Ethereum has been holding up well compared to the rest of the DeFi space, but the recent news that the second-round of stimulus checked proposed by the House was rejected by Trump has changed that.

The top-ranked altcoin just took 3% off its value in a matter of thirty minutes or less following the tweet making rounds. What does this mean for Ethereum and the already suffering DeFi space?

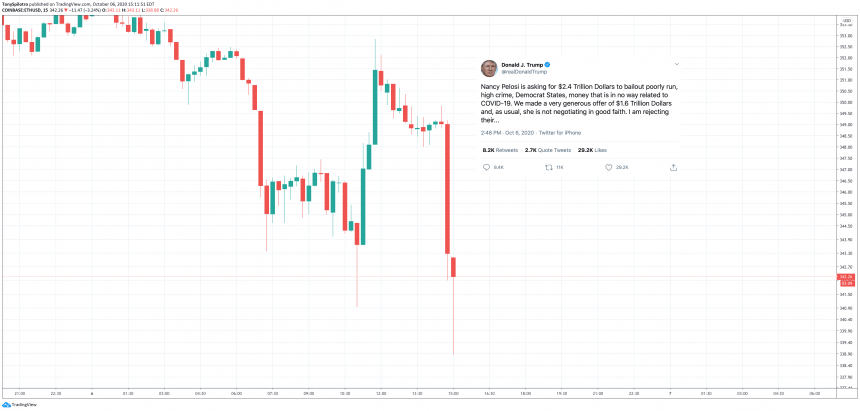

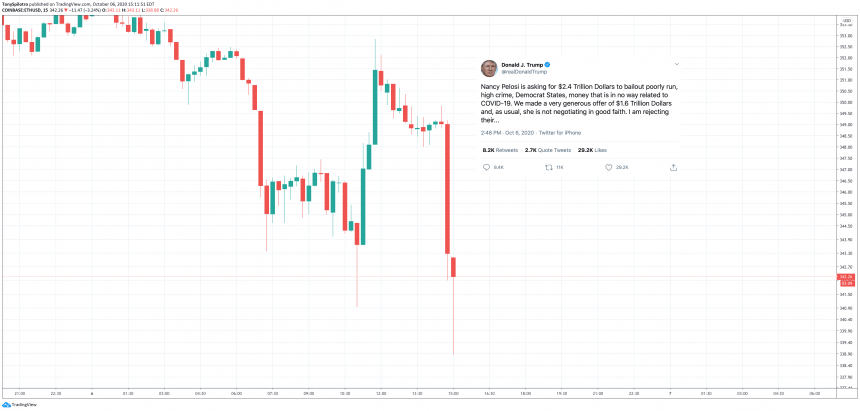

ETHUSD Falls 3% In Less Than 30 Minutes Following Stimulus Cancellation | Source: TradingView

Ethereum Falls 3% Sharply Following Further Stimulus Stagnancy

Ethereum price followed along with Bitcoin and stocks in plummeting after markets caught wind that US President Donald J. Trump had ended any chances of a second stimulus effort before the coming election this November.

The Senate and the House have been locked in battle preventing any version of the bill from being passed. A recent adjustment to the proposal passed by the House, according to Trump, won’t see the light of day.

…request, and looking to the future of our Country. I have instructed my representatives to stop negotiating until after the election when, immediately after I win, we will pass a major Stimulus Bill that focuses on hardworking Americans and Small Business. I have asked…

— Donald J. Trump (@realDonaldTrump) October 6, 2020

In a tweet, Trump says he is rejecting the request, and holding off any stimulus until after he “win[s].”

In response, Bitcoin fell $200 and Ethereum dropped by $10 or 3% in a matter of minutes. On shorter timeframes, the cryptocurrency can be seen setting a lower low above as a result of the news breaking.

Related Reading | DeFi Overtakes Ethereum In The Media, Data Shows

Ethereum was among the assets that fared the best following the last round of stimulus, offering anyone who took their $1,200 and put it into ETH earning a substantial ROI.

Ethereum surged over the summer months due to the DeFi trend, but with no more stimulus money on the way, these assets could fall just as quickly as they went on the way up.

Featured image from Deposit Photos, Charts from TradingView