Key Takeaways

- Zapper is the perfect tool for LPs, but doesn’t have integrations across DeFi’s various verticals.

- Zerion, on the other hand, doesn’t have comprehensive integrations in a single vertical, but allows its users to interact with a select few protocols in each sub-niche.

- Overall, the decision of choosing Zapper or Zerion depends on a specific user’s needs.

Share this article

Despite recent controversies, Internet companies have made exploring cyberspace a breeze. Instead of interacting with pure code or clunky protocols, companies like Google make it easier for users to connect.

Dashboards and other UX-enhancing products play this same role for the fledgling DeFi ecosystem. The two leaders in this field are Zapper and Zerion.

Zapper Fi

Zapper is a favorite amongst the DeFi community, specifically liquidity providers (LPs). It provides a seamless interface to interact with DeFi protocols. Zapper platforms DeFi by bringing various protocols to a single user-facing product. Anybody can interact with Uniswap, Curve, Balancer, and yEarn using Zapper.

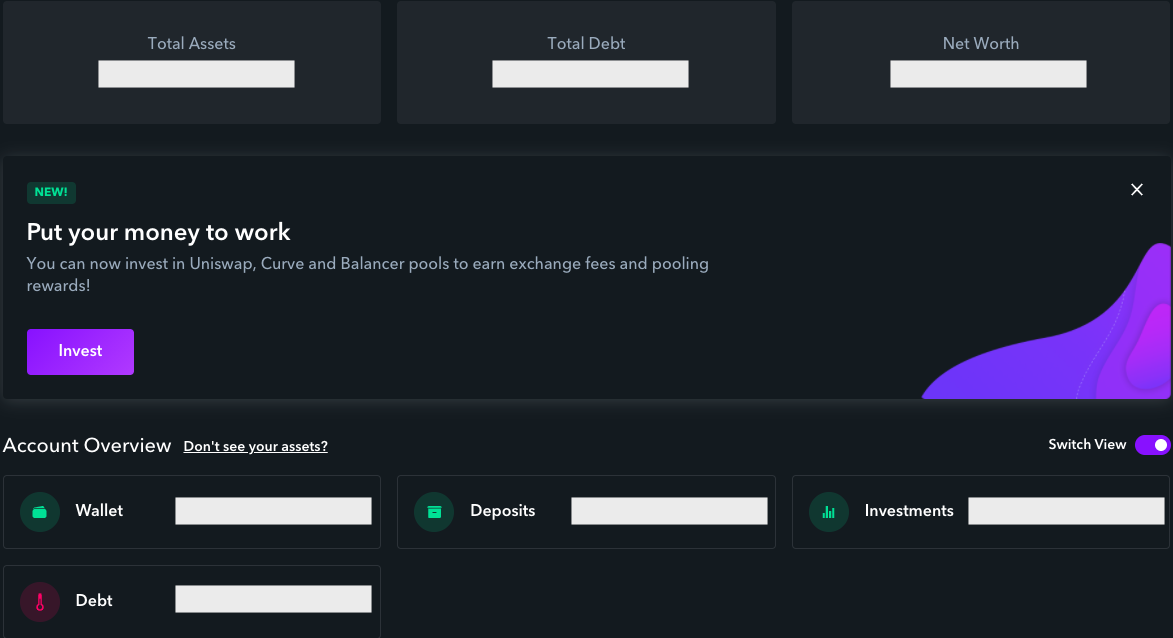

After you connect your Web3 wallet, the homepage will load an overview of your portfolio split into various categories like wallet (holdings), yield farming positions, liquidity provision, and borrowings. Zapper has become renowned for its dashboard, enabling users to gauge the value of their portfolios instantly.

Zapper’s prized feature is its “invest” option to deposit money in the top liquidity pools and yEarn vaults. This function supports top DEXes like Uniswap, Balancer, and Curve.

