Key Takeaways

- B.Protocol attempts to solve the inefficiency of DeFi liquidations, which hamper the sector’s growth.

- The project offers extra yield for users and makes liquidations more predictable for liquidators.

- The protocol seamlessly connects to platforms like Maker, Compound, and Aave without requiring any actions from their side.

- $1.5 million ETH was deposited on Maker through B.Protocol during the first 24 hours since launch.

Share this article

Decentralized crypto lending kickstarted the DeFi craze of 2020. The launch of Compound token COMP in June 2020 attracted the market’s attention and provoked the expansion of the DeFi ecosystem. As the prices surged, developers rushed to capitalize on the trend.

Despite a wave of innovation, DeFi platforms are far from perfect. From hacks, poorly engineered financial incentives, and centralization woes, much can be improved. What’s more, these issues can grow to existential proportions during times of extreme price volatility.

To reduce help reduce at least one major risk, that of mass liquidations, B.Protocol is working to become DeFi’s first-ever decentralized backstop.

DeFi Inefficiencies Are Preventing Adoption

Most of the DeFi action currently happens on Ethereum. As new platforms emerge, the ecosystem’s composability increases. DeFi protocols and primitives become building blocks, allowing developers to mix and match different tools to create new features.

Composability is essential because DeFi isn’t flawless. Platforms have significant limitations and potential risks due to architecture decisions or the underlying network’s constraints. Ethereum-based applications mostly suffer from the network’s low scalability, which new primitives can help get around.

Ethereum still has a maximum of 14 transactions per second, which isn’t sufficient to support a vibrant DeFi ecosystem. As on-chain activity increases, so does the transaction cost because only so many transactions can be included in a block.

The primary beneficiaries of the high transaction costs are miners. When users rush to interact with protocols, miners get to choose which transactions they want to include. Hence, they wait for the highest bids, which brings them substantial profits but jeopardizes DeFi efficiency.

