issuance of wrapped NXM (WNXM) was another monumental step for the DeFi insurance market. Also known as Nexus Mutants, WNMX is the non-KYC version of the original NXM token. This allowed listing of Nexus Mutants (WNXM) crypto exchanges like Binance, Huobi, Uniswap, Balancer, etc.

While the value of WNXM is pegged against NXM, its total market capitalization is calculated separately because they are different tokens.

Later, DeFi chefs associated yield farming incentives to the demand for NXM.

Yield Farming Incentives

Shortly after yNFT and WNXM took off, another pseudonymous developer by the handle of Insurance Chef introduced yieldfarming.insurance.

It is a DeFi platform for staking yNFT tokens obtained from yInsure or Rarible, and Nexus Mutuats (WNXM). These two tokens act as liquidity provider (LP) tokens on the platform, which is then used to yield farm SAFE tokens.

SAFE token is the governance token for yieldfarming.insurance.

yInsure NFT’s are now top 7 in volume sales on @opensea 🔥

Are you keeping your yield farming tokens $SAFE with yInsure NFT’s?https://t.co/WGebJo2tzO@iearnfinance pic.twitter.com/0rmCtFMLnr

— JuanSnow (@Juan_Snow1) September 14, 2020

While Nexus Mutual does not cover SAFE contracts, all covers bought via yNFT and WNXM that are staked for SAFE liquidity mining are covered by Nexus.

Hence, the circle of demand is now complete. DeFi chefs successfully conjured up a decentralized version of the insurance market backed by Nexus Mutual.

NXM and SAFE Price Action

Soon the yield farming incentives got the better of a greedy market. Reportedly, users staked $36 million WNXMin only five hours after the launch of yieldfarming.insure on Sept. 13.

The opportunity cost of staking of WNXM was far greater with an annual percentage yield (APY) of 2% over NXM’s average of 0.9%.

Cronje even implored the liquidity miners to sell their actual insurance contracts in small amounts on Rarible to serve its real purpose of providing smart contract insurance.

As these tokens boomed, and both Nexus Mutual and the decentralized version of the insurance market was booming, users began dumping their SAFE tokens.

On Sept. 14, Insurance Chef celebrated $100 million staked on the protocol after just one week. Meanwhile, farmers continued to dump SAFE on the market.

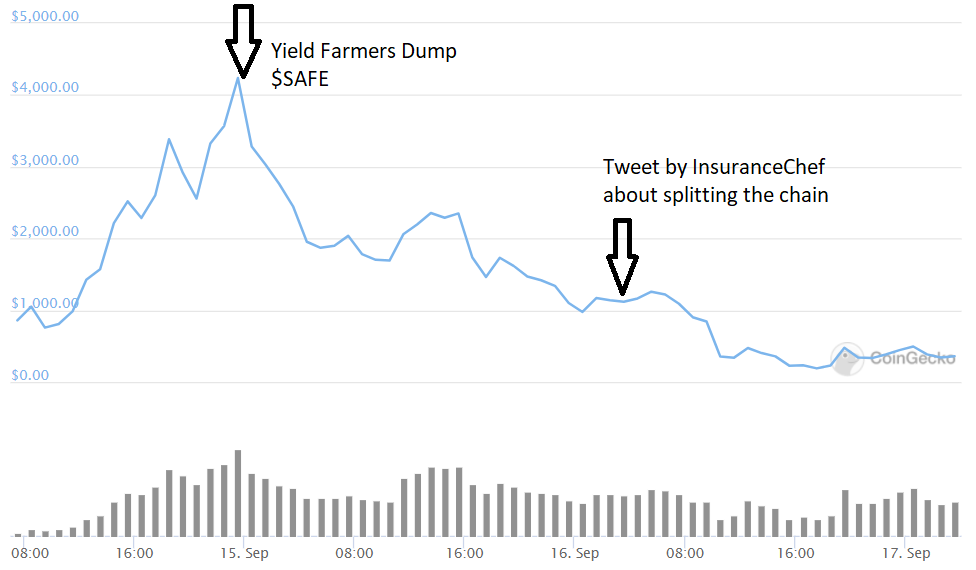

It was at the break of Sept. 15, when the dump from highs above $4,000 began. At this time, the farmers did not know about the civil war brewing; it was just DeFi business as usual.

This was mostly due to a lack of incentive to hold the SAFE tokens. The domino effect dragged the price of NXM along with it as well.

SAFE lost 96% of its value from its high on Sept. 14, declining from a high of $4,450 to less than $140 on Sept. 16.