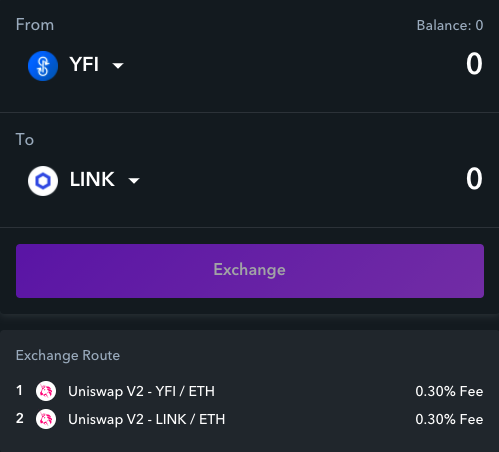

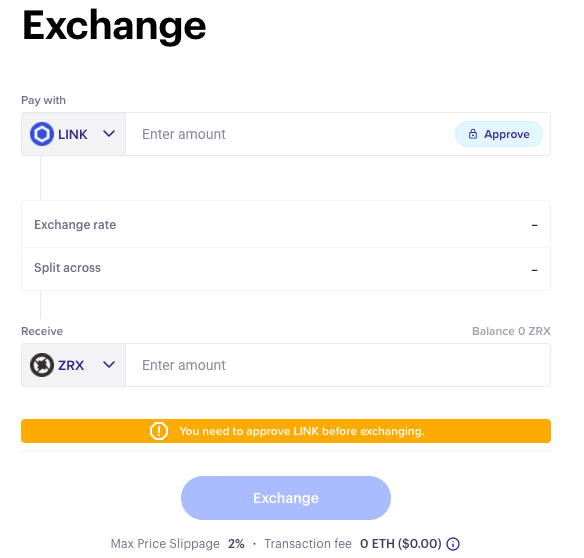

The platform has an exchange tab that connects to Uniswap and Balancer, tapping into the two automated market makers (AMMs) to create a simple liquidity aggregator. Users are guaranteed the best price between the two DEXes. Unlike aggregators like 1inch Exchange, Zapper doesn’t split the trade between multiple DEXes.

Finally, Zapper has “explore” and “transactions” pages. The explore function lets users with funds on asset management platforms like Set Protocol, yEarn Finance, and Synthetix take a deeper look into their performance. The transaction tabs gather the address’ transaction history.

Zapper’s Advantages

For the moment, Zapper’s sole focus is on liquidity provision and yield farming. Integrations with other DeFi verticals are expected soon.

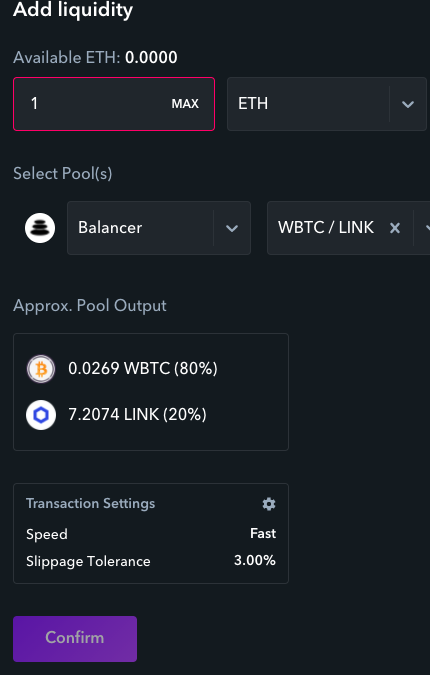

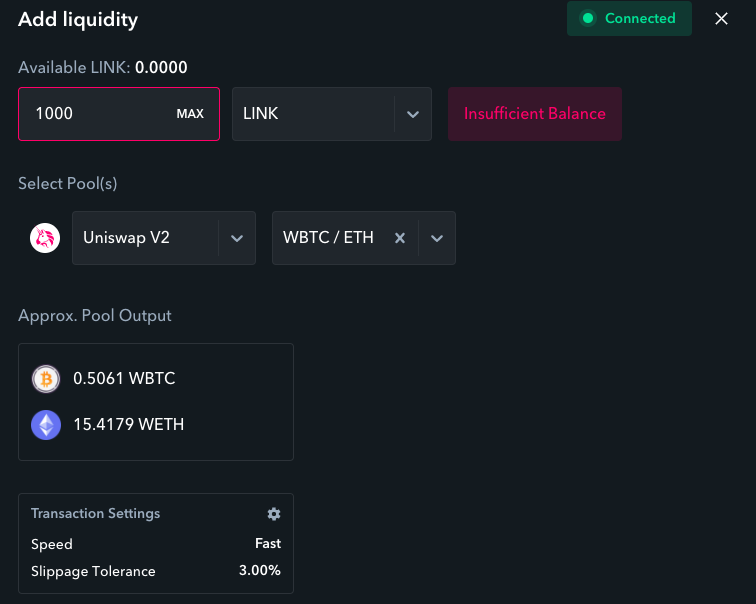

But Zapper is by far the easiest way to interact with liquidity pools, automating the split of capital between the pool assets. For example:

- Chad only owns ETH, but he wants to provide liquidity to Balancer’s 50-50 LINK/WBTC pool.