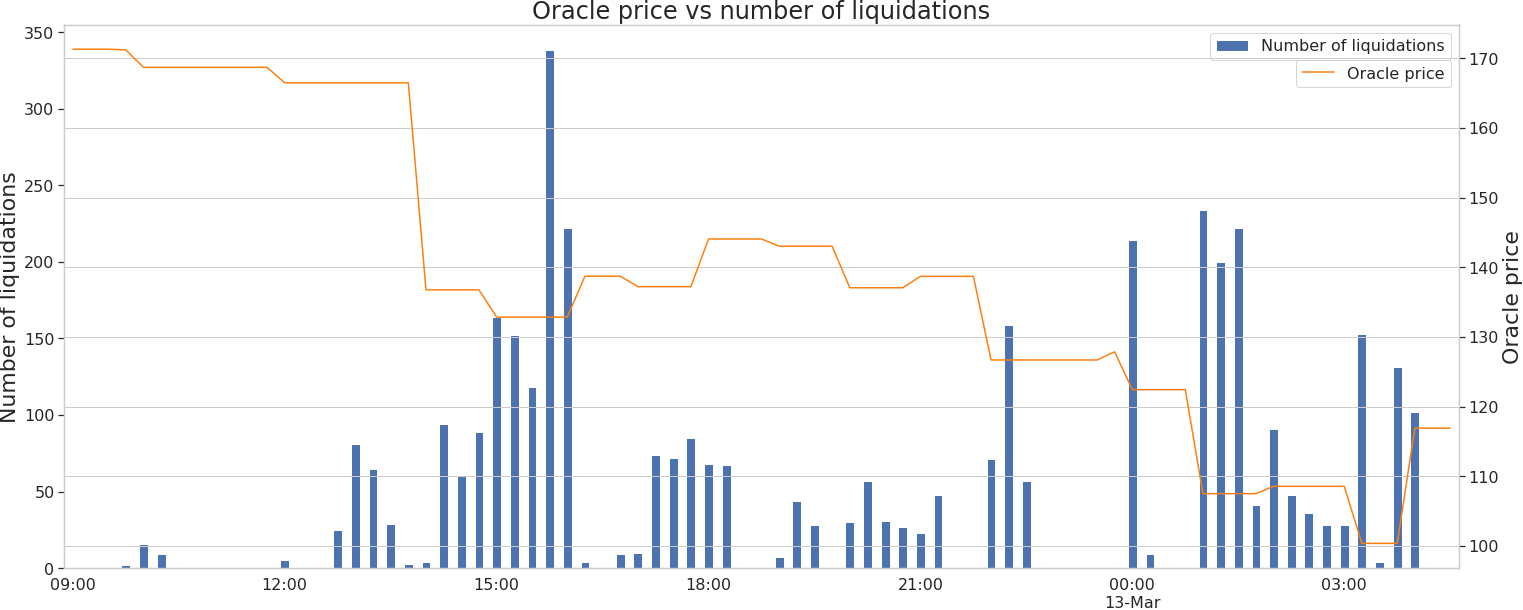

Moreover, the low throughput of Ethereum can significantly damage DeFi protocols under severe market conditions. When protocols must react fast, but they can’t. For instance, the March crypto flash crash put a lending platform Maker $4.5 million in debt as it’s liquidation system stalled.

The silver lining is that the evolving composability of DeFi can help protect platforms in the future. Developers continue to explore new primitives to fix projects’ vulnerabilities and make decentralized lending and trading more robust, facilitating further adoption.

One of such teams is B.Protocol. The project aims to create a backstopping layer for decentralized lending platforms, so cases like the Maker crisis can be prevented.

The Value of B.Protocol

Understanding the value proposition of B.Protocol requires looking closer at why lending platforms need liquidation systems and the drawbacks of existing implementations.

Decentralized loans are over-collateralized, meaning that borrowers deposit more than they can take out. The protocol and lenders can’t verify a borrower’s creditworthiness, so loans must be secured.

Every collateralized debt position (CDP) has a liquidation price, which indicates when the loan becomes under-collateralized. Under-collateralized loans are bad debt, meaning they put the system at risk of becoming insolvent.

If there are too many bad loans and the system doesn’t have a big enough insurance fund to cover them, lenders are at risk of losing their money. Liquidations help keep lending platforms solvent by repaying loans before they turn bad in exchange for borrowers’ collateral.

Liquidation systems aren’t new. It’s an established business for some algo traders on centralized exchanges, which offer margin trading on borrowed funds. Liquidators lock money on an exchange, which uses it for emergency liquidations. For helping support the exchange’s solvency, liquidators enjoy a 1-2% reward on each liquidation.

Rewards on decentralized lending platforms are much higher. Maker offers 13% extra, while Compound provides 8%. However, algo traders avoid providing similar services for decentralized platforms due to how slow and expensive Ethereum can be.

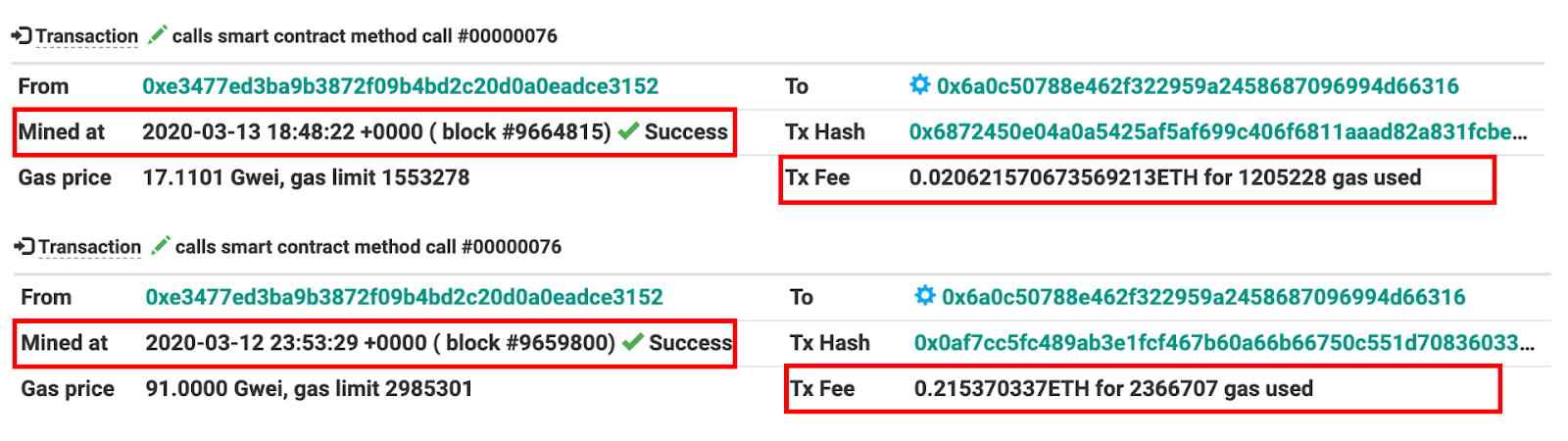

In the case of Compound, liquidators are subject to gas wars. When CDP goes underwater, it’s marked for liquidation, and the first user to call a respective function of Compound’s smart contract wins. Hence, liquidators race to pay the highest gas price.

Consider a CDP of $1 million on Compound; a reward for liquidating it is $80,000 (8%). Given the lucrative size of the reward, there will be extreme competition for liquidation. Hence, a liquidator can easily spend $20,000 on a transaction fee to be the first, effectively sharing a reward with miners.

High transaction costs make it difficult for professionals to model their performance, so they don’t actively participate in decentralized liquidations.

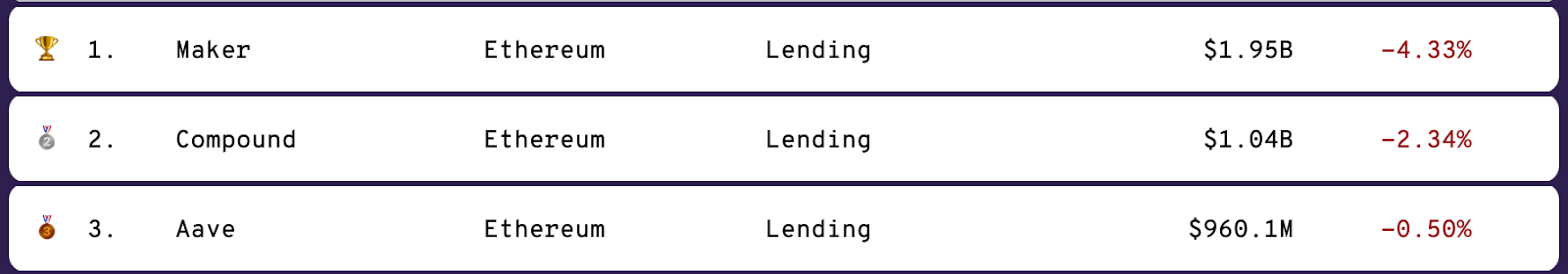

Consequently, lending platforms suffer from a lack of liquidators. For instance, Compound has only about 600 liquidators to take care of $1 billion of locked value. Many of them have only ever performed a single liquidation.

Moreover, the existing liquidators aren’t obliged to perform liquidations. Hence, the lending platforms end up at risk of becoming insolvent unless they have some additional backstopping mechanisms in place.

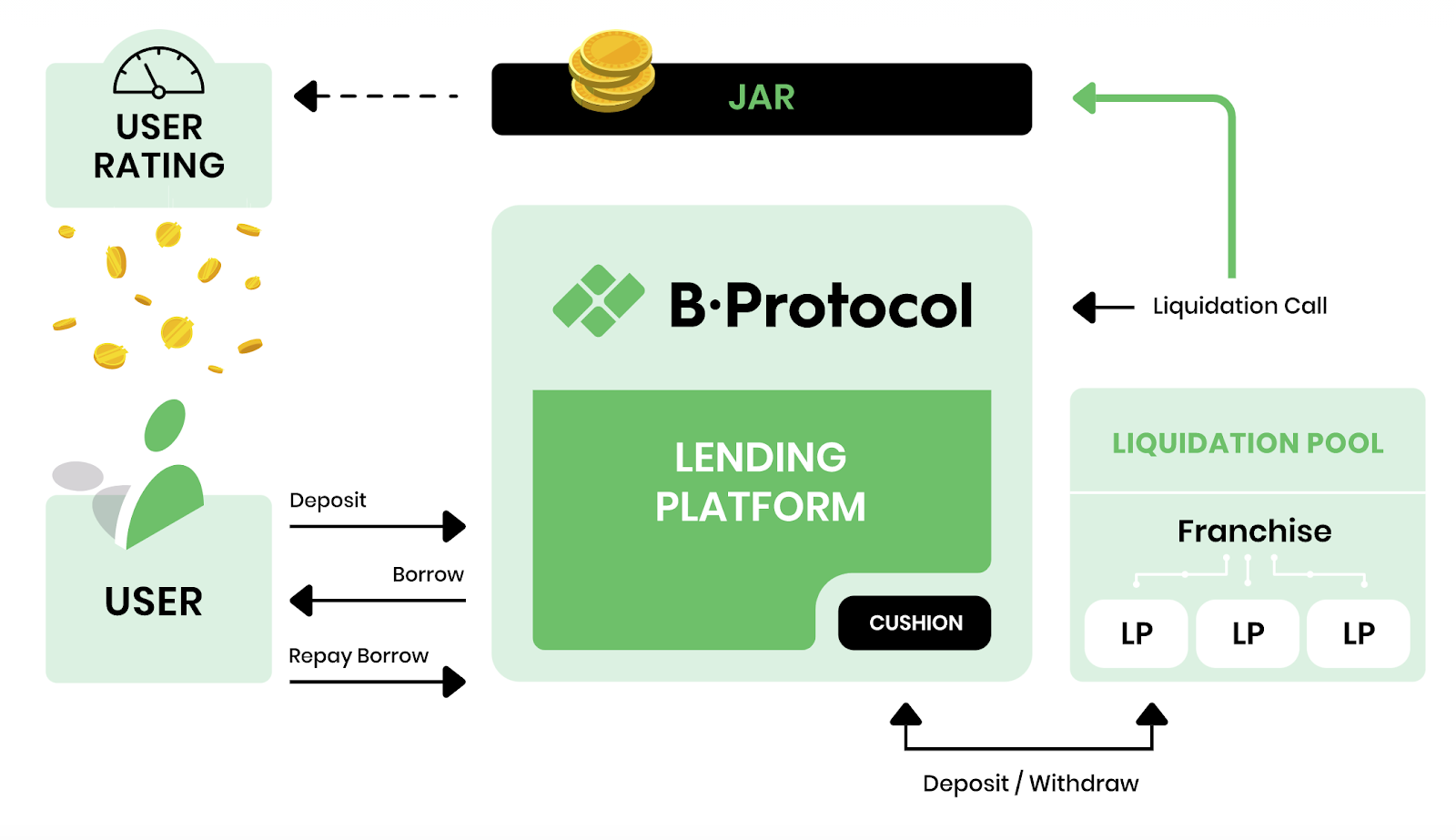

B.Protocol aims to solve the ongoing issues of liquidation systems, like liquidators’ uncertainty and gas wars. The project enables liquidators to get guaranteed priority access to undercollateralized CDPs in exchange for sharing profits with lenders and borrowers.

