Quick take:

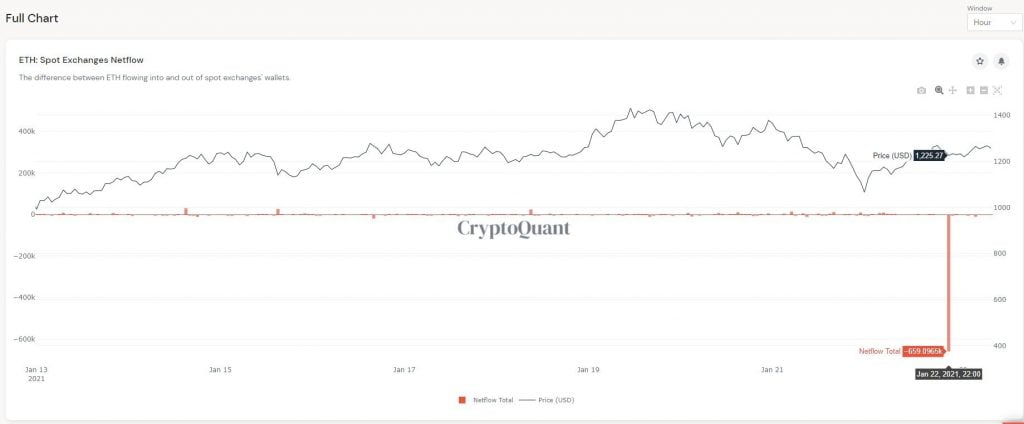

- Ethereum investors withdrew 659k ETH from crypto exchanges in One Hour on January 22nd

- This could be the largest net outflow of Ethereum from crypto exchanges in a 24 hour period

- Ethereum has reclaimed $1,300 and looks set to flip $1,350 into support once again

Ethereum investors withdrew 659,000 ETH from crypto exchanges in one hour on the 22nd of this month. This is according to an observation made by the CEO and Founder of NuggetsNews.com.au, Alex Saunders, who also postulated that the net outflow of Ethereum might be the largest to date in the stated time period.

His exact analysis can be found below together with a chart demonstrating the one-hour event.

Largest withdrawal of ETH ever? 659k ETH left exchanges in a single hour yesterday as dip buyers sent coins to their stack & stake. Great data as always CryptoQuant.com!

Ethereum Returns to Bullish Territory

As mentioned by Mr. Saunders, Ethereum investors probably moved their ETH to offline wallets, DeFi platforms or ETH 2.0 staking. The movement to any of the three possibilities is bullish for Ethereum as this means that ETH investors are bullish on the long term future of the digital asset. Furthermore, with less Ethereum on exchanges, the price of ETH will most likely increase with demand and a dwindling supply.

With respect to price, Ethereum is back in bullish territory after reclaiming the $1,300 price area as support. At the time of writing, Ethereum is trading at $1,328 and looks set to flip the $1,350 resistance level into support thus propelling it to higher levels with the new week.

As earlier mentioned, the weekly close tonight is a short term hurdle for Ethereum due to a weakening Bitcoin. If the King of Crypto can maintain a level above $30k – $32k to close the week, it will provide the stable environment needed for Ethereum to thrive and possibly push closer to $1,500 or even $2k.

Chances are that Ethereum’s bullish momentum is maintained till at least February 8th when the CME group launches their ETH futures contracts tailored for institutional investors.