- Instead of converting half his ETH into LINK and the other half to WBTC, he can leverage Zapper Fi to simplify the process.

- Chad wants to deposit 1 ETH ($300) into the pool.

- Zapper Fi kicks in, splitting the ETH into $150 of LINK and $150 of WBTC. It then deposits the tokens into the Balancer pool from Chad’s address, and the Balancer pool tokens are credited to the same address.

From the above example, it’s clear that Zapper’s automation makes it very simple to provide liquidity. Users no longer have to go through the burden of converting their tokens to the necessary split to become an LP. Zapper does it for them.

On the exchange front, Zapper isn’t a DEX aggregator, so it doesn’t split trades between various venues. But it’s still a huge benefit for smaller traders.

By aggregating Uniswap and Balancer markets – the most liquid DEXes – Zapper finds the best trade amongst these two and presents it to users. Since the trade isn’t split, transaction fees are the same as interacting with Uniswap or Balancer directly.

Disadvantages of Using Zapper

The platform’s biggest boon is also a bane – a lack of support for some of DeFi’s largest markets. Three of the top six (Aave, Maker, Compound) DeFi protocols by liquidity are in the business of borrowing and lending.

Zapper is yet to tap into this market, thus limiting the activities its user can do.

Zapper is a great product for DEX LPs. An integration with yEarn vaults marks the platform’s foray into tokenized asset management. Set Protocol strategies still aren’t accessible from the platform, however.

In July 2020, Zapper noted that protocols like Aave and Compound would be integrated soon. It’s now October, and this is yet to happen.

Founding Members of Zapper

Official co-founders include Seb Audet, Suhail Gangji, and Nodar Janashia. Each of them has a strong background in UX design, crypto development, and financial management, respectively.

Before forming Zapper, Audet helped build DeFi Snap, a dashboard that allowed users to view their DeFi activity on one simple interface.

Gangji and Janashia worked together to found DeFi Zap, a similar product that allows users to create bundled transactions to interact with multiple smart contracts simultaneously.

After answering a few questions to assess users’ investment profile, DeFi Zap would suggest a few “zaps” that users could use to express their crypto sentiment.

Zerion: What Is It and How Does It Work?

Zerion is one of the top DeFi tools that individuals can leverage to simplify their trading experience. Instead of individually visiting Compound, Uniswap, and other yield farms, DeFi investors can indirectly interact with these protocols through Zerion.

The first step is to connect one’s address to Zerion on the homepage. Users can connect multiple addresses for a simple, aggregated view of their “DeFi net worth.” Once that’s done, an overview of the wallet’s portfolio will show up, neatly split into various categories like savings and loans.

A portfolio’s top gainers and losers will show up on the overview too, enabling investors to track the performance of their overall portfolio and individual investments on the homepage.

EtherScan is the preferred tool for most DeFi investors to track their transactions, but Zerion makes glimpsing into an address’ previous actions much easier. The history page shows users an in-depth and graphical representation of each of their transactions. Instead of visiting EtherScan and opening a new link to view each transaction’s details, Zerion pulls up a detailed history on a single, scrollable page.

Zerion’s value for users, however, isn’t in the dashboard for assets and transactions. Using it as an interface for DeFi helps abstract a ton of complexity.

On the market page, users can purchase just about any Ethereum-based asset using ETH or stablecoins like USDC, DAI, USDT, or TUSD. Each asset on the market tab has brief information regarding its project and some simple financial data like price changes, market cap, and the asset’s all-time high.

For those seeking a bit more flexibility on the token side, Zerion gives users the option of a direct exchange interface to exchange any token for another. Notably, this only serves vanilla ERC-20 tokens and ETH.

