Quick take:

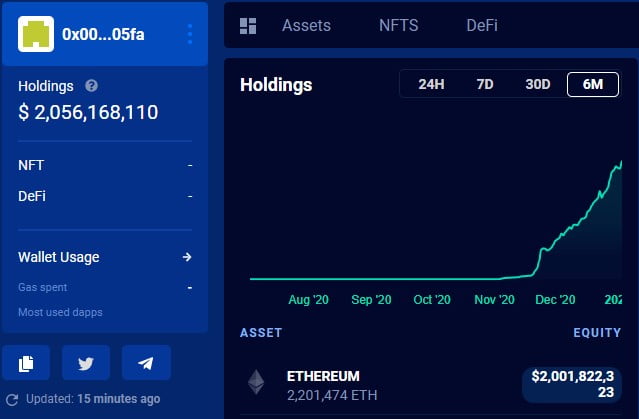

- A total of 2,201,474 ETH is staked on the Ethereum 2.0 deposit contract

- This equates to $2 Billion locked with the value of Ethereum a 2 year high of $946

- The value of ETH locked in the Ethereum contract has doubled in 16 days

- Ethereum has broken the $750 resistance level and flipping it into support is crucial in continuing its bullish momentum

Ethereum investors are still sending their ETH to the ETH 2.0 deposit contract. According to DappRadar, a total of 2,201,474 Ethereum is currently staked on ETH 2.0. This amount of Ethereum is now valued at $2 Billion due to ETH zooming past the $800 price ceiling and into the $900 territory last experienced in early 2018.

Furthermore, the value of Ethereum locked on the ETH 2.0 deposit contract has doubled in less than one month as the deposit contract breached $1 Billion in ETH locked on December 18th. This last milestone was only 16 days ago.

Below is a screenshot of the amount of Ethereum staked on the ETH 2.0 deposit contract courtesy of DappRadar.com.

Ethereum Breaks $800 and $830 to Post a 2-Yr High of $946

The value of Ethereum locked on the ETH 2.0 deposit contract hitting a value of $2 Billion is primarily due to a significant increase in the value of ETH today, January 3rd. Ethereum opened the day at a $775 only to catapult past the $800 and $830 resistance levels to post a two year high of $946 – Binance rate.

A quick glance at the daily ETH/USDT chart below reveals that Ethereum needs to flip the $750 and $800 resistance levels into support for its bullish momentum to be maintained into $1,000 territory.

Also from the daily ETH/USDT chart, the following can be observed.

- Trade volume is in the green as seen through the large candle today

- The daily MACD is exhibiting bullishness that is yet to show signs of exhaustion

- However, both the daily MFI and RSI are high at 78 and 79 respectively. These two indicators point towards an overbought scenario for Ethereum

However, the crypto markets are generally in bullish territory led by Bitcoin which has just posted a new all-time high of $34,817 – Binance rate. Ethereum’s fate is very much tied to that of Bitcoin’s and the bullishness of the latter digital asset could mean ETH will keep climbing into 4 digit territory.

As with all analyses of Ethereum, traders and investors are advised to use stop losses and low leverage when trading ETH on the various derivatives platforms.