Quick take:

- The value of Ethereum staked on the ETH2.0 deposit contract has hit $1B in value

- There is 1.54 Million Ethereum staked on ETH2.0

- Ethereum deposits to the contract seem to be entering a plateau phase

- If ETH2.0 was ranked as a DeFi project, it would be in the top 10 in terms of value locked

- Ethereum looks set to break $700 amidst a generally bullish crypto market environment

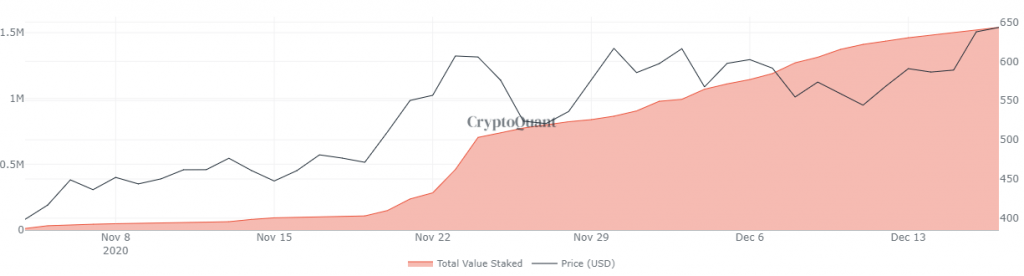

The amount of Ethereum staked on the ETH2.0 deposit contract has reached a new milestone of $1 Billion. At the time of writing, a total of 1.54 million has been sent to the ETH2.0 deposit contract. This amount is valued at $1.001 Billion using Ethereum’s current value of $650.

Ethereum Deposits to ETH2.0 Might Entering a Plateau Phase

Investors have continued sending Ethereum to the deposit contract despite the minimum threshold of 524,288 ETH being reached on November 24th. However, the Ethereum deposits might be entering a plateau phase (pink chart) as demonstrated in the following chart courtesy of CryptoQuant.com.

ETH 2.0 Would Rank a top 10 DeFi Project

If ETH2.0 were officially considered as a DeFi project, it would rank in the top ten based on the $1 Billion in value locked. A quick look at DeFiPulse reveals that ETH2.0 would be ranked seventh below Uniswap ($1.42B) and Sushiswap ($1.18B).

Ethereum Inches Closer to $700

The total value locked on ETH2.0 hitting the $1 Billion milestone is primarily due to the value of Ethereum zooming past the $600 price ceiling alongside a bullish Bitcoin. Ethereum just set a two-year peak value of $676 as Bitcoin set its all-time high around $23,800 – Binance rate.

With the weekend only a few hours away, Ethereum could very well be on a path towards testing $700 as retail traders take the helm at the crypto markets. Institutional investors are generally known to pause for the weekend although the 24-hour crypto markets might cause some to stick around after hours.

Therefore, the weekend could provide a new all-time high for Bitcoin that will ultimately fuel a push by Ethereum above $700. However, a Bitcoin correction should not be left out of the table and should be considered when analyzing Ethereum moving forward.