The team created a system where a smart contract, not miners, decides which liquidator gets to perform a liquidation. B.Procol gets in front of the underlying lending protocol’s liquidators by providing a cushion for CDPs.

B.Protocol’s backstop liquidity providers (BLPs) partially repay loans, which are close to liquidation. Hence, if a CDP on B.Protocol goes underwater, the underlying lending platform won’t know this, which frees BLPs from competing with other liquidators.

Since B.Protocol guarantees providing access to liquidations, more users will be comfortable providing liquidity. To become a BLP, a user needs to participate in an auction, where they offer to share a percentage of their liquidation rewards with other participants. The highest bidders will get franchises, which provide the rights to perform liquidations on the platform.

Shared rewards end up in a so-called jar, from where they are periodically distributed to lenders and borrowers. By eliminating gas wars and introducing reward sharing, B.Protocol shifts profit extraction from miners to users.

The rewards are distributed based on ranks, which reflect users’ borrowing or lending activity. The more interest earned or paid, the higher the reward share. Hence, the platform looks more appealing for lenders and borrowers due to extra rewards, plus it incentivizes user participation.

Importantly, B.Protocol doesn’t require any changes to lending platforms with which it connects. Moreover, it doesn’t have access to users’ funds; all CDPs are kept on the underlying platforms.

B.Protocol can seamlessly integrate with decentralized lending platforms and provide them with a more secure liquidation mechanism. Meanwhile, all lending platforms’ users: lenders, borrowers, and liquidators benefit from more confidence and increased rewards.

How B.Protocol Works

The app acts as a proxy to the decentralized lending apps. It doesn’t hold users’ funds, but lenders and borrowers can access existing CDPs and create new ones on the underlying platforms via B.Protocol’s interface.

B.Protocol has three key components: a liquidation pool, a CDP management smart contract, and a jar.

One of the key agents in the system are BLPs, which live in the liquidation pool.

Getting into the pool requires receiving a franchise. Each month, potential BLPs bid for the franchise by offering the highest percentage share of their liquidation rewards. The BLPs with the most appealing bids make it to the pool.

Importantly, the initial set of BLPs includes only a handful of users selected by the team. They are Kyber Reserve, OneBit Quant, and an active anonymous Maker liquidity provider. They will act as BLPs for six months from launch.

B.Protocol’s CDP management contract substitutes the original contract of the underlying platform. It ensures that BLPs in the B.Protocol’s liquidity pool enjoy privileged access to the liquidations. Once B.Protocol’s management contract detects that a CDP is close to going underwater, it automatically selects a BLP for liquidation.

The BLP repays some of the CDP’s loan, effectively lowering the liquidation price. However, it gets ready to liquidate the loan at the original liquidation price.

Consider an example, where Alice takes a loan on Compound through B.Protocol. Suppose she supplies 1 ETH worth $300 and borrows a 100 DAI loan. With the Compound’s ETH collateral factor of 75%, Alice’s liquidation price is $130.

If ETH drops to $135, B.Protocol enables a selected BLP to repay 10 DAI on behalf of Alice, lowering the liquidation price on Compound to $120. Meanwhile, the BLP will liquidate Alice’s position as soon as ETH goes below $130, getting in front of Compound’s liquidation.

Since Compound isn’t aware that Alice’s CDP became undercollateralized, it doesn’t mark it appropriately, so the platform’s liquidators don’t race to do their job. As a result, gas costs for the liquidation are significantly lower, and the CDP is guaranteed to go to one of the BLPs.

For liquidation, a BLP will receive a premium of 8%, part of which they committed to sharing with lenders and borrowers when they bid to get a franchise. Shares of the rewards are transferred to the jar contract, where they are accumulated until the franchise epoch is ended and then distributed among users based on their ranks.

Lenders increase their ranks proportionately to the interest rates they earn, while borrowers do so according to how much interest they pay. B.Protocol’s smart contract automatically calculates ranks.

