Quick take:

- The total value locked in DeFi protocols has just hit a new all-time high of $34.2 Billion

- This is partly due to Bitcoin, Ethereum and several Defi tokens such as Uniswap, gaining value this week

- According to the team at Weiss Ratings, the potential for growth in DeFi is enormous

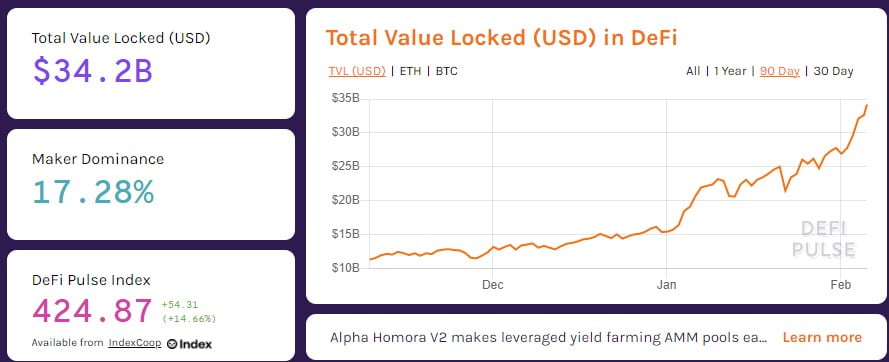

The DeFi realm has hit a new milestone in terms of total value locked. According to DeFiPulse, DeFi protocols have set a new all-time high of $34.2 Billion in total value locked. This milestone can be seen in the following screenshot courtesy of DeFiPulse.com.

Ethereum, Bitcoin and DeFi Tokens at All-time High Levels

Key to the total value locked in DeFi reaching $34.2 Billion is the appreciation in the value of Ethereum, Bitcoin and several DeFi tokens. This past week alone has seen Ethereum and top DeFi tokens such as Uniswap hit all-time high levels.

At the time of writing, Bitcoin – which is at the core of WBTC – is trading at $38k. Additionally, Ethereum has confidently broken the $1,700 ceiling and is trading at $1,720. With respect to DeFi tokens, AAVE is trading at $527; Uniswap at $20.75; Maker at $2,660; just to name a few.

DeFi’s Potential for Growth is Enormous

With respect to the future of DeFi, the team at Weiss Crypto Ratings is optimistic that the current levels above $30 Billion are just the beginning. However, in the short term, they caution that some of the DeFi tokens are currently overpriced thus caution should be undertaken when trading them.

The team at Weiss shared their insights on the current state of DeFi via the following statement.

There is $30 billion in total value locked in #DeFi. This is next to nothing. The potential for growth is enormous and there’s ample room to growth until we are in the trillions on that key metric. Having said that, in the short term at least, prices look a bit over-stretched.