Ethereum, aside from Chainlink, is the best performing cryptocurrency in the top ten by market cap. The top-ranked Advertisements

Ethereum, aside from Chainlink, is the best performing cryptocurrency in the top ten by market cap. The top-ranked Advertisements

” href=”https://www.newsbtc.com/dictionary/altcoin/” data-wpel-link=”internal”>altcoin has had enjoyed a substantial rebound from Advertisements

” href=”https://www.newsbtc.com/dictionary/bear/” data-wpel-link=”internal”>bear market lows and surged all throughout 2020 on the heels of the DeFi trend.

But despite the greater crypto market recovery, one crypto analyst sees a bearish Elliott Wave count on Ethereum, that could take the double-digit prices after the recent rise to just under $500 per ETH, but had you told investors that bought the top in early 2018 wouldn’t have expected a four-digit Advertisements

” href=”https://www.newsbtc.com/dictionary/altcoin/” data-wpel-link=”internal”>altcoin to fall to just $80.

The drop from $1,400 was eye-opening for anyone that experienced the full force of the crypto a strong showing in 2020.

Related Reading | Asset Manager Who Predicted Ethereum Outperforming Bitcoin: The Trend Is “Done”

The asset class is the top-performing basket of investments, beating out stocks, gold, and more. DeFi helped carry the market out of the gutter, caused Bitcoin to break above $10,000, and Ethereum to set the first higher high since its all-time peak.

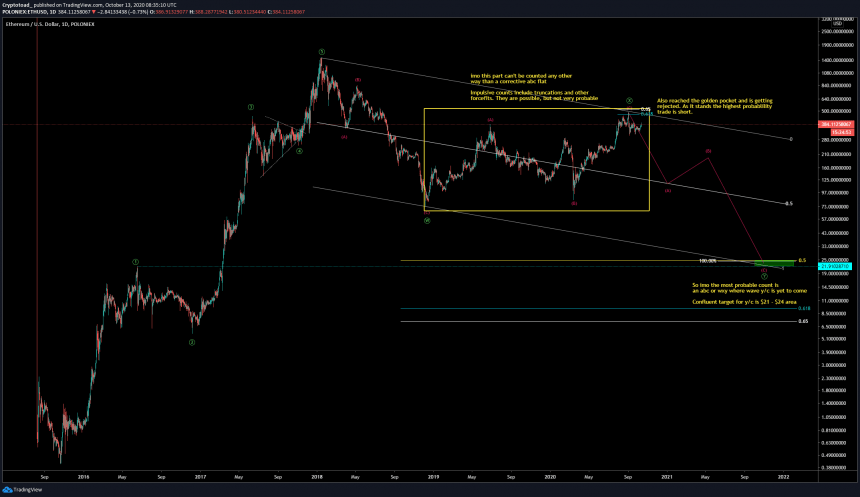

But one crypto trader well versed in Elliott Wave Theory believes there’s a possibility that Ethereum returns to double-digits. Worse, yet a lower low as deep as just $20 is possible, according to the bearish wave count.

The crypto analyst expects the

Ethereum Elliott Wave Theory Target $20 | Source: ETHUSD on TradingView.com

Elliott Wave Theory is a polarizing trading technique, with both as many believers are there are pundits. Elliott Wave Theory believes that markets, driven by human emotion, moves in impulsive or corrective waves in varying degrees.

Related Reading | DeFi Overtakes Ethereum In The Media, Data Shows

Impulse waves are typically divided into five smaller sub-waves, while corrective waves are three. Like all technical analysis, charts are up for interpretation and should only be used to consider probabilities.

While it isn’t impossible for Ethereum to return to such low prices, after the recent showing in 2020, the probabilities are low. And even the trader himself argues that the top Related posts: