Key Takeaways

- Injective Protocol is building an environment for builders to erect powerful DEXes capable of derivatives products.

- The protocol leverages the Cosmos SDK and 0x order book design.

- Ethreum traders seeking a decentralized alternative to leaders like Uniswap, plus more complex trading products, may find Injective’s value proposition enticing.

Share this article

Injective Protocol is a decentralized derivatives project that offers fast transaction speeds, deep liquidity, and front-running protection. The project makes up part of the growing DeFi ecosystem that is being built outside of Etheruem.

Unlike many of the DEXes previously covered, Injective’s architecture isn’t an automated market maker (AMM). Instead, it leverages a key feature from 0x protocol and is order book-based.

The following guide will unpack how Injective Protocol uses a cocktail of different crypto technologies to offer traders access to spot markets, perpetual swaps, and futures trading products.

Before digging into Injective Protocol, it will first help understand some of the building blocks that go into the trading platform. Two key components are the Cosmos SDK and the 0x Protocol.

Injective Protocol and Cosmos

The Cosmos SDK is an open-source framework that lets developers spin up high-functioning blockchains from scratch. Official Cosmos documentation refers to these blockchains as application-specific. They stand in contrast to virtual-machine blockchains, like Ethereum.

Using the Cosmos SDK, teams are essentially offered all the tools and pieces to build a blockchain that fits their specific requirements.

A common trope within the Bitcoin and Ethereum communities is that these two blockchain networks are technically limited in what they can do. Bitcoin may be the soundest money the world has seen, but it does not compete with Ethereum in terms of flexibility. Similarly, the ICO boom of 2017 and this summer’s DeFi craze revealed Ethereum’s limitations.

Each blockchain’s source code limits projects attempting to build on top of either network. Thus, Cosmos’ SDK allows teams to create a native blockchain according to the specific objectives of the project’s mission.

In the case of Injective Protocol, this means high throughput, swift finality, and interoperability, all of which are key characteristics for a cryptocurrency exchange.

Projects using this SDK enjoy higher throughput because the SDK itself is built on top of Tendermint, a Byzantine-Fault Tolerant (BFT) consensus algorithm. A consensus algorithm is just one component of a blockchain; these two terms are not interchangeable.

Cosmos, for instance, is a blockchain built using Tendermint. It’s the network’s engine, helping it validate operations.

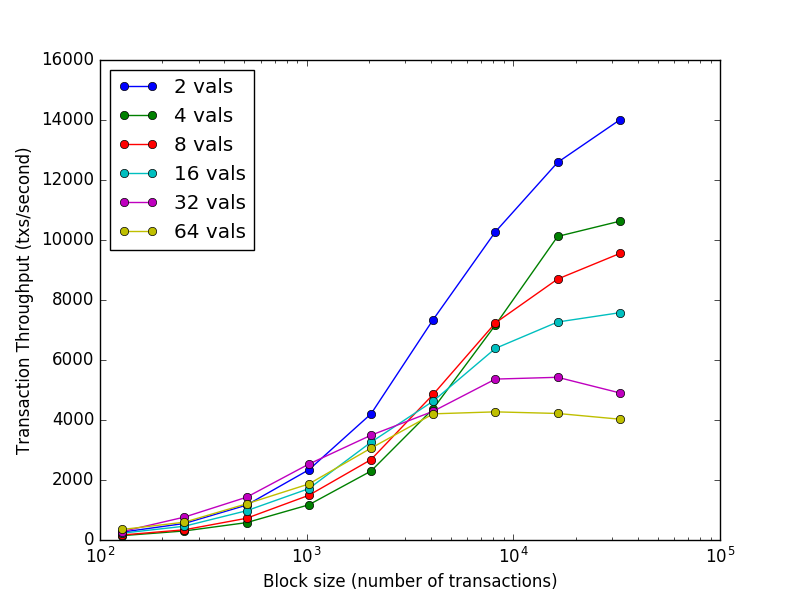

Tendermint offers 1-second finality and boasts thousands of transactions per second (TPS). TPS is a function of the number of validators in a network. The more validators, or users who are needed to double-check operations, the lower the TPS.

After high throughput and fast finality, building with Cosmos SDK also offers blockchains the ability to transact with other networks easily. This feature is possible, thanks to the Inter-blockchain Communication (IBC) protocol. For chains that already enjoy fast finality, they are also capable of interacting with a Cosmos-based application.

Bitcoin and Etheruem, however, do not meet this criterion. To get around this, projects like Injective leverage so-called “peg-zones.” These are bridge blockchains that connect the Cosmos ecosystem with other blockchains that may not perfectly match the Cosmos ecosystem’s technical specifications.

Peg-zones allow for the relatively seamless transfer of ERC-20 tokens, for instance, back and forth between Injective and the Ethereum ecosystem.

All of these features are important for an exchange. And though it uses the Cosmos SDK and Tendermint to validate transactions, the development environment is identical to Ethereum. This is because the SDK also uses Ethermint, a Tendermint-based version of Ethereum’s virtual machine (EVM).

Injective Protocol and 0x Protocol

The second key component of Injective is its order book design. Decentralized exchanges come in various shapes and sizes, with the current market leader being Uniswap.

It is technically leveraging a “Constant Function Market Maker” (CFMM), which is just one type of market maker in the AMM family. DODO Exchange is another example of an AMM.

Injective, however, falls into the order book-style of exchange. To do this, the project leverages the 0x Protocol to match buyers and sellers. According to 0x, there are two levels to a trade: Order matching and execution.

Order matching is done off-chain and only executed on-chain once the order has a clear maker and taker. This mediation occurs in the 0x network between relayers, of which there are many. Any open order on any relayer is eligible for fulfillment by any other order on another relayer.

In the Injective environment, relayers are replaced by nodes. Node operators earn fees for routing and matching orders. And like 0x relayers, node operators could each be independent DEXes within a larger network.

For the uninitiated, Matcha and Tokenlon are two popular order book-based DEXes powered by 0x Protocol.

Injective Protocol is looking to create a similar environment for anyone interested in building a DEX for both the Cosmos and Ethereum ecosystems. Outside of spot trading, they will also allow builders to create more complex derivatives products. Only perpetual swaps and contracts for difference (CFD) are currently available.

Using 0x also allows Injective to evade front-running traders, a common problem for many order book-based exchanges. Due to blockchain technology’s transparent nature, it is easy for market participants to witness large trades occurring in real-time. Richard Chen, a partner at the crypto VC firm 1confirmation, writes:

“Once this [large] order is seen by a [crypto] miner who realizes that your order is big enough to drive up the price of the token, the miner can create their own buy order and include it in the block before you do. Then, assuming that the miner is able to mine this particular block, they would have earned a risk-free profit by taking advantage of the information in your order.”

To solve this problem, Injective introduces Verifiable Delay Functions (VDFs). VDFs are essentially time stamps that can be placed on transactions to ensure an orderly and fair sequence of orders.

The INJ Token and Community

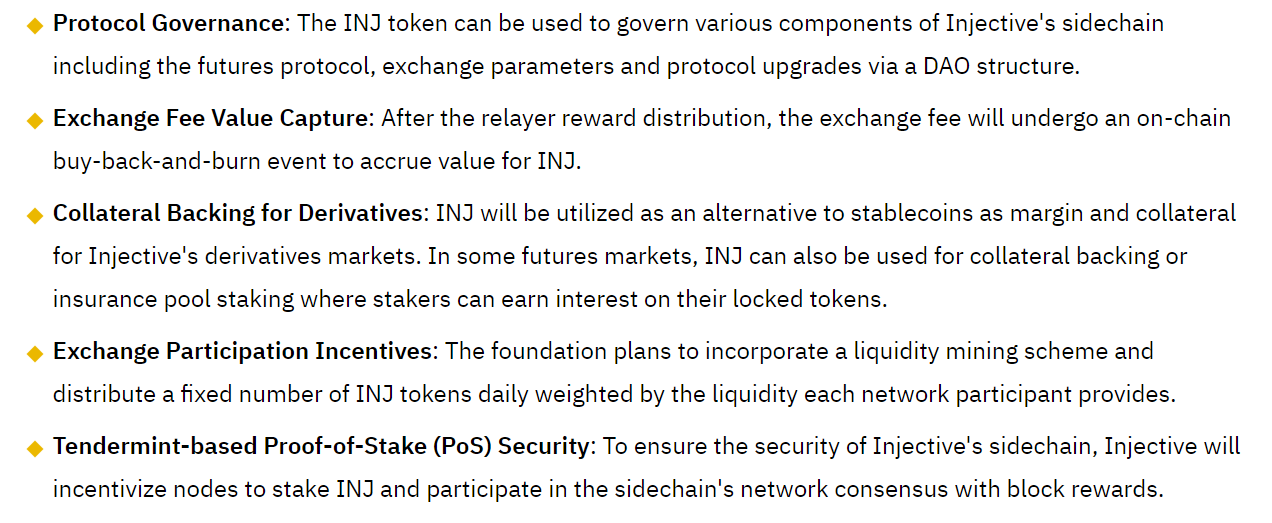

Injective’s native token, INJ, can be used in several different ways, according to marketing materials. It has not been officially launched yet.

As a product of Binance’s incubation program, INJ will list on Binance’s IEO platform. During this sale, 9% of the total token supply will be sold on Oct. 19, 2020.

The Injective team is made up of nine team members. They include Eric Chen (CEO), Albert Chon (CTO), Max Kupriianov (senior backend engineer), Markus Waas (engineer), Bojan Angjelkoski (engineering), Alexandros Athanasopulos (engineer), Michael Siedlecki (engineer), Xinran Xu (business development), and Boris Shevchenko (product manager)

Final Thoughts: Injective Protocol

Injective Protocol is taking different key portions of crypto technologies to recreate a better DEX experience.

By tapping the Cosmos SDK and its scalable Tendermint algorithm, DEXes built in the Injective environment evade congestion. For the same reasons, Injective exchanges will be fully-interoperable with both Cosmos and Ethereum.

However, with gas prices dwindling, only time will tell if users will be so eager to jump ship and participate in projects built with Injective. Though the summer served a prescient reminder that Ethereum cannon meet mainstream demands, DeFi, the culprit behind breaching many technical limits, has lost much of its luster.

Still, most market leaders, like Uniswap, do not offer derivatives products. This absence may earn Injective a captive userbase.

Disclosure: One or more members of the Crypto Briefing Management team are investors in Injective Protocol.

Share this article

Supercharge Your Crypto Trading With Bracket Orders

Crypto markets are renowned for their volatility. It’s common to see prices swing 10% in a single day. Because of this, the moves are large, making swing trading one of…

The DEX Top 10: Crypto Briefing’s Decentralized Exchange Picks

Every time an exchange is hacked, it seems a DEX springs up. Although these decentralized exchanges have advantages, it can be difficult to find the best one. Here are our…

Cosmos Technicals Present Golden Profit Opportunity

Cosmos looks ready to make gains after a two-month correction. But first, one technical indicator suggests that ATOM prices will drop further, giving traders a chance to get back into…

Understanding Position Sizing

Let’s briefly examine the most important aspect of any trading system, position sizing, or specifically how much we will bet on any one given trading idea.