NXM also gained 40.1% on Sept. 14 with a high of $72 as the demand for the insurance kept growing. Following its high on Sept. 14, NXM crashed 37.6% to $43.

The final decline in the price of the tokens began early on Sept. 16, when more news of the scuffle between SAFE token’s developer and the project’s lead investor came to light.

Blame Game

There are two sides to this story. One from the pseudonymous college student InsuranceChef who is the lead developer of the protocol, and the other is Azeem Ahmed, the investor who helped Insurance Chef kickstart the project.

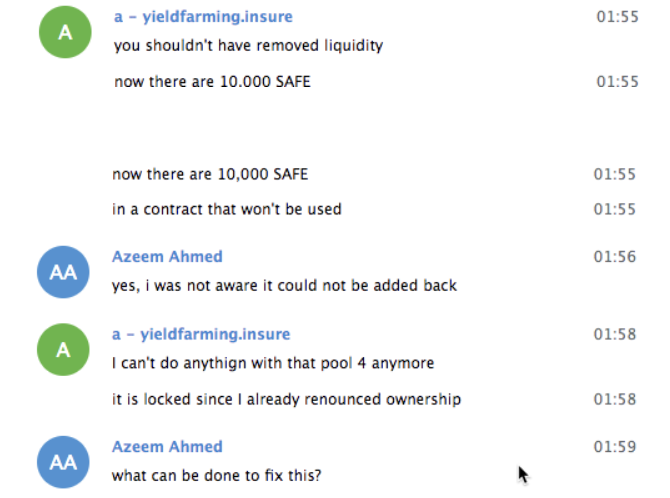

Hasty decisions by both entities led to them to accidentally lock up 10,000 SAFE tokens in the smart contract, forever.

This was because of an incorrect deployment of the fourth pool for the SAFE token in Balancer.

Behind the scenes, the two individuals were also scheming against each other and waiting to blow up publicly. A tweet by Insurance Chef of the initiation and then the splitting of the chain marked the end to the one-week-old project, according to Azeem. He tweeted:

“Then this dumb nugget killed the whole project and lost people millions with a single tweet. Remember we just launched 2-3 days ago, with NO product, here’s what we jammed on so far.”

Later, Insurance Chef called a vote to migrate the SAFE tokens to a new blockchain and raised talks of blacklisting Azeem and rolling back transactions from Azeem’s wallet.

On the other hand, Insurance Chef accuses Azeem Ahmed of being dishonest and dumping his SAFE tokens on the market. Azeem had already made millions off with SAFE protocol in the early phase of the yNFT secondary market launch on Rarible.

Azeem responded with elaborate proof that babbles out a tale of inexperience, destroying a promising new endeavor.

How to Save SAFE Now?

ChefNomi of SushiSwap dumped on the market before the liquidity migration from Uniswap and left the project amid development.

Coming back to SAFE, the yieldfarming.insurance platform is now similarly left hanging. Moreover, it has an additional burden of 10,000 tokens locked out of its total supply of 80,000 forever.

With SushiSwap, Sam Bankman-Fried, the founder of FTX crypto exchange and Serum, became the savior and steered the successful migration. Now, another leading DeFi analyst believes that someone can help SAFE rise from its ashes as well.

The one who builds from this ashes will be known for long. The idea itself is powerful. Creating value.

— mini Blue Kirby // YFI🔥 (@minibluekirbyfi) September 16, 2020

Blue Kirby is also moderating a truce between Azeem and Insurance Chef to renew the project development.

The rollercoaster ride that SAFE and NXM took in the past week is becoming the norm in DeFi.

Share this article

Nexus Mutual Accepts Claims Worth 31,000 DAI Post bZx Exploit

DeFi-native insurance protocol Nexus Mutual paid out its first claims after stakers voted in favor of paying coverage to those who had taken out insurance before the first bZx exploit….

DeFi Review: What Is Nexus Mutual? Introduction to NXM

Nexus Mutual offers DeFi investors “cover” or “protection” for specific activities within the crypto ecosystem. It’s essentially insurance, but for legal reasons, the team isn’t allowed to call it that….

July BTC Market Analysis

After roughly 2 months of price consolidation following its rapid recovery from Black Thursday (March 12th), Bitcoin broke out of its range following an extended period of muted volatility. Currently…

YFI Worth More Than Bitcoin? Prices Pass $11k Following Insurance Prod…

Ethereum-based DeFi token YFI nearly surpassed Bitcoin prices as speculators went berserk over yEarn’s prototype insurance product, yInsure. YFI Enters Peak Mania yEarn Finance, previously known as iEarn Finance, has…