Using the market tab reduces the variety of tokens one can pay with, but users will soon be able to buy into Set Protocol and Melon’s tokenized asset management strategies.

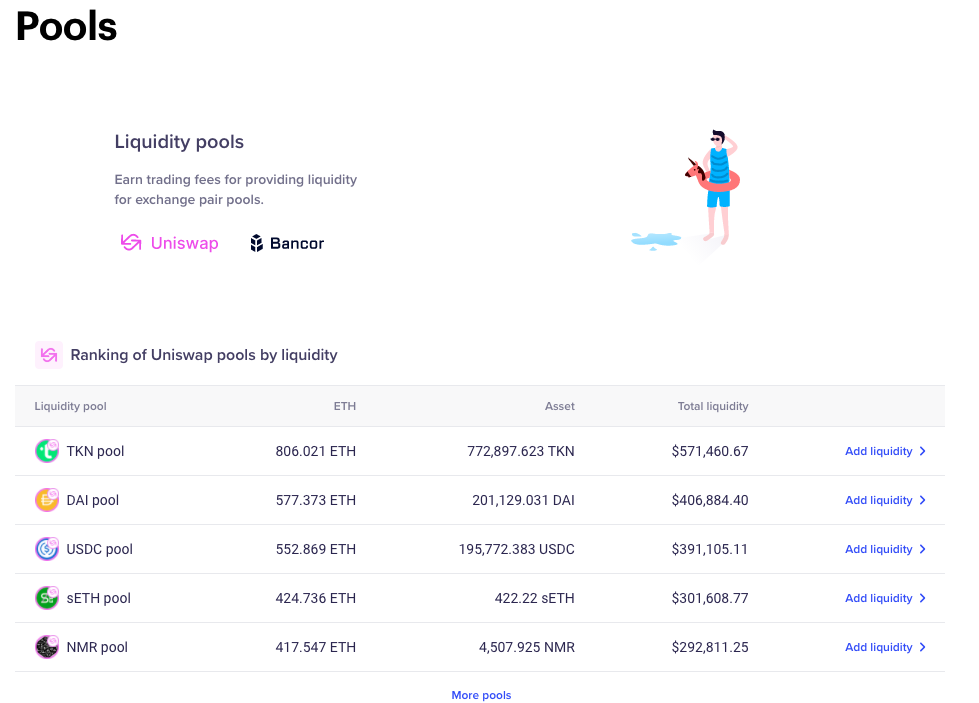

Zerion also serves liquidity pools and yield farmers. Platforms include Balancer Labs, Curve, yEarn Finance, Bancor, and Uniswap. They will soon add support for Mooniswap too.

Finally, Zerion offers access to lending markets on Compound and borrowing markets on Compound and Maker. To summarize, Zerion integrates the most vital parts of DeFi and is currently in the process of adding more value add features, like mStable’s savings scheme and staking for Nexus Mutual, Curve, Matic, and others.

Advantages of Using Zerion

Tracking the newest products and improvements in DeFi is a full-time job. Unless one is a dedicated power user, it’s impossible to stay on top of everything. This is where aggregators like Zerion come in.

Plan on collateralizing some of your ETH for a USDT loan on Compound, then depositing ETH and USDT in a Uniswap pool to farm UNI? Just use Zerion.

Instead of visiting multiple interfaces and executing a series of transactions, investors can do it all from a single interface.

Zerion is adding new features that can turn it into a useful product even for DeFi’s power users. Staking NXM on Nexus Mutual or accessing vested BZRX tokens on bZx are just a few new features coming to the platform.

The dashboard is clean and intuitive, making it less confusing to use and track one’s history with DeFi protocols.

Downside of Zerion

Zapper’s approach is to focus on a single niche and really buckle down on it. Zerion expanded its offering across multiple verticals but still doesn’t support every protocol in those verticals.

On the lending and borrowing side, Zerion has support for Compound and Maker, but, once again, omits Aave – the largest money market protocol in DeFi.

Zapper has become an integral tool for active LPs thanks to its comprehensive integrations and product development approach.

Meet the Zerion Team

In 2016, Zerion’s three co-founders formed the company to create a simple solution to track and manage ERC-20 tokens. Since then, the vision evolved into becoming a one-stop-shop for interacting with DeFi products.