From a technical perspective, users are free to migrate from B.Protocol to any other CDP management tool like DeFi Saver. However, such functionality is not yet available via the app’s user interface.

The First-Mover Advantage

Despite explosive growth, DeFi is still nascent. Many primitives like backstop liquidations are still lacking.

While developers refine decentralized lending and trading platforms to make them more secure, B.Protocol’s approach is novel to the space, and some platforms have already suffered without it.

In March, the crypto flash crash put the oldest and the largest lending platform, Maker, in a predicament. $4.5 million debt was liquidated for free.

When Ethereum’s price dropped almost 50% in a matter of hours, Maker initiated massive liquidation of CDPs. Unlike Compound, the platform uses auctions, in which liquidators make bids to get liquidation access.

Due to Ethereum’s congestion, most liquidators didn’t participate in auctions, so there was almost no competition. Hence, a handful of liquidators won auctions with zero-value bids, putting Maker in debt.

Maker reacted to the event professionally, performing necessary measures to restore the platform’s solvency. Still, the efforts didn’t solve the project’s overarching issues, so the team focused on modifying Maker’s liquidation system.

Considering the lack of liquidators, the team reduced the number of auctions that can happen simultaneously and extended the auctions’ duration to six hours. In the future, Maker plans to switch to Dutch auctions, which some of the industry players like Set Protocol have already implemented.

While the updated liquidation system has its merits, it doesn’t provide the assurances that B.Protocol does. The system still doesn’t oblige liquidators to liquidate CDPs, and the liquidations are still not guaranteed.

B.Protocol doesn’t compete with Maker’s improved liquidation system. It complements it by adding an extra layer of security. Lenders benefit from using B.Protocol in conjunction with the upgraded Maker because if BLPs don’t liquidate a CDP, the underlying lending platform will do it.

A potential competitor for B.Protocol is Perpetual Protocol, which has backing from famous industry players like Alameda Research and Binance.

Perpetual Protocol features up to 20x leveraged trading of perpetual contracts, which is much more than the 3x that borrowers can get on platforms like Maker and Compound. It also has an insurance fund for backstopping losses and can mint PERP tokens if the insurance fund gets depleted.

While Perpetual Protocol can compete with B.Protocol for some users, not everyone will be inclined to use it. For example, Perpetual Protocol isn’t designed for lenders.

The major weak point of Perpetual Protocol against B.Protocol is that the former still runs on a testnet, so B.Protocol has the first-mover advantage.

The Pros and Cons of B.Protocol

Besides the first-mover advantage, B.Protocol has some extra points going for it. First, it’s built around the top DeFi lending platforms.

Currently, B.Protocol supports Maker CDPs, but the integrations with Compound and Aave are upcoming. The combined ETH locked on these three lending platforms is 4 million ETH ($1.5 billion). Hence, B.Protocol addresses a large user base.

Furthermore, the project’s team is small but very experienced and has connections to the top players in the DeFi space. Yaron Velner is the former CTO at Kyber Network, Jitendra Chittoda is a former smart contract architect at Aave, mStable, and DeFiner, and Eitan Katchka is a co-founder of La’Zooz.

It’s encouraging to see that Solidified audited the platform, but as the recent Harvest Finance exploit shows, attack vectors don’t come solely from smart contract bugs.

The project’s downsides include initial centralization of decisions, potential inefficiencies of the user ranking system, risk of reward devaluation, and lack of commitment from the liquidators.

During the first six months since launch, the team will steward the protocol. The team will choose BLPs, which is a centralized setup. However, it’s not a critical downside, considering that the team doesn’t have access to funds within CDPs.

Once the power goes to users, however, there may be complications. B.Protocol doesn’t have a token.

A user’s voting weight in the governance process depends on their rank. During the first month, the platform gives users a 2x boost to their ranks, which is concerning. The initial wave of users may have an advantage overusers who arrive later in terms of governance power.

