Key Takeaways

- Synthetix is preparing for its Bellatrix release.

- Synthetic tokens for Aave, Uniswap, Yearn.Finance, Polkadot, REN and Compound will be available in the protocol from Thursday.

- Bellatrix will include two further updates, pending community approval.

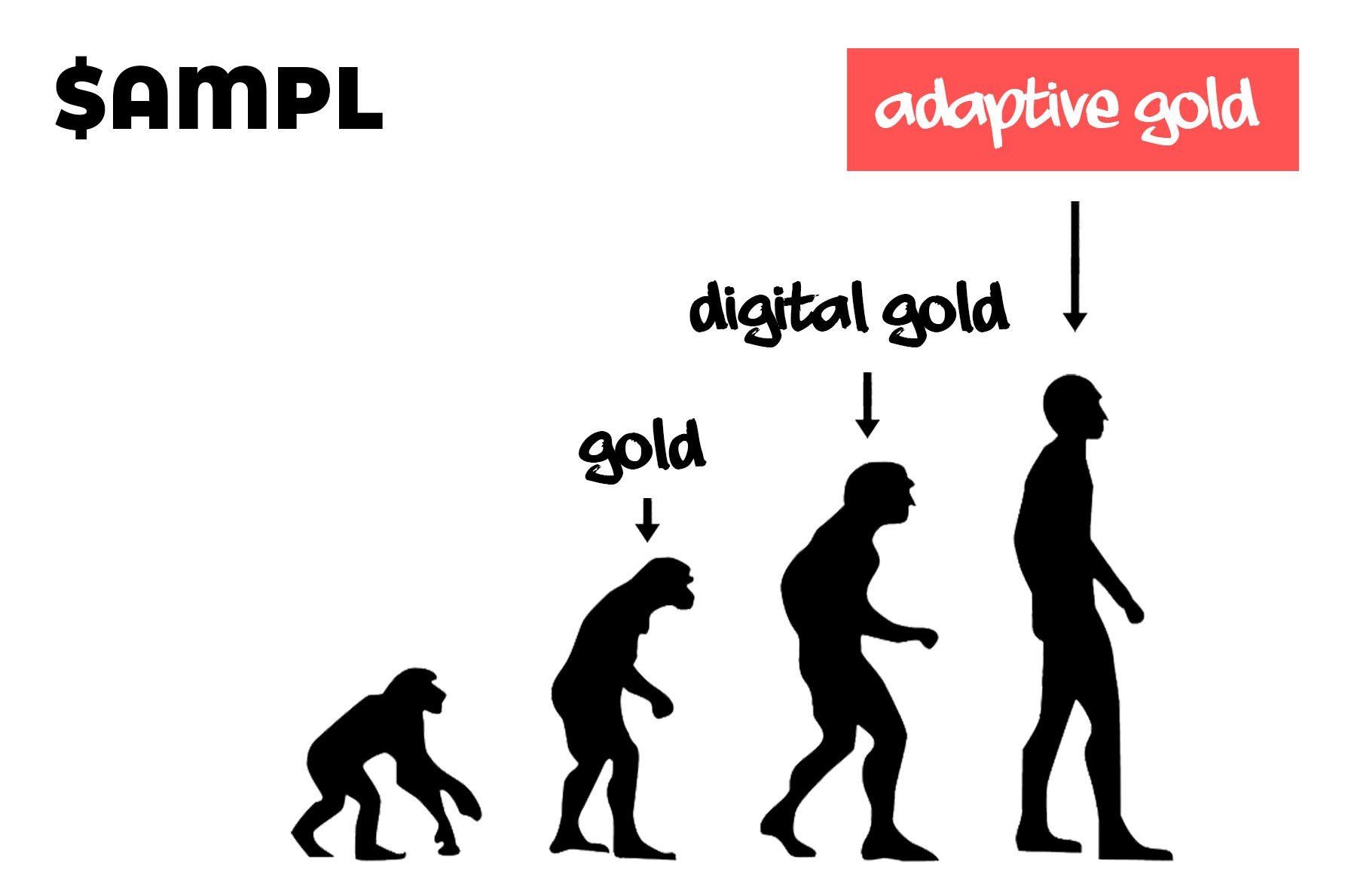

The DeFi news category was brought to you by Ampleforth, our preferred DeFi partner

Share this article

DeFi’s favorite synthetic assets protocol is getting a revamp. Bellatrix will see Synthetix add a new batch of synthetic DeFi tokens.

Synthetix Expands DeFi Offerings

Synthetix is launching a new group of synthetic DeFi tokens.

Tokens for Aave, Uniswap, Yearn.Finance, Polkadot, REN, and Compound will all be available as Synths, the protocol’s label for its native synthetic assets. According to a blog post, each new token will also have a corresponding Inverse Synth. The update will be deployed this Thursday.

Synthetic assets are designed to track the price of an underlying asset. Synthetix currently offers users exposure to synthetic assets for crypto assets, fiat currencies, and commodities like precious metals. It’s thought that the protocol may add stocks at some point in the future, similar to those Injective Protocol has listed recently.

Users of Synthetix can mint Synths by staking the protocol’s SNX token. These Synths are tradable on the protocol’s decentralized exchange, Kwenta. While Synths essentially replicate their corresponding asset price, Inverse Synths fall in price as the tracked asset’s price increases, and vice versa.

The addition of a list of new DeFi tokens is just one proposed update of the Bellatrix release. There are also plans to incentivize users to open shorts against sBTC and sETH and add support for Synth exchange suspension during market closures. However, both of those updates are pending community approval.

Synthetix, the biggest derivatives protocol on Ethereum by some distance, names each of its major releases after stars in the solar system. Other recent updates have included Castor, Shaula, and Adhara.

Disclosure: At the time of writing, the author of this feature owned ETH and SNX. They also had exposure to SNX, AAVE, UNI, YFI, COMP, and REN in a cryptocurrency index.

Share this article

Synthetix Liquidates SNX Holders Suggesting DeFi Has Hit Bottom

The recent crash in the DeFi space has liquidated several SNX stakers. Since then, however, the sector has rebounded, suggesting the bottom is in. Synthetix Liquidates Holders for First Time…

Looking Back on 2020 and 2021 Predictions

Happy New Year from all of us at Crypto.com Research! 2020 was an unprecedented year for the world and for crypto. Before we fully plunge into 2021 predictions, we will…

After FAANG Stocks, Injective Protocol Lists GameStop

Decentralized exchange (DEX) Injective Protocol has rolled out the first decentralized and commission-free futures trading of GameStop (GME) stock. Injective Competes With US Brokerages Injective has listed GME futures trading…

A Comparison of DeFi Protocol Token Valuations

The proliferation of DeFi protocols was the crypto story of last year. But how do the major token valuations compare? Valuing DeFi Protocol Tokens DeFi protocols earn money by charging…