Quick take:

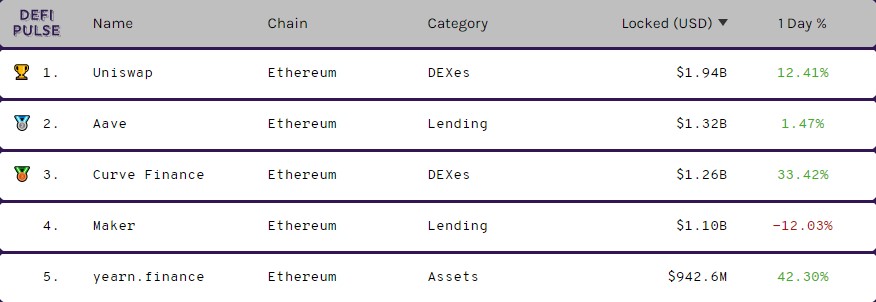

- UniSwap is now the leading DeFi protocol in terms of Total Value Locked

- At the time of writing, $1.94 Billion is locked in Uniswap

- UniSwap’s TVL has eclipsed Aave, Curve Finance, Maker and Yearn Finance

- However, the UNI token is in the midst of a correction in the crypto markets

The launch of the UniSwap token and the airdrop of UNI to all users that interacted with the protocol before September 1st has had a positive impact in terms of total value locked on the platform. According to DeFiPulse.com, Uniswap has reclaimed the number one spot in this regard and has managed to edge out several heavyweights in the process. The team at DeFiPulse.com noted this accomplishment via the following tweet.

@UniswapProtocol has come stampeding up the leaderboard and is back at

#1 Total Value Locked in #DeFi.

Check out the TVL chart at https://t.co/cpEfG0qRDr pic.twitter.com/3N6dwJEtIG

— DeFi Pulse

(@defipulse) September 18, 2020

Over $1.94B Locked in UniSwap

Taking a second look at the rankings at DeFiPulse.com reveals that the total value locked in Uniswap now stands at $1.94 Billion. Furthermore, Uniswap has edged out the DeFi protocols of Aave, Curve Finance, Maker and Yearn Finance. Below is a screenshot of the current rankings.

UniSwap (UNI) Token is in the Midst of a Correction

In terms of market value, the UniSwap (UNI) token has done alright in the sense that it has more than doubled its value since being listed on multiple exchanges. UNI opened trading at an average value of $2.50. The token is now valued at $5.67 after hitting an all-time high value of $8.39 on the 18th of September and less than 48 hours after its official launch.

At the time of writing, Uniswap (UNI) is available for trading on Binance, Coinbase Pro, Huobi, OKEx, Gate.io, KuCoin, ZebPay, Binance US, DigiFinex, BitZ, BigONE, Bitrue, FTX, Wazir X, Bitfinex, Poloniex, Uniswap and more.

Judging by the fact that it is a very new token, there is not much historical data to provide a long term comprehensive market analysis. However, the lower time frames of 15 minutes and 30 minutes could provide information that would be more valuable to scalpers.

Also worth mentioning is that crypto-twitter is for the opinion that the top is in based on the fact that a few crypto personalities have started calling for a $50 UNI. This theory can be found via the following two tweets.

And the $UNI top is in…

— me (taker of LINK) (@keycommando114) September 19, 2020