On the BLPs’ side, the major con is that B.Protocol’s model still doesn’t require liquidators to commit funds upfront. BLPs have soft commitments, and while they are guaranteed to get liquidations, they don’t have to liquidate. Hence, B.Protocol doesn’t provide strong security under severe market conditions, remaining inferior to centralized platforms.

Finally, the reward pool has a six-month gap before the rewards are distributed to users. The protocol accumulates rewards in assets held in CDPs, so if the market conditions are subpar, users’ rewards can diminish before they are distributed.

Adoption and Flash-Loan Governance Debacle

Although B.Protocol launched very recently, on Oct. 27, it has already managed to generate traction.

The project’s social networks have average involvement. The official Twitter attracted roughly 1,000 followers in 122 days, and the Discord group has 159 members so far. Unfortunately, there is no Telegram group.

In terms of on-chain activity, the project is doing well. As the team communicated on Oct. 28, 4,100 ETH were already deposited to Maker through B.Protocol. The project’s smart contract shows 57 opened CDPs.

However, the network’s launch was darkened by the team’s effort to influence Maker’s governance.

On Oct. 26, B.Protocol’s team used a flash-loan to quickly take out 13,000 MKR tokens ($7 million) and use them for voting on Maker. The incident raised concerns for Maker’s community.

While B.Protocol’s team exploited Maker’s governance, it didn’t do so with malicious intentions. The project depends on Maker, so no harm was done.

B.Protocol acted as a white-hat hacker, an ethical entity that discovered Maker’s vulnerability before malicious actors could exploit it.

Our side of the story:

We meant no harm, and no harm was made.@MakerDAO was never under real threat, and flashloans are only a future (theoretical) threat.

B.Protocol is built on top of Maker, and makes it stabler by bringing committed Keepers, who share proceeds with users 👇 https://t.co/CE5nZxLSx5— B.Protocol (@bprotocoleth) October 29, 2020

Still, B.Protocol had to provide explanations, and Maker reacted by adding possible restrictions on flash loans, which doesn’t put the project in a good light.

B.Protocol’s Perspectives

Considering B.Protocol’s first-mover advantage in solving a hair-on-fire problem of inefficient liquidation systems of decentralized platforms, it can become one of DeFi’s default building blocks.

The team plans to make B.Protocol compatible with any decentralized application down the road. If it can improve liquidators’ reliability by taking upfront deposits, many platforms would want to direct their user traffic through B.Protocol.

Suppose the B.Protocol’s user base will continue to expand at the same rate. In that case, it’s network effect can grow to a critical point, where the solution is so ubiquitous that developers use it as a default for backstopping liquidity.

Regarding governance, the team doesn’t have a strong stance, but a token might eventually be introduced. If an additional incentive in the form of liquidity mining is introduced, the platform will see an influx of yield farmers.

Finally, the team plans to tap into the decentralized oracle problem. Considering the success of ChainLink, research and development in the oracle direction can help B.Protocol in promoting its brand.

Share this article

Project Spotlight: Flamingo Finance, China’s Full Stack DeFi Protoco…

Flamingo Finance is a “full-stack” DeFi protocol built on the NEO blockchain, according to marketing materials. Upon further inspection, however, it better resembles a mishmash of top DeFi protocols originally…

Understanding Position Sizing

Let’s briefly examine the most important aspect of any trading system, position sizing, or specifically how much we will bet on any one given trading idea.

DeFi Project Spotlight: Injective Protocol, a Derivatives DEX

Injective Protocol is a decentralized derivatives project that offers fast transaction speeds, deep liquidity, and front-running protection. The project makes up part of the growing DeFi ecosystem that is being…

DeFi Project Spotlight: Polkastarter, Polkadot’s Uniswap

Polkastarter is a decentralized exchange (DEX) akin to Ethereum’s Uniswap. But as popularity for current DEXes has risen, many platforms have become cumbersome to use. Long wait times for trade…