Share this article

“Decentralized stablecoin is an oxymoron,” tweeted crypto analyst Loomdart. The dominance of centralized stablecoins like USDT and USDC on DeFi platforms poises grave risks for the entire niche.

Instances of Centralized Control

Tether Limited is the issuer of the largest stablecoin in the crypto space, USDT. It is a U.S. dollar-pegged cryptocurrency launched on various blockchains like Ethereum, Tron, OMNI, Algorand, and others.

The USDT on these platforms also includes a reversibility or blacklisting option. Tether recently exercised this option after blocking the addresses of the Kucoin exchange hackers, stopping over $1 million from changing hands.

. @Tether_to just froze also 1M USDt on Omni as part of the #kucoin hack

https://t.co/I1vXYrHcXg1M less in the hands of the hackers. https://t.co/pbrrEXfpxX

— Paolo Ardoino (@paoloardoino) September 26, 2020

As reported earlier, CENTRE consortium, the issuers of USDC run by Circle and Coinbase, blacklisted a wallet with over $100,000. The CENTRE consortium revealed that blacklisting of addresses is part of the USDC design. They added that such blacklisting can also be done to comply with legal orders.

These are rare instances, usually enforced to block malicious activities on the network.

Paolo Ardoino, the CTO of Bitfinex and Tether, reiterated this fact about centralized stablecoins in a tweet after the Kucoin decision:

“Tether is a centralized stablecoin that serves as a better and faster transport layer for fiat on chain. Being centralized is also subject to regulatory requirements.”

DeFi’s Obsession With Stablecoins

MakerDAO is the top DeFi platform in total value locked with over $1.9 billion locked in its contracts. The collateral is made up of various cryptocurrencies, including ETH, BAT, USDC, and USDT.

MakerDAO is designed to peg the value of DAI against the U.S. dollar.

The collateral on MakerDAO enables the liquidity provider to borrow DAI from these contracts. Currently, the $1.9 billion on MakerDAO backs the value of 891 million DAI.

An over-collateralization on MakerDAO helps hedge against liquidity risk for the number of DAI issued. Unfortunately, there is a mounting risk that much of this DAI is backed by private stablecoin issuers, like CENTRE and Tether.

There are now more $DAI created from $USDC that $ETH.

That’s it: sadly, that’s the tweet.

Out of the 891M circulating DAI:

541M (~60%) are minted from vaults using tokens requiring trust, such as $wBTC, $PAX $USDC $TUSDhttps://t.co/VvGiBdXOIk pic.twitter.com/MxPaWCEzlM

— TokenBrice.eth (@TokenBrice) September 25, 2020

Moreover, the collateral amount for each cryptocurrency or stablecoin for DAI is different. It is greater for utility-based cryptocurrencies, like Ethereum, where users need $150 in ETH to mint $100 in DAI. Stablecoins instead offer much less collateralization, where even $101 USDC is enough to loan $100 DAI.

Hence, the actual collateral backing DAI is more for centralized stablecoins.

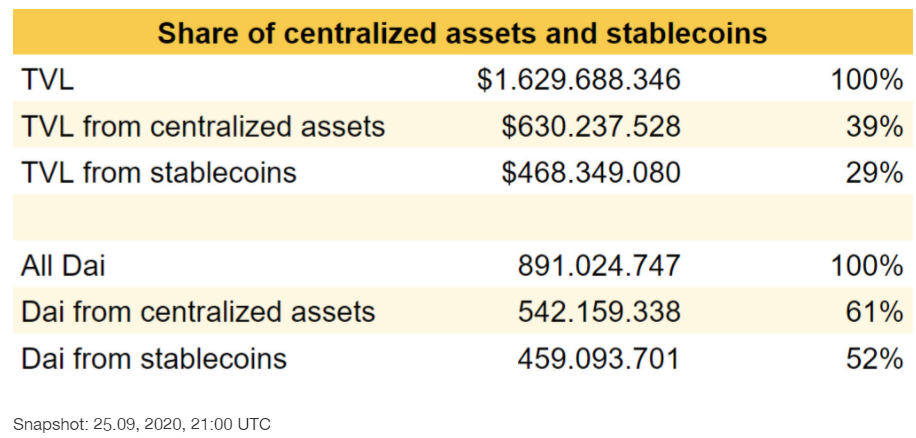

According to research by crypto analyst Hasu, the share of centralized stablecoins backing DAI issuance is over 60%.

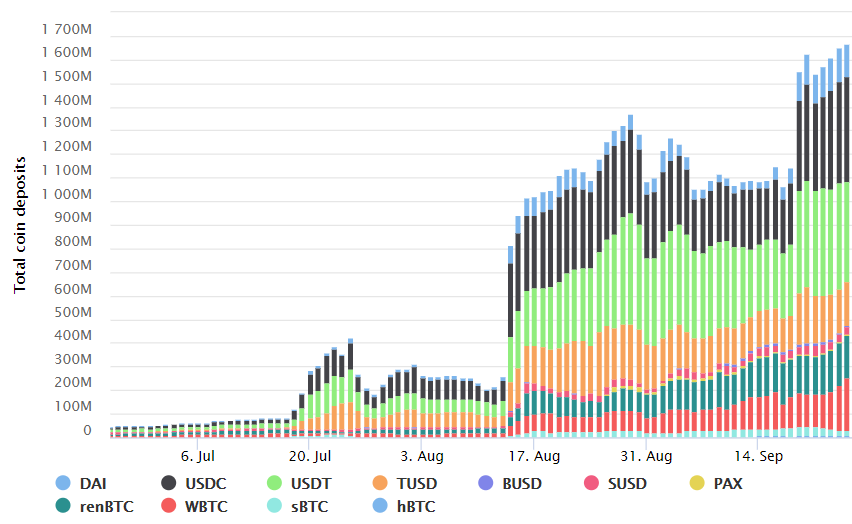

Leading decentralized exchanges (DEXes) Uniswap and Curve are not free from these regulatory risks either. Centralized assets like USDC, USDT, TUSD, BUSD, and WBTC account for more than 75% of Curve’s total deposits of $1.6 billion.

Likewise, the liquidity of USDT on Uniswap is $267 million, about 12.5% of the total liquidity on the DEX.

Yearning for Decentralized Money

Hypothetically, the SEC, FinCEN, or any other international organization like the Financial Action Task Force (FATF), could decide to take down the entire DeFi space with an attack on either USDC or USDT.

Restrictions on its usage in DeFi, or temporary or permanent suspension of these stablecoins would bring down DAI as actual assets backing its value would vanish. The borrowers of DAI would be required to either increase their collateral in other cryptocurrencies or have their DAI liquidated.

More importantly, DAI is used for trading and providing liquidity to other DeFi projects. DAI accounts for 65% of the total collateral out of a total of $1.8 billion on the top lending and borrowing platform, Compound Finance.

Similarly, for Curve, if USDT restrictions plunge its liquidity pools, it would practically shut down the largest vault on yEarn Finance with over $200 million backed by Curve’s LP tokens.

Though far-fetched, regulatory crackdown in this way is not impossible. Afterall, USDT is already under the regulatory radar with a pending court case over U.S. dollar deposits worth $850 million allegedly missing from its reserves.