Vadim Koleoshkin is the business-minded co-founder of Zerion. He previously founded Jufy Projects, a consulting firm, and app development studio.

Evgeny Yurtaev is a co-founder of Zerion, who previously worked as a software engineer at Google and Jufy Projects. Yurtaev has extensive experience dealing with blockchains, namely, Ethereum.

Alexey Bashlykov is the third co-founder and CTO of Zerion. He’s an android developer, working alongside his co-founders at Jufy Projects.

Zerion vs. Zapper

The argument is nuanced and depends on each individual’s needs. Those looking for a product with widespread integrations for liquidity pooling and yield farming would be pleased with Zapper over Zerion. On the other hand, more active and diversified users who also want access to lending and borrowing would prefer Zerion.

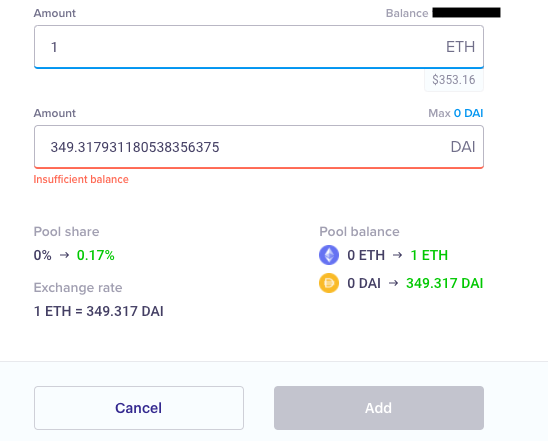

Zapper has a clear edge for LPs. For example, providing liquidity to a Uniswap pool can be done using just ETH on Zapper, slimming the process from two steps to one.

One can choose to utilize an unrelated asset, like LINK, and Zapper will convert the asset to half ETH and half DAI to deposit into the Uniswap pool.

On Zerion, however, the user needs to manually sell half their ETH for DAI first and add the two assets in the correct proportions. Thus, Zerion’s only advantage over adding liquidity on Uniswap’s native interface is that it also connects to other protocols.

Zapper recreates this same benefit on its integration with other protocols. One can invest in any yEarn vaults using a variety of assets. Zapper first converts the token to its necessary form (USDC for yUSDC vault or YFI for the yYFI vault) and then makes the deposit.

While Zerion plans to integrate more protocols, the platform currently only offers yield farming integrations for Uniswap and Bancor.

Zerion’s dashboard is cleaner than Zapper’s when viewing an address’ transaction history. But Zapper once again comes out on top in terms of the depth of information available.

For instance, SNX stakers can view in-depth information using both Zerion and Zapper. But Zapper offers a few more data points, such as exchange fees available to claim from Synthetix. And in this particular respect, Zapper also has a better outlay.

To Zerion’s credit, it has taken a broader approach to product development and is becoming a jack of all trades rather than a master of one. In the future, it seems reasonable to expect Zerion to whip up faster integrations and eventually become a comprehensive hub for interacting with DeFi.

Conclusion

Both Zerion and Zapper are phenomenal products that will aid DeFi adoption through superior UX. Currently, the choice between the two is solely dependent on a user’s specific needs.

For active LPs, Zapper has a very obvious edge. But for those looking to dabble with DeFi and test all its moving parts, Zerion is the perfect partner.

Share this article

Project Spotlight: Zapper Finance and the DeFi Investor’s Dashbo…

As the level of sophistication in DeFi and crypto rises, so too have initiatives to keep it user-friendly. Aggregators and top design teams are now working to corral all of…

Understanding Position Sizing

Let’s briefly examine the most important aspect of any trading system, position sizing, or specifically how much we will bet on any one given trading idea.

All You Need to Know About DeFi’s SushiSwap Saga (But Were Afrai…

The SushiSwap saga and its native token, SUSHI, will go down in crypto history. What began as a tokenized version of Uniswap has spiraled into something much more. It reminds…

DeFi Project Spotlight: Matcha and “The Robinhood of Ethereum…

Though activity on decentralized exchanges (DEXes) has been quiet, 2020 has been a breakout year for the crypto primitive. Initially touted as a safer, more secure mechanism for trading crypto,…