Key Takeaways

- Yearn has released its quarterly report, which breaks down its revenue and expenses over the past three months.

- This is the first quarerly report isused by a major DeFi platform.

- The report ensures that Yearn is accountable to the public.

Share this article

The popular yield farming platform Yearn Finance has released its first-ever quarterly report, detailing finances from Aug. 20 to Oct. 20.

Plenty of Revenue for Yearn

Over the last quarter, Yearn’s revenue before expenses was $4.4 million. The platform’s most popular product, yVault, was responsible for virtually all of this income: it contributed $4.1 million to the total.

In turn, most of that $4.1 million came specifically from Yearn’s yUSD vault, which brought in $2.8 million. Nine other token vaults generated the remaining $1.3 million in revenue.

The majority of Yearn’s revenue was generated from withdrawal fees paid by depositors. This will remain true in the future, as an upcoming upgrade will introduce a new fee structure of 2% assets under management (AUM) free plus a 20% performance fee.

On top of this, Yearn generated $121,000 of revenue from its liquidity pool (yPool) and $90,000 from token airdrops.

Costs of Business

Yearn’s revenue has been distributed to users who participated in the project’s development and operation. Governance members who staked tokens were paid $2.5 million from the project’s revenue.

Yearn additionally paid operating expenses to participants in the form of administrative salaries ($173,000) and security audits ($82,000). Futhermore, $43,000 was put into community grants that funded development activity, legal work, and publicity.

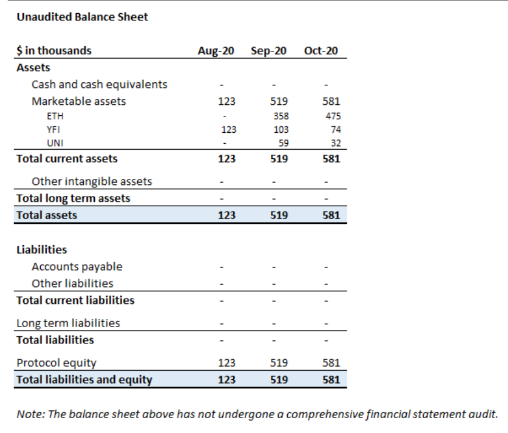

In the end, the project’s balance sheet is healthy, with assets amounting to $581,000 and no liabilities.

Report First of Its Kind

Since its launch in July 2020, Yearn has grown rapidly in terms of value and popularity. It is the currently 11th largest DeFi protocol on Ethereum, with a total locked value of $440 million.

However, financial success is only part of the story. Accountability is also key, and Yearn’s team is the first major DeFi platform to issue a quarterly report. Though traditional businesses often release these reports, it is rare in the DeFi world, despite the fact that most of these platforms have on-chain data to work with.

It remains to be seen if other DeFi projects will follow Yearn’s lead and issue similar reports in the future.

Share this article

yEarn Announces Two More DeFi Mergers

yEarn Finance has merged with two DeFi projects—Akropolis and SushiSwap—allowing investors to use those projects’ earning DeFi capabilities in unison. Akropolis Adds More Options The merger between Akropolis and yEarn…

DeFi Auction House Bounce Integrates yEarn

Popular DeFi protocol, Bounce Finance, which acts as an auction house, lottery, and prediction market, has integrated yEarn and opened up a yGift store. yEarn Launches NFT Marketplace on Bounce…

Managing Emotions

For almost everyone, having skin in the game, or a vested financial interest in something will stir up emotion. If a trader or investor is unable to manage their emotions,…

yEarn.Finance Founder Andre Cronje Announces Deriswap

Andre Cronje, the founder of the highly-popular DeFi protocol yEarn.Finance has released details of a new project called Deriswap. Cronje has been extremely busy in the DeFi space throughout this year,…